Annual Compliance Filing For Private Limited Company

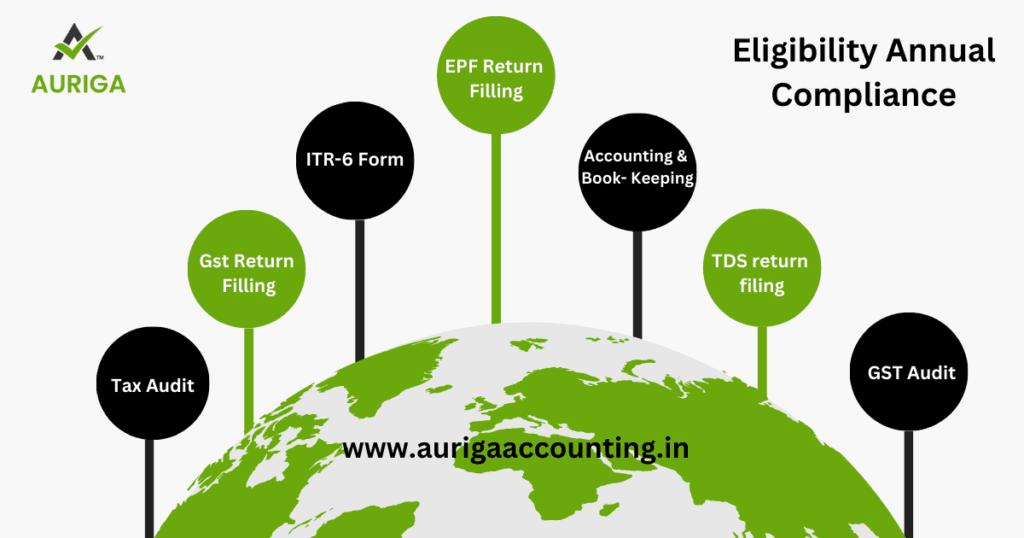

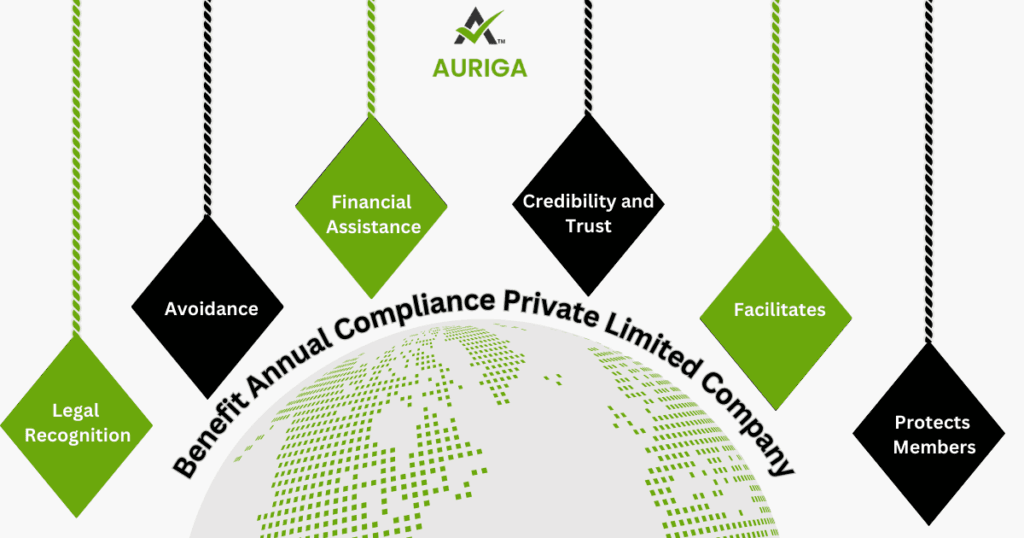

“Annual Compliance Filing For Private Limited Company” refers to the set of legal and regulatory obligations that individuals, businesses, and organizations must fulfill on an annual basis to remain in good standing and compliance with the laws and regulations applicable to them. With “India’s BEST TAX CONSULTANT.” Connect with our Experts.

Get ROC FILLING For a Private Limited Company. Online Hassle Free

Annual Compliance Filing For Private Limited Company. Online with Auriga Accounting

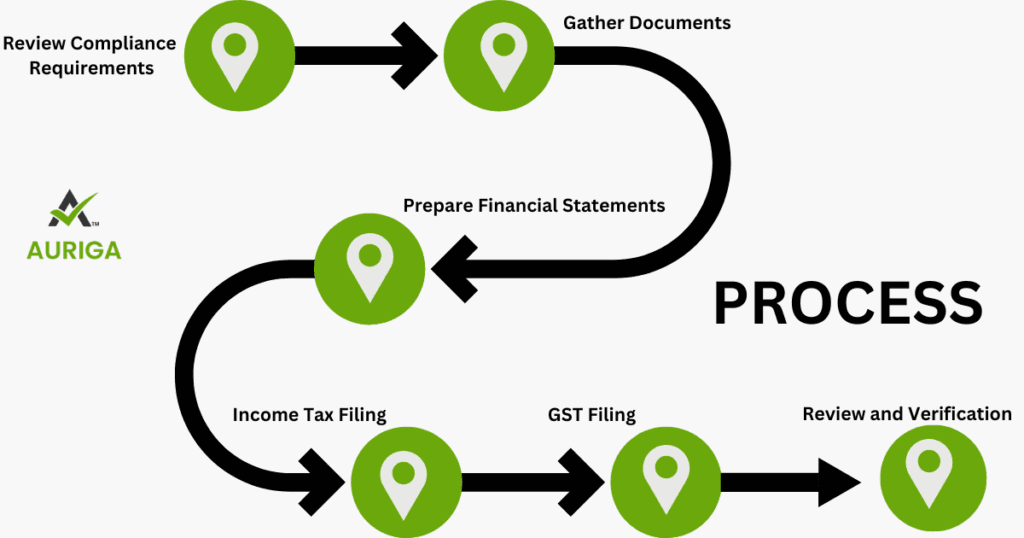

- Connect with our Experts

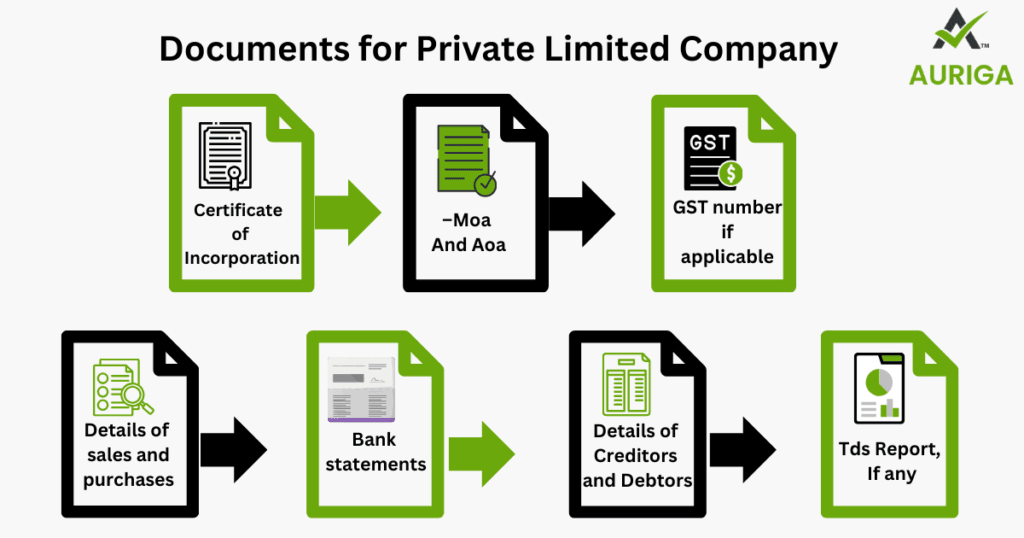

- Submit Your Required Documents

- Track Application Status

- Received your Certificate