HOW CAN I ENSURE THE SUCCESSFUL FILING OF MY INCOME TAX RETURN?

Introduction

ToggleYOU NEED TO KNOW HOW CAN I ENSURE THE SUCCESSFUL FILING OF MY INCOME TAX RETURN?

Introduction of income tax return

The process of filing your Income Tax Return (ITR) is a significant annual financial task. It not only helps you comply with your legal obligations but also provides an opportunity to review your financial situation, claim deductions, and potentially receive tax refunds. To ensure a successful ITR filing, you need to follow a systematic approach, stay informed about tax laws, and avoid common mistakes. In this comprehensive guide, we will discuss the key steps and strategies to help you successfully file your ITR. Visitofficialwebsite

Preparing for ITR Filing

Before you even start the process of filing your ITR, there are several critical steps to take for proper preparation.

1. Gather Necessary Documents:

Collect all the essential financial documents and records needed for your tax return. These may include:

- Form 16: If you are a salaried employee, your employer will provide Form 16, which contains details of your salary, tax deducted, and other allowances.

- Form 16A: If you have income from sources other than your salary, you may receive Form 16A from the entities responsible for deducting TDS (Tax Deducted at Source).

- Bank Statements: Gather bank statements from all your accounts to track your income and expenses.

- Investment and Expense Proofs: Ensure you have proofs of investments and expenses that are eligible for tax deductions (e.g., receipts for insurance premiums, tuition fees, or home loan interest).

- PAN Card: Your Permanent Account Number (PAN) is a must for filing your ITR.

- Aadhaar Card: Link your Aadhaar card to your PAN as it is mandatory for e-filing.

- Previous Year’s ITR: Having your last year’s ITR can be helpful for reference.

- Interest Certificates: Collect interest certificates from banks, post offices, or other financial institutions for interest income.

2. Choose the Correct ITR Form:

Select the appropriate ITR form based on your sources of income and financial situation. The Income Tax Department offers different ITR forms for individuals, Hindu Undivided Families (HUFs), and businesses. Ensure you use the correct form to avoid rejection or discrepancies.

3. Verify Form 26AS:

Form 26AS is a crucial document that provides details of tax deducted at source (TDS) from various sources of income. Verify that the details in Form 26AS match the TDS certificates you’ve received. Any discrepancies should be resolved before filing your ITR.

Methods of Filing ITR

Now that you’re prepared, it’s time to explore the various methods for filing your ITR.

1. E-filing:

E-filing your ITR is the most common and convenient method. The Income Tax Department’s official e-filing portal allows you to file your returns online. Some benefits of e-filing include:

- Faster processing and quicker refunds.

- Error-checking features to minimize mistakes.

- Secure and convenient submission from the comfort of your home.

- Various ITR forms are available for e-filing.

2. Seeking Professional Help:

If you find tax filing complex or have a complicated financial situation, consider seeking assistance from a tax professional or a certified chartered accountant. They can ensure accurate filing and help you maximize deductions.

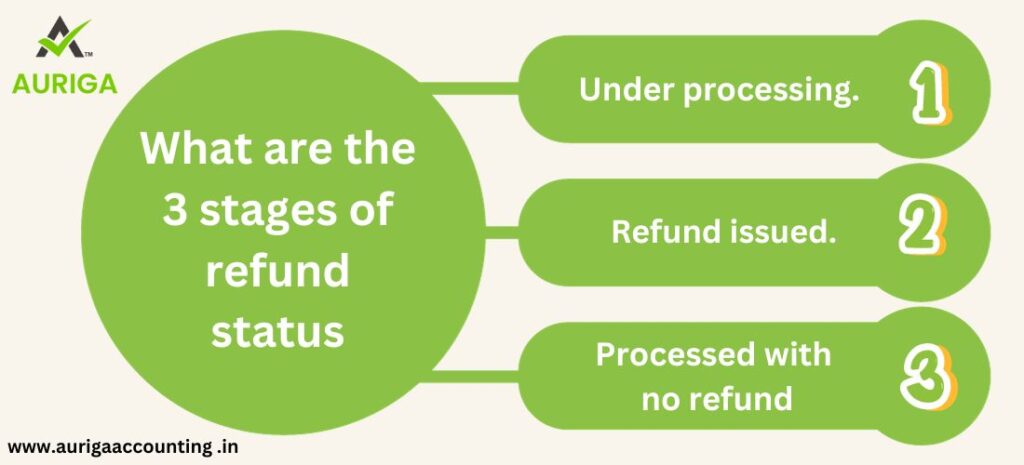

What are the 3 stages of refund status

1.Under processing.

2.Refund issued.

3.Processed with no refund

Common Mistakes to Avoid

To ensure the successful filing of your ITR, it’s important to steer clear of common mistakes that can lead to rejection or complications.

1. Providing Inaccurate Information:

Ensure that all the details provided in your ITR are accurate and match the records available with the Income Tax Department. Inaccuracies can lead to scrutiny and rejection.

2. Missing Filing Deadlines:

Missing the ITR filing deadline can result in penalties and interest on outstanding tax dues. File your return well before the due date, which is usually July 31st for individuals.

3. Forgetting to Verify:

After e-filing, it’s essential to verify your ITR. Failing to do so can render your filing incomplete, and the return may be considered invalid.

4. Neglecting to Report All Income:

Report all sources of income, including salary, rental income, interest income, capital gains, and any other income you’ve earned during the financial year.

5. Ignoring Deductions and Exemptions:

Be aware of the deductions and exemptions available under the Income Tax Act. Missing out on eligible deductions means you may pay more tax than necessary.

6. Mismatch in TDS Details:

Ensure that the TDS details in your ITR match with the TDS certificates in Form 26AS. A mismatch can lead to discrepancies and delays in processing.

7. Not Retaining Records:

Keep records of all financial transactions, investment proofs, and other supporting documents for at least six years. These documents can be crucial in case of an audit.

Tips for Successful ITR Filing

1. Regularly Update PAN and Aadhaar:

Ensure that your PAN and Aadhaar details are up to date and linked. This is crucial for e-filing and timely tax refunds.

2. Review Previous Year’s Return:

Refer to your previous year’s ITR to avoid any discrepancies or inconsistencies in your current return.

3. Double-Check Calculations:

Before filing, double-check all calculations, especially when you are manually filling out ITR forms.

4. Use Digital Signatures:

Opt for digital signatures for e-filing, as they provide an added layer of security and are considered authenticated filings.

5. Keep Tax Records Organized:

Organize your tax records, such as TDS certificates, investment proofs, and bank statements, in a systematic manner to ease the filing process.

6. Maintain Transparency:

Be transparent in your tax filing. If you have foreign assets or offshore accounts, disclose them accurately to avoid legal issues.

7. Explore Tax Planning:

Plan your taxes efficiently by investing in tax-saving instruments and schemes. This not only reduces your tax liability but also helps in wealth creation.

8. Stay Informed:

Keep yourself updated with changes in tax laws, exemptions, and deductions to make the most of available tax benefits.

9. Seek Professional Assistance When Needed:

If your financial situation is complex or you are unsure about tax laws, don’t hesitate to seek professional help. A tax consultant or chartered accountant can provide guidance and ensure accurate filing.

Conclusion

Successful ITR filing requires careful preparation, choosing the correct form, and accurate reporting of your financial information. It’s a crucial financial responsibility that can impact your tax liability, refunds, and overall financial well-being. By following the steps, avoiding common mistakes, and staying informed, you can ensure a smooth and successful ITR filing process. Remember that timely and accurate filing not only fulfills your legal obligations but also provides an opportunity to optimize your finances and secure your financial future.

how auriga accounting help you to ensure a successful and error-free Income Tax Return (ITR) filing process

Auriga Accounting can be a valuable resource for individuals and businesses looking to ensure a successful and error-free Income Tax Return (ITR) filing process. Here are some ways in which Auriga Accounting can assist you in filing your ITR successfully:

1. Expertise and Knowledge:

Auriga Accounting employs experienced tax professionals who have a deep understanding of tax laws, regulations, and the complexities of the tax code. They stay updated with the latest changes in tax laws and can provide expert guidance.

2. Correct ITR Form Selection:

Auriga Accounting can help you choose the appropriate ITR form based on your sources of income and financial situation. Using the correct form is essential to ensure accurate filing and avoid rejection.

3. Comprehensive Review:

Before filing, Auriga Accounting professionals conduct a thorough review of your financial records, ensuring that all necessary documents and income sources are accounted for. This minimizes the risk of errors and omissions.

4. Error Identification and Correction:

Auriga Accounting experts can identify errors, discrepancies, and missing information in your financial records and tax documents. They can correct these issues to ensure accurate and compliant filing.

5. Timely Filing:

Auriga Accounting ensures that your ITR is filed well before the due date to prevent late filing penalties and complications.

6. Verification Assistance:

Auriga Accounting can help you with the verification process after filing your ITR. They ensure that the filing is complete and correct and guide you through the verification options.

7. Handling Complex Financial Situations:

If you have a complex financial situation, such as multiple sources of income, investments, or international assets, Auriga Accounting can provide specialized assistance to ensure that your ITR is filed accurately and in compliance with relevant tax laws.

8. Communication with Tax Authorities:

Auriga Accounting professionals can act as intermediaries between you and tax authorities if any issues or disputes arise. They can communicate with tax authorities on your behalf, providing expert representation.

9. Tax Planning:

In addition to ITR filing, Auriga Accounting can offer tax planning services. They can help you strategize your financial affairs to optimize your tax liability and take advantage of available deductions and exemptions.

10. Record-Keeping Guidance:

Auriga Accounting can provide guidance on maintaining proper records of financial transactions, investments, and tax-related documents. This ensures that you have the necessary documentation for accurate tax filing and potential audits.