WHAT ARE THE REQUIREMENT FOR REGISTRATION OF NIDHI COMPANY IN HARYANA? NO.1 GUIDE

Introduction

ToggleYOU NEED TO KNOW WHAT REQUIREMENT FOR REGISTRATION OF NIDHI COMPANY IN HARYANA?

introduction of nidhi company

A Nidhi Company is a unique type of non-banking financial company (NBFC) in India that primarily focuses on cultivating the habit of thrift and savings among its members. Nidhi Companies are formed for the purpose of facilitating lending and borrowing money within a closed group of individuals, often referred to as “members.” These companies are an essential part of the informal credit system in India and play a significant role in catering to the financial needs of small and medium-sized savers and borrowers.Visitofficialwebsite

Minimum Requirements for Nidhi Company Registration:

a. minimum capital requirement

Minimum Capital: To register a Nidhi Company, you need to have a minimum paid-up equity share capital of Rs. 5 lakhs. This capital is necessary to start the company and conduct its operations.

Minimum Number of Members: You must have at least 200 members to register a Nidhi Company. It is important to note that these members must be real individuals and not artificial persons.

Minimum Number of Directors: You need at least 3 directors to form the board of directors for your Nidhi Company.

b. eligibility criteria

Residency: All the members and directors should be residents of India.

Age: Members and directors should be of legal age (18 years or older).

Financial Stability: Members should have a certain level of financial stability to be eligible for membership.

Document Requirements:

a. document for director and member

Aadhar Card: The Aadhar card is mandatory for all members and directors.

PAN Card: PAN (Permanent Account Number) card is also required for all members and directors.

Proof of Residence: Documents like utility bills, passport, or voter ID can be used as proof of residence.

Passport-sized Photographs: Recent passport-sized photographs are needed for all members and directors.

b. registered office address proof

You must provide proof of a registered office for your Nidhi Company. This can include:

- Ownership Proof: If you own the premises, you can provide a property document.

- Rental Agreement: If you’re renting, a rental agreement along with a NOC (No Objection Certificate) from the landlord is necessary.

- Utility Bill: A utility bill in the name of the premises owner is also required.

Registration Procedure:

The registration procedure for a Nidhi Company in Haryana involves the following steps:

a. name reservation

You need to apply for name reservation through the Ministry of Corporate Affairs (MCA). The name should include “Nidhi Limited” at the end to denote the type of company. The name should be unique and not similar to any existing company.

b. Incorporation Application:

Once the name is approved, you should file an application for the incorporation of the company. This involves submitting various documents, including the Memorandum of Association and Articles of Association, with the MCA.

c. Obtaining Certificate of Incorporation:

After the MCA reviews your application and documents, and they are found to be in order, a Certificate of Incorporation is issued. This certifies the formation of your Nidhi Company.

d. Apply for PAN and TAN:

Once you have the Certificate of Incorporation, you can apply for a PAN (Permanent Account Number) and TAN (Tax Deduction and Collection Account Number) for your Nidhi Company.

e. Commence Business:

After obtaining the Certificate of Incorporation and PAN/TAN, you can officially commence your Nidhi Company’s business operations.

Post Registration Compliance:

Here are some key advantages and disadvantages of a Nidhi company:

Advantages:

- Nidhi companies have less regulatory compliance compared to other NBFCs. They do not require a license from the RBI and only need to register with the MCA as per the Nidhi Rules, 2014.

- Nidhi companies aim to promote savings and thrift among middle and lower income groups by providing loans at lower interest rates.

- Nidhi companies operate only for the benefit of their members. Outsiders cannot invest in or avail credit from Nidhi companies.

- Nidhi companies can raise funds from their members, though the amount is limited due to their restricted membership.

Disadvantages:

- The funds raised by Nidhi companies are limited since they can only accept deposits from members. This restricts their ability to provide loans.

- Though Nidhi companies have less compliance, they are still regulated and governed by the RBI and central government rules. They do not have complete regulatory exemption.

- Nidhi companies have to comply with deposit acceptance rules of the RBI which adds some regulatory burden.

- The central government issues directions and amendments to the Nidhi Rules from time to time which Nidhi companies have to follow.

In summary, while Nidhi companies have advantages like lower compliance and ability to provide loans at lower rates, their limited funds, regulatory oversight and compliance with deposit rules act as disadvantages. A balanced approach is needed to leverage the pros while minimizing the cons.

Post Registration Compliance:

a. RBI Registration:

Nidhi Companies need to be registered with the Reserve Bank of India (RBI) as per the RBI rules and guidelines. You must comply with RBI requirements to conduct lending and borrowing activities.

b. Regular Filing and Compliance:

Annual Returns: You are required to file annual returns with the Registrar of Companies (RoC) in the prescribed format.

Auditing: Regular auditing of your company’s accounts is mandatory.

Nidhi Rules Compliance: Ensure that your company complies with the Nidhi Rules, 2014, including the rules regarding lending and borrowing limits, membership, and other operational aspects.

Meeting Requirements: Hold annual general meetings and other meetings as per company law requirements.

Maintain Statutory Registers: Maintain and update statutory registers as required by company law.

Financial Reporting: Prepare and submit financial statements as per the Companies Act.

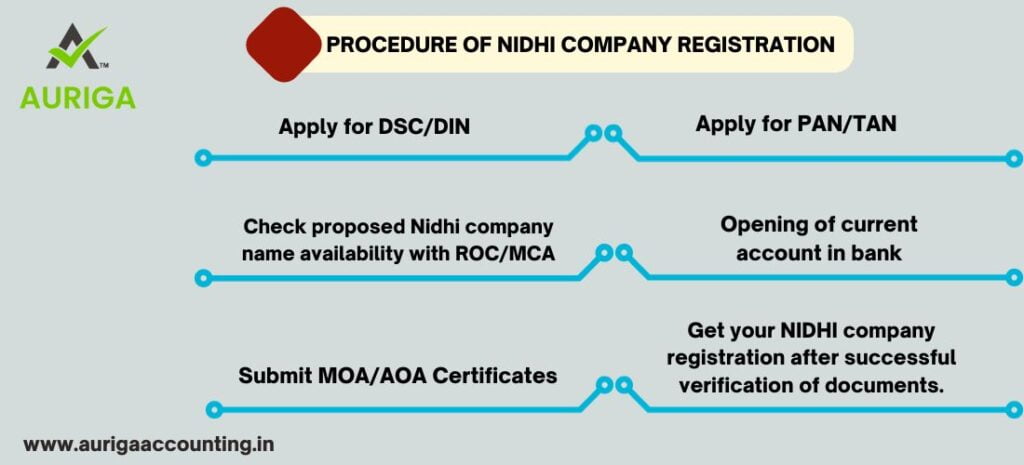

PROCEDURE OF NIDHI COMPANY REGISTRATION

- Apply for DSC/DIN

- Check proposed Nidhi company name availability with ROC/MCA

- Submit MOA/AOA Certificates

- Apply for PAN/TAN

- Opening of current account in bank

- Get your NIDHI company registration after successful verification of documents.

What is the structure of a nidhi company in India

A Nidhi Company is a legal structure incorporated by the Ministry of Corporate Affairs under Section 20A of the Companies Act, 1956. NIDHI stands for National Initiative for Developing and Harnessing Innovations. It is a non-banking investment corporation performing the business of lending and investing with its members.

The Nidhi Company registration is specifically established primarily for mutual benefit and developing the habit of savings among its members. The contribution from the members is the main source of financing for the Nidhi Company.

The Nidhi Organization is obliged to have at least 200 members within one year of its existence. In addition, the Net Owned Funds should be at least Rs 10 lakhs or more within one year of their existence. The ratio between the Net Owned Fund and the deposit does not exceed 1:20.

Restrictions on Nidhi Company

A Nidhi Corporation is prohibited from performing any of the following operations-

- To conduct the hire purchase business, chit fund, lease financing, securities acquisition, or insurance. It cannot issue preference debentures or shares.

- They are not allowed to open the current account of the company member.

- It is prohibited from receiving, lending, or depositing money to any person other than its members.

- The Nidhi company is not allowed to enter into any kind of agreement or pay brokerage to implore any kind of deposits.

- They can’t promise any of the assets submitted by the company members as security.

Members can avail Loan

Nidhi company can lead loan to its members, following limits are set against the deposit made-

- Nidhi company can grant a loan of Rs 2 lakhs if the deposit amount is Rs 2 crores. A loan amount of Rs 7.50 lakhs can be provided if the deposit is more than Rs 2 crores but less than Rs 20 crores.

- A loan amount of Rs 12 Lakhs can be granted if the deposit is more than Rs 20 crores but less than Rs 50 crores.

- For the loan amount of Rs 15 lakhs, the deposit should be more than Rs 50 crores. As per the last audited financial statements, it will not allow deposits above 20 times of its Net Owned Asset.

- The tenure will be for a minimum period of 6 months and a cumulative period of 60 months.

However, investing in Nidhi companies is considered risky due to less monitoring from the Government Investors are advised to check the background/status of the Nidhi Company, in particular, their declaration of their status as a Nidhi Company by the Central Government before becoming a member and investing their hard-earned money in such businesses.

Haryana-Specific Requirements:

Haryana, like many other Indian states, may have specific requirements or additional compliances. It’s important to check with the local authorities and the Registrar of Companies in Haryana to ensure that you meet any state-specific obligations.

Conclusion:

Starting and operating a Nidhi Company in Haryana or any part of India requires careful adherence to the Companies Act, Nidhi Rules, and RBI regulations. Meeting the minimum capital, eligibility, and documentation requirements is essential. Moreover, post-registration compliance is equally important to maintain the company’s legal standing and credibility. Always consider seeking professional assistance to navigate the intricate legal and financial aspects of operating a Nidhi Company in Haryana or any other location in India.

how auriga accounting help you to register nidhi company in haryana

Auriga Accounting is a professional service provider that specializes in assisting businesses with various financial and legal matters, including company registration. If you’re looking to register a Nidhi Company in Haryana, Auriga Accounting can offer valuable assistance throughout the process. Here’s how they can help you:

Understanding Nidhi Company Registration Requirements: Auriga Accounting professionals have a deep understanding of the legal and regulatory requirements for Nidhi Company registration in Haryana. They can explain the prerequisites and criteria you need to meet, ensuring that you are fully informed about the process.

Name Reservation: They can help you with the selection and reservation of a suitable company name. This step is crucial, as the name should comply with the naming guidelines set by the Ministry of Corporate Affairs (MCA).

Document Preparation and Verification: Auriga Accounting can assist you in preparing and verifying the necessary documents, such as the Memorandum of Association, Articles of Association, and other documentation required for the registration process.

Filing and Application Submission: They can handle the submission of your application for Nidhi Company registration with the Registrar of Companies (RoC). This includes submitting the required documents and paying the necessary government fees.

Liaison with Government Authorities: Auriga Accounting can act as your liaison with government authorities, such as the RoC and the Ministry of Corporate Affairs, to ensure a smooth and efficient registration process.

Compliance with Nidhi Rules and Regulations: They will ensure that your Nidhi Company adheres to all the rules and regulations set forth by the Nidhi Rules, 2014, and other relevant laws and guidelines. Compliance is essential to avoid legal issues in the future.

RBI Registration: If required, Auriga Accounting can assist with the registration of your Nidhi Company with the Reserve Bank of India (RBI), as Nidhi Companies need to comply with RBI regulations.

Post-Registration Compliance: They can provide ongoing support for your company’s compliance requirements, including filing annual returns, conducting audits, and managing statutory registers as mandated by the Companies Act.

Local Expertise: Having a presence in Haryana, Auriga Accounting is familiar with the specific state-level requirements and can ensure that your Nidhi Company complies with any regional regulations or obligations.

Professional Advice: Auriga Accounting’s team of experts can offer professional advice on financial management, taxation, and other financial aspects of running a Nidhi Company.

Efficiency and Time-Saving: Utilizing their services can save you time and effort, as they have the experience and knowledge to navigate the complexities of the registration process efficiently.

Reduced Risk: With professional guidance from Auriga Accounting, you can minimize the risk of errors or non-compliance, which could lead to legal issues in the future.