WHAT IS THE GOVERNING LEGISLATION FOR PRODUCER COMPANIES IN INDIA?

Introduction

ToggleWHAT IS THE GOVERNING LEGISLATION FOR PRODUCER COMPANIES IN INDIA?

The governing legislation for producer companies in India is the Companies Act, 2013. Producer companies are regulated under Chapter IX A of the Companies Act, which specifically addresses their incorporation, management, and administration. It’s essential to be aware that laws and regulations may undergo changes, so it’s advisable to check for any updates or amendments to the legislation. Consult the latest version of the Companies Act or seek legal advice for the most current information on producer companies in India. Visitofficialwebsite

Historical Context producer company

The concept of producer companies has its roots in India’s cooperative movement, which gained momentum during the pre- and post-independence periods. The cooperative movement aimed to empower and uplift the rural and agrarian communities by organizing them into collective entities. The enactment of the Companies Act, 1956, laid the foundation for these entities by introducing provisions for the formation of cooperative societies and farmer producer organizations (FPOs). However, it was the Companies (Amendment) Act, 2002, that introduced the concept of producer companies as a distinct corporate entity, separate from traditional cooperatives.

The Companies (Amendment) Act, 2002, recognized the need for a more dynamic and flexible corporate structure that could better serve the interests of primary producers. This act laid the groundwork for the inclusion of Chapter IXA in the Companies Act, 1956, which was later incorporated into the Companies Act, 2013. These legislative developments were instrumental in facilitating the creation of producer companies as a means of promoting the welfare and economic development of primary producers.

What is the role of CEO in farmer producer company

Provide monthly report, quarterly report, annual report, success stories and MIS of FPO to various stake holders as per the requirement from time to time. Organize Training and meeting for Farmers on various initiatives like improved agriculture practices, new scheme for farmers etc.

Objectives of Producer Companies:

Producer companies are established with specific objectives, which are outlined in the governing legislation. The primary objectives of producer companies in India are as follows:

Promotion of Economic Interests: The foremost objective of producer companies is to promote and protect the economic interests of their members, who are primarily involved in primary production activities.

Collective Action: Producer companies enable primary producers to collectively engage in various activities related to primary production, such as cultivation, harvesting, procurement, processing, and marketing of agricultural and other rural products.

Resource Mobilization: These companies facilitate the mobilization of financial and other resources necessary for improving the economic conditions of their members. This includes raising capital, availing financial assistance, and accessing government schemes and incentives.

Market Access: Producer companies provide a platform for primary producers to access markets and obtain better prices for their produce. By acting collectively, they can negotiate more effectively and reduce the impact of intermediaries.

Capacity Building: Producer companies often engage in capacity-building activities for their members, including training and education in modern agricultural practices, technology adoption, and financial literacy.

Technology Adoption: They encourage the adoption of modern technology and best practices to enhance the productivity and quality of the produce.

Quality Assurance: Producer companies often establish quality control and assurance mechanisms to ensure that the produce meets industry and consumer standards.

Diversification: They may assist their members in diversifying their income sources and engaging in value-added activities.

Who are the members of a producer company

The minimum paid-up Capital being Rs. 1 Lakh and minimum authorized capital being Rs. 5 lakh for a PC, it easy to mobilise the small amount. Minimum number of producers required to form a PC is 10 while there is no limit for maximum number of members and the membership can be increased as per feasibility and need.

Can a private company be converted into producer company

Shareholder Approval: Obtain the consent of shareholders through a special resolution for the conversion. c. Altering the Memorandum and Articles of Association: Amend the Memorandum and Articles of Association to align with the objectives and structure of a Producer Company.

Is producer company a small company

On registration, the producer company shall become as if it is a Private Limited Company for the purpose of application of law and administration of the company. However, it shall comply with the specific provisions of part IXA. The limit of maximum number of members is not applicable to these Companies.

What is the minimum number of directors in a farmer producer company

The minimum requirement for producer company registration is 5 directors and 10 members. The minimum paid-up capital should be Rs. 5 lakhs to complete the incorporation of a producer company. There can be unlimited number of members in the company as there is no specific prescribed limit of members.

Key Provisions of the Governing Legislation:

The governing legislation for producer companies in India is primarily the Companies Act, 2013. The following are some of the key provisions and requirements outlined in the legislation:

Formation and Incorporation: Producer companies must be registered as companies under the Companies Act, 2013. The Act provides the legal framework for their incorporation. The producer company is required to have a minimum of five and a maximum of fifteen directors.

Membership: Membership in a producer company is open to individuals and other entities involved in primary production. The members are both shareholders and participants in the company’s operations.

Limited Liability: Members of producer companies enjoy limited liability, which means that their personal assets are protected from the company’s debts and liabilities.

Democracy and Control: Producer companies operate on democratic principles, with members having voting rights in proportion to their transactions with the company. This ensures that the interests of primary producers are taken into account.

Minimum and Maximum Share Capital: The governing legislation specifies the minimum and maximum share capital requirements for producer companies. The minimum paid-up capital required for a producer company is relatively low compared to other types of companies.

Object Clause: The Memorandum of Association of a producer company must include an object clause that clearly outlines the primary activities and objectives of the company.

Distribution of Profits: Producer companies distribute profits among their members based on their transactions with the company, ensuring that those who engage more with the company benefit more from its operations.

Audit and Financial Reporting: Like other companies, producer companies are required to maintain proper financial records and submit annual financial statements for audit. These statements must comply with the applicable accounting standards.

Regulation and Oversight: The Ministry of Corporate Affairs (MCA) is responsible for regulating producer companies in India. The MCA oversees the incorporation, functioning, and dissolution of these companies, ensuring compliance with legal requirements.

Capacity Building and Training: The legislation encourages producer companies to engage in capacity-building activities for their members, including training and education in modern agricultural practices, technology adoption, and financial literacy.

Market Linkage and Access: Producer companies are encouraged to facilitate market linkages for their members, helping them access markets and obtain better prices for their produce.

Financial Assistance: Producer companies have provisions for raising capital and availing financial assistance to support the economic interests of their members. These provisions are in line with the overall objectives of producer companies.

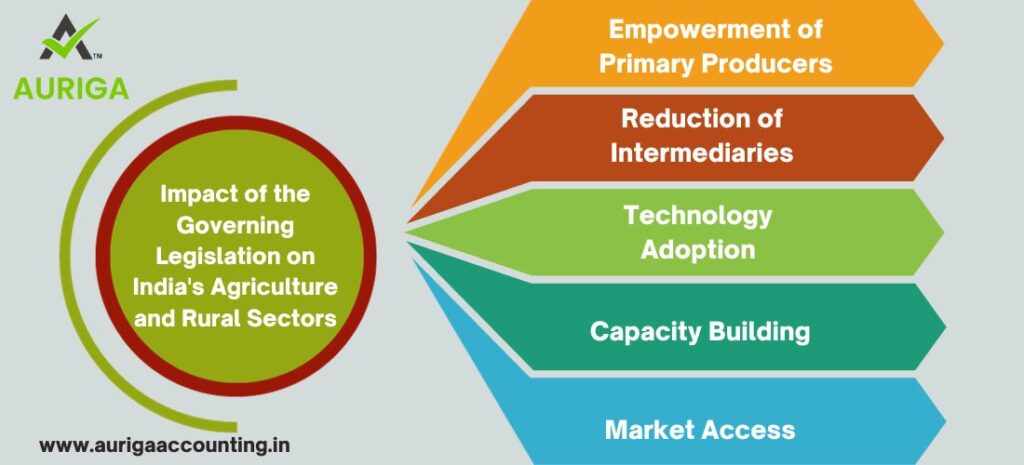

Impact of the Governing Legislation on India's Agriculture and Rural Sectors:

The governing legislation for producer companies has had a significant impact on India’s agriculture and rural sectors. Some of the key effects and contributions include:

Empowerment of Primary Producers: Producer companies empower primary producers by providing them with a collective and organized platform to engage in activities that enhance their economic well-being.

Reduction of Intermediaries: By directly connecting primary producers with markets, producer companies reduce the role of intermediaries, which often results in better prices for the produce.

Technology Adoption: The legislation encourages the adoption of modern technology and best practices in agriculture, leading to increased productivity and improved product quality.

Capacity Building: Producer companies engage in capacity-building activities, improving the skills and knowledge of their members in areas such as modern farming techniques and financial management.

Market Access: These companies help primary producers access markets that they might not have been able to reach individually. This results in expanded market opportunities and increased income.

Challenges and Future Prospects:

While the governing legislation for producer companies has been instrumental in promoting the welfare of primary producers, there are challenges and areas for improvement. These include:

Awareness and Outreach: Many primary producers, especially in remote and underserved areas, may not be aware of the benefits of forming or joining producer companies. Outreach and awareness-building efforts are essential.

Capacity Building: While producer companies engage in capacity-building activities, more comprehensive training and education programs can further enhance the skills and knowledge of members.

Access to Capital: Ensuring that producer companies have access to affordable capital and financial services is crucial for their growth and success.

Market Linkages: Expanding market access for producer companies and providing support for market linkages is vital to help them reach a wider customer base.

Sustainability and Environment: Encouraging sustainable and environmentally responsible agricultural practices should be a priority for producer companies to ensure the long-term health of the agricultural sector.

Policy Support: Advocating for policies that promote the interests of primary producers and producer companies is an ongoing challenge that requires concerted efforts.

Conclusion producer company

The governing legislation for producer companies in India, primarily the Companies Act, 2013, serves as the legal framework for the establishment, operation, and regulation of these unique corporate entities. The concept of producer companies has its roots in India’s cooperative movement and aims to empower primary producers, especially those engaged in agriculture and related activities. The legislation outlines the objectives, key provisions, and principles that guide the formation and operation of producer companies.

Producer companies have had a transformative impact on India’s agriculture and rural sectors, empowering primary producers, reducing the role of intermediaries, and promoting technology adoption, value addition, and sustainability. However, there are challenges to address and opportunities for further growth and development. With ongoing support from the governing legislation and the concerted efforts of various stakeholders, producer companies are poised to continue playing a vital role in India’s agricultural and rural development, benefiting primary producers and contributing to the nation’s economic growth and food security.

How auriga accounting help you to governing legislation for producer company

Auriga Accounting or any professional accounting and financial services provider can play a significant role in helping companies, including producer companies, adhere to the governing legislation and regulations. They provide financial expertise, compliance services, and strategic guidance to ensure that companies operate within the legal framework. In the context of producer companies in India, here’s how Auriga Accounting can assist in adhering to the governing legislation:

1. Legal Compliance:

Understanding the Legislation: Auriga Accounting professionals are well-versed in the governing legislation for producer companies in India. They can help you understand the specific provisions and requirements of the Companies Act, 2013, and related laws that apply to producer companies.

Compliance Audits: They can conduct compliance audits to ensure that your producer company adheres to the legal requirements. This includes reviewing your company’s documentation, governance structure, and operational procedures to identify areas of non-compliance.

Regulatory Updates: The regulatory landscape can change, with new laws and amendments. Auriga can keep you informed about any changes and help you make necessary adjustments to remain compliant.

2. Incorporation and Governance:

Company Formation: Auriga can assist in the proper formation and incorporation of a producer company, ensuring that all legal requirements are met during the registration process.

Board Composition: The governing legislation specifies the minimum and maximum number of directors for producer companies. Auriga can provide guidance on structuring the board of directors within these limits.

Memorandum and Articles of Association: They can help draft or amend the Memorandum and Articles of Association to ensure that the company’s objectives and operations align with the legal requirements.

3. Financial Management and Reporting:

Financial Record Keeping: Auriga can help establish and maintain proper financial record-keeping systems, ensuring that all financial transactions are accurately recorded and in compliance with the accounting standards.

Financial Reporting: They can prepare and submit the necessary financial statements, including balance sheets and income statements, in accordance with the prescribed accounting standards and regulatory requirements.

Audits: An essential aspect of compliance is conducting annual financial audits. Auriga can help you prepare for and manage these audits to ensure that your financial statements are accurate and reliable.

4. Shareholder Relations:

Shareholder Compliance: Producer companies often have specific requirements regarding shareholding patterns and transactions. Auriga can help ensure that all transactions and distributions are in compliance with the governing legislation.

Member Communication: They can assist in communication with members regarding meetings, voting rights, and participation in decision-making, in line with democratic principles.

5. Governance and Ethics:

Code of Conduct: Maintaining a code of conduct is essential for ethical and transparent operations. Auriga can help develop and enforce a code of conduct in accordance with legal and ethical standards.

Conflict of Interest Management: Managing conflicts of interest among board members and employees is crucial. Auriga can provide guidance on implementing conflict of interest policies and practices.

6. Tax Compliance:

Tax Planning: Producer companies may have specific tax implications based on their activities and organizational structure. Auriga can assist in tax planning to ensure that the company complies with tax laws while optimizing its tax liabilities.

GST Compliance: If applicable, they can help ensure compliance with the Goods and Services Tax (GST) regulations, including filing timely returns and maintaining accurate records.

7. Training and Capacity Building:

Financial Education: Auriga can provide financial education and training to board members and employees to enhance their understanding of the governing legislation, financial management, and compliance requirements.

Capacity Building: They can assist in building the capacity of the company to comply with legal requirements, covering areas such as governance, financial management, and regulatory compliance.

8. Due Diligence:

Mergers and Acquisitions: If the producer company is considering mergers, acquisitions, or collaborations, Auriga can conduct due diligence to assess the legal and financial implications and ensure that all transactions are executed within the legal framework.

Compliance Checks: Regular compliance checks and due diligence can help identify and address any potential issues that may arise in the future.

9. Financial Planning and Strategy:

Strategic Guidance: Auriga can provide strategic financial guidance to align the company’s operations and growth plans with legal requirements.

Financial Forecasting: They can assist in preparing financial forecasts and budgeting, which is essential for long-term planning and ensuring financial sustainability while adhering to the governing legislation.

10. Legal and Regulatory Updates:

Monitoring Changes: Keeping track of changes in the governing legislation and regulations is vital. Auriga can provide updates on relevant legal developments that may impact the company’s operations.

Adaptation: They can help the company adapt to new regulations and ensure that the necessary adjustments are made to remain in compliance.