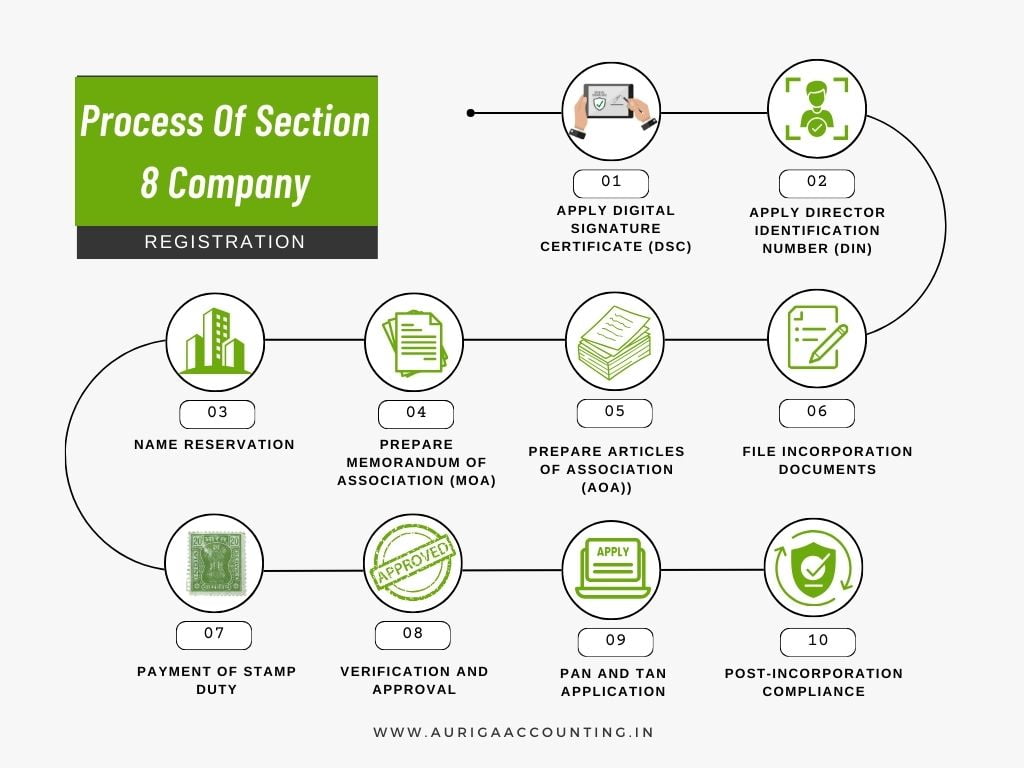

Section 8 Company Registration

Register your Business just in One Click. Choose Auriga Accounting Platform “India’s biggest Platform.” Connect with our Experts.

Get Your Company registered in 7 days Start From ₹7,999 Only!

Incorporate your business with Auriga Accounting

- Connect with our Experts

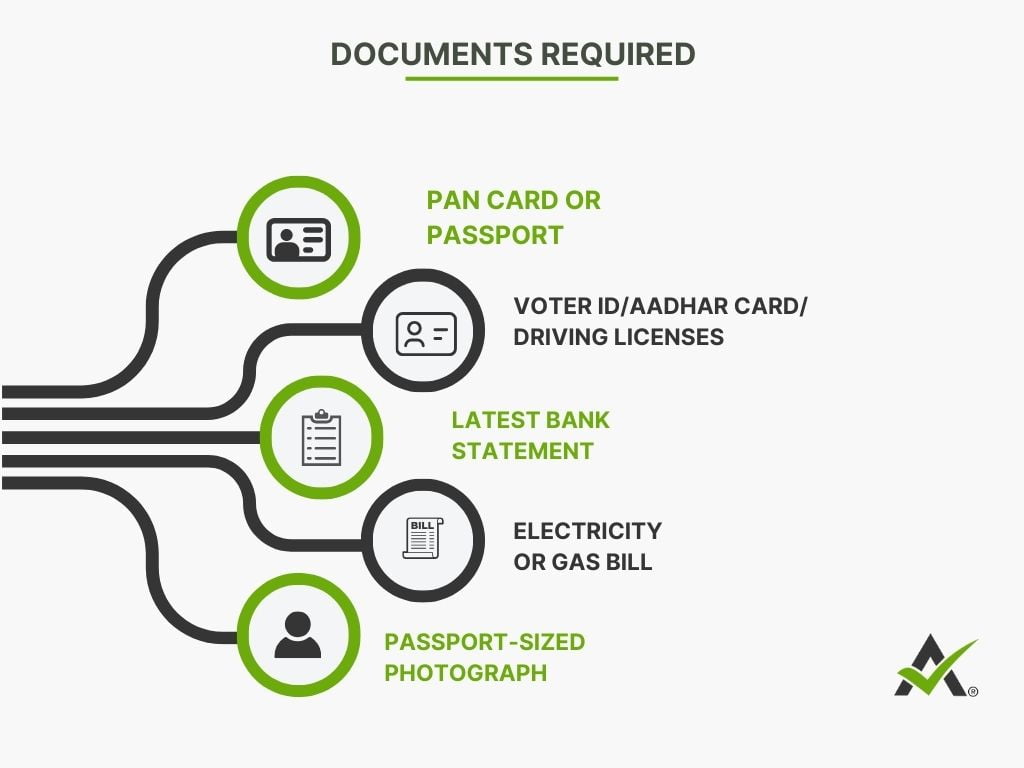

- Submit Your Required Documents

- Track Application Status

- Received your Certificate