ARE TAX RETURN EVER REJECTED?

Introduction

ToggleARE TAX RETURN EVER REJECTED?

Introduction of tax return

Filing a tax return is an annual obligation for individuals and businesses, and it’s not uncommon for returns to be rejected by tax authorities. A rejected tax return can be a source of frustration, but it’s important to remember that it can be resolved. This comprehensive guide will take you through the steps involved in dealing with a rejected tax return and provide insights into preventing future rejections.Visitofficialwebsite

Understanding Tax Return Rejection

A rejected tax return is one that has not been accepted by the tax authorities, typically the Internal Revenue Service (IRS) in the United States. Rejections can occur for a variety of reasons, including errors, omissions, inconsistencies, and mismatches in the information provided on the return. It’s crucial to understand that a rejected return is not the same as a “filed” return, and it requires correction and resubmission.

Notification of Rejection

The first step in handling a rejected tax return is to be aware of the rejection. Tax authorities will typically notify you of the rejection, and this notification can come in various forms, including email, postal mail, or through tax preparation software if you filed electronically. Once you receive this notification, it’s essential to act promptly.

Common Reasons for Tax Return Rejection

Inaccurate Personal Information: One of the most common reasons for tax return rejection is inaccurate personal information. Errors in names, Social Security numbers, and addresses can lead to the rejection of the return. This section explores the impact of inaccurate personal information and provides tips on how to prevent it.

Mathematical Errors: Mathematical errors, such as incorrect calculations of income, deductions, or credits, can lead to tax return rejection. This part discusses the importance of double-checking mathematical calculations and offers guidance on error prevention.

Missing or Incomplete Forms and Schedules: Another reason for tax return rejection is missing or incomplete forms and schedules. The essay elaborates on the significance of ensuring all necessary forms and schedules are included in the return and provides tips on how to avoid this issue.

Failure to Sign the Return: A tax return is not valid without the taxpayer’s signature. This section highlights the importance of signatures and discusses how they can lead to rejection if missing or incomplete.

Filing Status and Dependency Errors: Errors in selecting the correct filing status or inaccuracies in claiming dependents are common reasons for tax return rejection. The essay provides insights into how to prevent these errors.

Preventing Future Rejections

While handling a rejected tax return is essential, it’s equally important to take steps to prevent future rejections:

Use Tax Software: Utilize tax preparation software that can help reduce common errors and provide guidance on accurate filing.

Double-Check Information: Review your tax return carefully before submission to catch any mistakes or discrepancies.

E-File: If possible, consider e-filing your return. E-filing can reduce the likelihood of errors and may provide faster processing.

Stay Informed: Stay updated on changes in tax laws and regulations to ensure that you are in compliance.

Keep Accurate Records: Maintain organized and accurate records of your financial transactions, income sources, and expenses to support your return.

How to Avoid Tax Return Rejection

Tax return rejection can be a frustrating and time-consuming experience, but it is preventable. There are several steps individuals and businesses can take to minimize the risk of their returns being rejected:

a. Double-Check Personal Information: Ensure that all personal information, including names, social security numbers, and addresses, is accurate and up-to-date. A simple typographical error can lead to rejection.

b. Choose the Correct Filing Status: Take the time to determine the appropriate filing status. If there is any doubt, consult with a tax professional or use tax software that can guide you through the process.

c. Careful Calculations: Avoid mathematical errors by double-checking all calculations. Tax preparation software can help in this regard, but manual calculations should also be reviewed for accuracy.

d. Complete All Forms and Schedules: Make sure to include all required forms and schedules when filing your return. If you have multiple sources of income or complex financial situations, consider consulting a tax professional for assistance.

e. Report All Income: To avoid rejection due to unreported income, maintain detailed records of all income sources and ensure that they are accurately reported on your tax return.

f. Verify Deductions and Credits: Before claiming deductions and credits, confirm that you meet the eligibility criteria. Tax software and professional advice can help ensure accurate claims.

g. File On Time: To avoid late filing issues, be aware of the tax filing deadline and consider requesting an extension if you anticipate delays in filing.

h. Protect Against Identity Theft: In the age of identity theft and fraud, take steps to protect your personal information. Safeguard your social security number, use secure and unique passwords, and monitor your financial accounts for suspicious activity.

i. E-File Your Tax Return: Electronic filing (e-filing) is generally faster and more accurate than paper filing. E-filing software can catch many common errors and is often the preferred method for tax authorities.

j. Seek Professional Assistance: If you have a complex financial situation or are unsure about certain aspects of your return, it’s wise to seek the guidance of a qualified tax professional or use tax preparation software.

k. Respond to IRS Notices Promptly: If your tax return is rejected or you receive a notice from the IRS, address it promptly. Ignoring these notices can lead to further complications and potential penalties.

How can you get your tax refund the same day

When filing a Federal Income Tax return you cannot receive the refund the same day you file your return. It takes approximately 4–6 weeks to process your return and to receive a refund. Shorter time if you e-file.

As previously stated by Ms. Farris, there are some tax preparers who may charge you to do your taxes and charge you a fee to advance you your refund. I have also heard of car dealerships doing this also. Just be careful in doing this because they may charge you an outrageous amount in fees!

I always file by e-file and it can be amazing how quickly they deposit your money in your account (especially if you file early!)

Hope this is helpful. Have a GREAT day!

How can I check the status of my tax refund

Checking the status of your tax refund is a simple and easy process that you can do online. Here are the steps that you can follow:

- Visit the Income Tax India website

- Log in to the portal using your registered USER ID (PAN number), password, and captcha code.

- Look for ‘View Returns / Forms’ or ‘Refund/Demand Status’ under ‘My Account’.

- Select ‘Income Tax Returns’ from the drop-down menu, then click the ‘Submit’ button.

- You will see a list of your filed returns for different assessment years. Click on the ‘Acknowledgement Number’ of the return for which you want to check the refund status.

- You will see a summary of your return details, including the status of your refund. The status can be one of the following:

- Not Determined: This means that your return has not been processed yet by the Income Tax Department. You may have to wait for some time before your refund is processed and issued.

- Refund Paid: This means that your refund has been paid by the Income Tax Department. You will also see the mode of payment (either direct credit to your bank account or cheque) and the date of payment.

- Refund Determined and sent out to Refund Banker: This means that your refund has been approved by the Income Tax Department and sent to the State Bank of India (SBI), which is the refund banker. You will also see a reference number that you can use to track your refund on the SBI website.

- Refund Unpaid: This means that your refund has been rejected by the Income Tax Department due to some reason. You will also see the reason for rejection, such as incorrect bank details, expired cheque, address mismatch, etc. You may have to rectify the error and resubmit your request for refund.

- No Demand No Refund: This means that there is no refund due to you as per your return. Your tax liability and tax paid are equal, or you have a tax demand that is equal to or more than your tax refund.

I hope this answer helps you check the status of your tax refund. If you have any further questions or need more guidance, please feel free to ask me.

I am always happy to help you with your tax queries and goals.

What is the process for claiming a tax refund, and why might I be eligible for one

You need to file the income tax return(ITR) for claiming refund. Please note following things before proceeding to file your ITR –

- Make sure you have full knowledge of how to file ITR. Don’t refer Google and file it. Remember half knowledge is always dangerous.

2. Make sure you have all legitimate income tax deductions with all valid proof of investment and expenses.

3. Read chapter VI-A of Income tax to understand what all investments are allowed.

4. To claim refund in bank account, the account must be compulsorily linked to your pan

5. Your pan and adhar are linked.

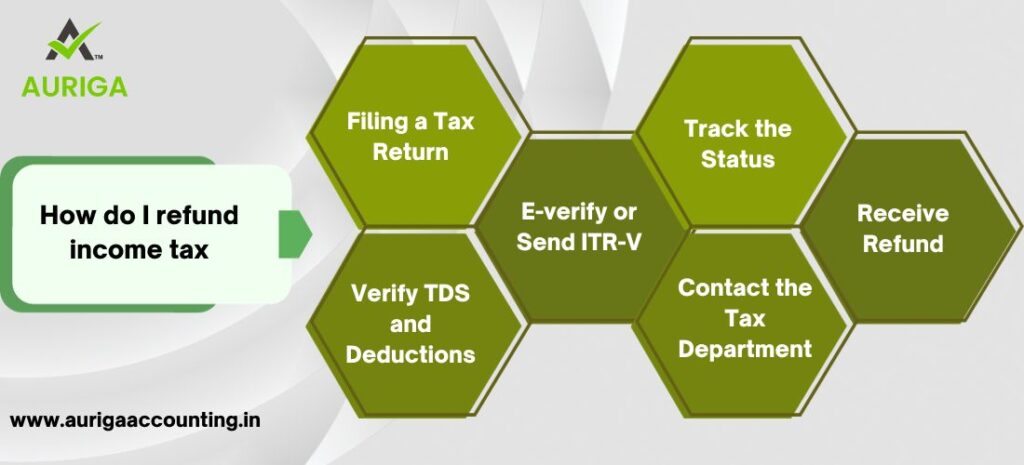

How do I refund income tax

In India, to claim a refund of income tax, follow these steps:

- Filing a Tax Return: Ensure you have filed your income tax return accurately. You can file your return online or manually.

2. Verify TDS and Deductions: Check that your employer or other sources have deducted the correct amount of Tax Deducted at Source (TDS). Also, verify your eligible deductions and exemptions.

3. E-verify or Send ITR-V: If you file your return online, e-verify it using your Aadhar card or net banking. If filing manually, send the ITR-V form to the Centralized Processing Centre within 120 days of filing.

4. Track the Status: You can check the status of your refund by visiting the Income Tax Department’s official website.

5. Receive Refund: If your return is processed and a refund is due, it will be credited directly to your bank account. Make sure your bank details are correctly provided in your return.

6. Contact the Tax Department: If you face delays or issues, you can contact the tax department or visit your local tax office for assistance.

It’s important to ensure the accuracy of your tax return and supporting documents to expedite the refund process. Consulting with a tax professional can also be helpful if you encounter any complexities in your tax situation.

Amend and Resubmit the Return

After identifying and correcting errors and inaccuracies, you’ll need to amend your tax return. The process for amending a return depends on the tax authority and the filing method:

Paper Returns: If you initially filed a paper return, you’ll need to complete an amended return form (e.g., 1040X in the United States) and mail it to the tax authority with the necessary attachments.

Electronic Returns: If you filed electronically, you may be able to resubmit the corrected return through the same electronic filing method. Follow the instructions provided in the rejection notice.

Amendment Filing Deadline: Be aware of any deadlines for amending a return. In the United States, for example, you generally have three years from the original filing date to amend your return.

Conclusion

In conclusion, tax return rejection is not uncommon and can occur for various reasons, from minor errors in personal information to more significant issues like unreported income and fraud concerns. However, by taking precautions and following best practices, individuals and businesses can significantly reduce the risk of their tax returns being rejected. Accuracy, completeness, and attention to detail are essential when preparing and filing tax returns. Moreover, staying informed about tax law changes and protecting personal information can further enhance the likelihood of a successful tax filing experience. Ultimately, understanding the common reasons for tax return rejection and taking proactive measures to address them can lead to a smoother and more stress-free tax season.

how auriga accounting help you to tax rejection

Auriga Accounting, being a comprehensive financial and accounting software, can be a valuable tool in helping individuals and businesses address and prevent tax return rejection. Here’s how Auriga Accounting can assist in managing tax rejections:

1. Data Accuracy and Validation:

Auriga Accounting is designed to minimize errors by providing validation checks throughout the data entry process. It helps users enter accurate and complete financial information, reducing the risk of common errors that can lead to tax return rejection. This includes checking for mathematical errors, validating personal information, and ensuring proper forms and schedules are completed.

2. Real-time Error Alerts:

The software can instantly identify errors or inconsistencies in your financial data and alert you as you enter information. This real-time feedback can prevent issues that might otherwise lead to tax return rejection. It guides you to rectify the problem before you submit your return.

3. Electronic Filing Assistance:

Auriga Accounting often integrates with e-filing services, making it easier to electronically submit your tax return. E-filing is generally faster and less error-prone than paper filing. The software can guide you through the e-filing process, reducing the chances of rejection due to manual data entry errors.

4. Support for Complex Tax Situations:

For individuals and businesses with complex financial situations, Auriga Accounting can handle various income sources, deductions, and credits. It helps ensure that all necessary forms and schedules are included, reducing the risk of rejection due to incomplete or missing information.

5. Audit Trail and Record-keeping:

Auriga Accounting maintains a detailed record of all financial transactions and activities. This is invaluable in the event of an audit or if you need to amend a tax return due to a rejection. Having an organized audit trail simplifies the process of identifying and addressing errors.

6. Integrated Document Management:

The software often comes with document management features, allowing users to store and organize supporting documentation for their tax returns. This is essential when dealing with a rejected return, as you’ll need to provide documentation to support corrections.

7. Tax Law Updates:

Auriga Accounting typically stays updated with the latest tax laws and regulations. This helps users remain in compliance with tax laws and reduces the risk of rejection due to outdated or inaccurate information.

8. Professional Assistance:

Many accounting software solutions, including Auriga Accounting, offer customer support or access to tax professionals who can provide guidance and assistance if you encounter tax return rejection. They can help you understand the rejection reasons and guide you through the correction process.

9. Preventative Measures:

The software often offers features and tools for ongoing financial management and organization, which can help you take preventative measures to reduce the likelihood of future tax return rejection. These may include tracking income sources, monitoring expenses, and setting reminders for tax deadlines.

10. Reports and Analysis:

Auriga Accounting provides a variety of reports and financial analysis tools. These can help you review your financial data before submitting your tax return, giving you an opportunity to catch errors and inaccuracies before they result in rejection.