HOW TO FILE INCOME TAX RETURN CORRECTLY IN DELHI?

Introduction

ToggleHOW TO FILE INCOME TAX RETURN CORRECTLY IN DELHI?

Introduction to Income Tax Filing

Income tax is a direct tax that individuals pay on their earnings to the government. Filing income tax returns is a mandatory requirement for most taxpayers in Delhi, as in the rest of India. It is an annual process that helps the government collect tax revenue and enables individuals to report their income, claim deductions, and avail of benefits. Filing your income tax return accurately is essential to avoid penalties and legal complications.

Preparing for Income Tax Filing

Before you start the income tax filing process, it’s crucial to prepare by gathering the necessary documentation and understanding your financial situation:

a. Documentation and Record Keeping:

- Collect documents like PAN card, Aadhaar card, Form 16, and any Form 16A for other income sources.

- Maintain records of investments, bank statements, rent receipts, medical bills, and other supporting documents.

- Keep track of TDS certificates, if any.

b. Understanding Income Sources:

- Identify all your sources of income, including salary, rental income, business income, capital gains, and any other sources.

- Understand the tax implications of each income source.

c. Eligibility for Filing Income Tax Return:

- Check whether you meet the criteria for mandatory income tax return filing based on your income level.

Choosing the Correct Income Tax Form

The next step is to choose the appropriate income tax return (ITR) form. The choice of form depends on your income sources and status (individual, HUF, company, etc.). In Delhi, most individuals with salary income file ITR-1 (Sahaj), while those with business or professional income may file ITR-3, ITR-4, or other applicable forms.

Filing Online vs. Offline

The Income Tax Department strongly encourages online filing of income tax returns. The process is more convenient, efficient, and secure compared to traditional offline filing. To file your returns online, register on the Income Tax e-Filing portal (https://www.incometaxindiaefiling.gov.in) and choose the correct ITR form.

Filling Out the Income Tax Return Form

Once you’ve chosen the appropriate ITR form, follow these steps to fill out your return correctly:

a. Personal Information:

- Provide your personal details, including your name, PAN, Aadhaar number, and contact information.

b. Income Details:

- Report all your income sources in the relevant sections, such as salary, house property, business income, capital gains, and other sources.

- Declare any exempt income and other income sources.

c. Deductions and Exemptions:

- Claim deductions under sections like 80C, 80D, and 80G, if applicable.

- Report exemptions under sections like 10, 10A, and 10B, if applicable.

d. Taxes Paid:

- Provide details of any taxes paid, including TDS (Tax Deducted at Source) and advance tax.

- Calculate your tax liability and determine whether you are eligible for a refund or need to pay additional taxes.

e. Verification:

- Sign and date your return form. You can file electronically by using an Electronic Verification Code (EVC), Aadhaar OTP, or other methods, or by sending a physical ITR-V to the Centralized Processing Center (CPC) in Bengaluru.

E-Verifying Your Income Tax Return

E-verification is a convenient and secure way to confirm the accuracy of your income tax return. You can e-verify using one of the following methods:

- Electronic Verification Code (EVC): This is a 10-digit code sent to your registered mobile number and email address. It can be generated on the e-Filing portal.

- Aadhaar OTP: Use the OTP sent to your registered mobile number linked with your Aadhaar.

- Net Banking: If you have internet banking, you can e-verify through your bank’s online platform.

- Bank ATM: Visit your bank’s ATM and use the ATM-based e-verification method.

- Demat Account: E-verify using your Demat account, if you have one.

- Bank Account Number: You can use your bank account number for e-verification.

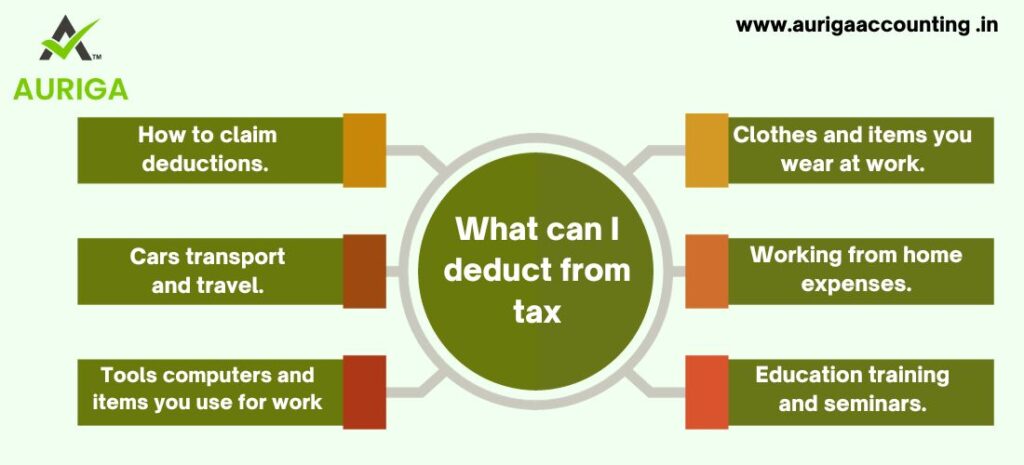

What can I deduct from tax?

- How to claim deductions.

- Cars transport and travel. …

- Tools computers and items you use for work.

- Clothes and items you wear at work.

- Working from home expenses.

- Education training and seminars.

What is interest deductions

Interest deduction causes a reduction in taxable income. If a taxpayer or business pays interest, in certain cases the interest may be deducted from income subject to tax. Some examples of interest payments that can be deducted are: Interest payments for a home mortgage or home equity loan1

Benefits of Filing Income Tax Return Correctly

Filing your income tax return accurately in Delhi offers several advantages:

- Compliance with tax laws and regulations.

- Eligibility for loans and visas, as an updated income tax return is often required.

- Refund of excess taxes paid.

- Avoiding penalties and legal issues.

why you choose auriga accounting

AURIGA ACCOUNTING PVT. LTD. || INDIA

Auriga Accounting Private Limited is a technology driven platform which provides legal & financial services through its team of professionals. Auriga Accounting Private Limited provide expert services which can get your new business off to a flying start. We are Compliance and finance officers for your business. Here you get simple and affordable online company registration and range of essential services. A world class technology – driven platform, offering end to end service from startup to well established firm.

BUSINESS SOLUTION’S || ACCOUNTING SERVICE’S || BUSINESS CONSULTANT

A business agency is a company such as, We Auriga Accounting, that provides a specialized service to their clients. Often, agencies act on behalf of another company, group or individual to manage a segment of their business.

No. 01 CA Firm Company in INDIA is Auriga Accounting.Hassle Free Services. We Got 17+ National Awards & 5+International Awards.

Some key aspects of business services include:

1.BUSINESS REGISTRATION || 2.TAX REGISTRATION. || 3.COMPLIANCES

contact us for more information : Website- https://aurigaaccounting.in/. Email- Admin@AurigaAccounting.in

how auriga accounting help you to file income tax return correctly

Auriga Accounting can play a vital role in helping individuals and businesses file their income tax returns correctly. Here’s how Auriga Accounting can assist you in this process:

1. Expertise in Tax Laws and Regulations:

- Auriga Accounting professionals are well-versed in tax laws and regulations, including both central and state taxes. They stay updated with changes in tax laws to ensure that your return complies with the latest requirements.

2. Accurate Income Assessment:

- Auriga Accounting will help you accurately assess your income from all sources, ensuring that you don’t miss any taxable components. They will consider various income types, including salary, business income, capital gains, rental income, and more.

3. Identifying Deductions and Exemptions:

- The team at Auriga will identify deductions and exemptions applicable to your financial situation. This includes deductions under various sections of the Income Tax Act, such as Section 80C for investments, Section 80D for health insurance, and more.

4. Choosing the Right ITR Form:

- Auriga Accounting will help you select the correct Income Tax Return (ITR) form based on your income sources and the complexity of your financial situation. Using the right form is crucial to ensure accurate tax reporting.

5. Accurate and Timely Filing:

- Auriga ensures that your tax return is filed accurately and within the specified deadlines. Filing your return on time is essential to avoid penalties and interest charges.

6. E-Filing Assistance:

- Auriga Accounting can assist in the electronic filing of your tax return, which is the most convenient and efficient method. They can guide you through the process of registering on the Income Tax e-Filing portal and submitting your return electronically.

7. Verification Support:

- After filing, Auriga can help you with the verification process. They can assist in generating Electronic Verification Codes (EVC) and ensuring that your return is correctly e-verified.

8. Handling Complex Situations:

- For individuals with complex financial situations, such as those involving multiple income sources, international income, or substantial investments, Auriga Accounting provides specialized expertise to handle these complexities.

9. Tax Planning:

- Auriga Accounting can also assist in tax planning, helping you make strategic financial decisions that minimize your tax liability legally. This includes guidance on investments, deductions, exemptions, and other strategies to optimize your tax situation.

10. Compliance and Record-Keeping:

- Auriga Accounting ensures that your tax return complies with all applicable laws and regulations. They can also advise you on maintaining proper records and documentation to support your tax filings.