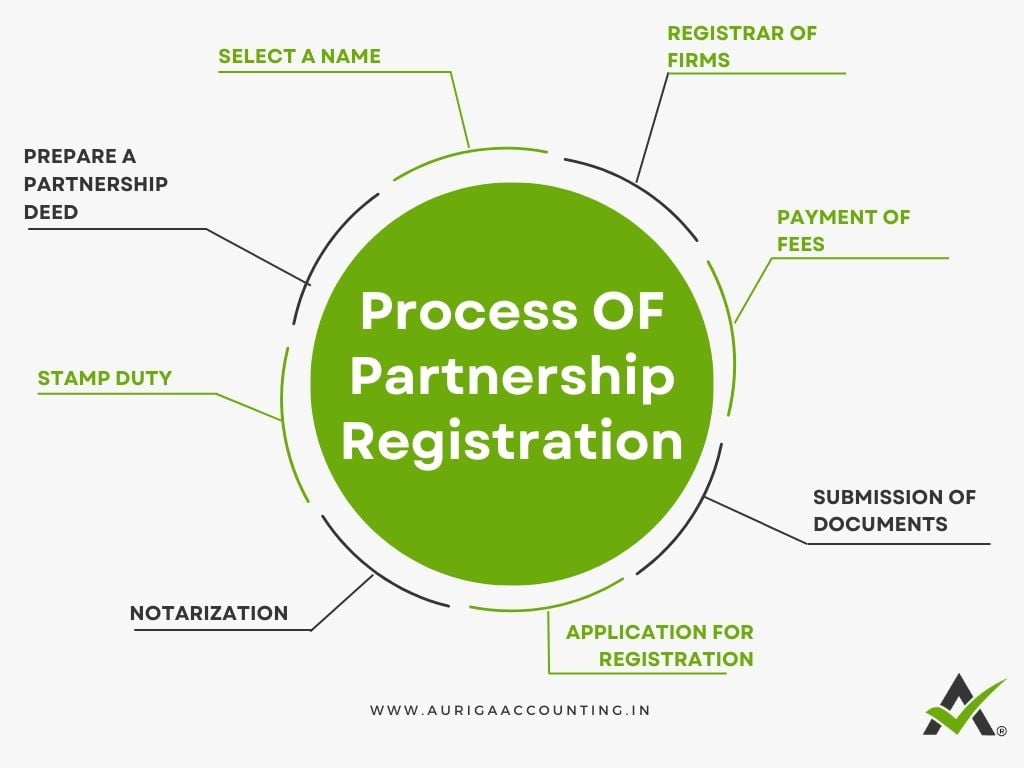

To formalise a partnership firm in Tamil Nadu, specific prerequisites must be met:

Minimum Number of Partners: The formation of a partnership requires a minimum of two partners.

Drafting a Partnership Deed: The partners are obligated to prepare a partnership deed, which delineates the terms and conditions of their cooperation.

Partnership Deed Stamping and Notarization: It is crucial to have the partnership deed stamped and notarized, signifying its legal validation.

Obtaining a Permanent Account Number (PAN): The partners must secure a PAN for the firm, which serves as its unique tax identification.

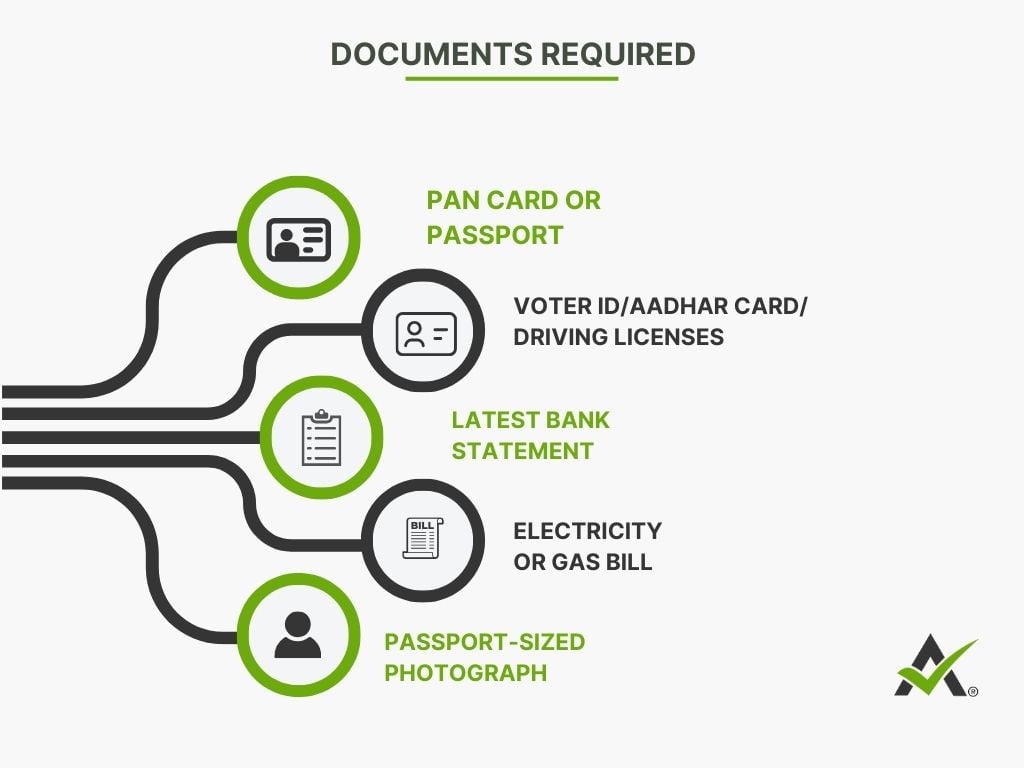

Additionally, certain necessary documents are required from the partners. These include:

- PAN Card

- Aadhaar Card

- Driver’s License

- Passport

- Voter ID

- Sale deed (in case a partner owns the premises)

- Rental agreement copy (if the property is rented)

- Latest electricity bill (not more than 3 months old)

These prerequisites and documents collectively enable the formal registration of a partnership firm in Tamil Nadu, ensuring it functions within the legal framework