WHAT IS THE MINIMUM NUMBER OF DIRECTOR REQUIRED FOR A PRODUCER COMPANY?

Introduction

ToggleWHAT IS THE MINIMUM NUMBER OF DIRECTOR REQUIRED FOR A PRODUCER COMPANY?

Minimum number of director required for a producer company: A Producer company in India is required to have a minimum of five directors, according to the Companies Act, 2013. These directors can be the primary members or individuals nominated by them. The appointment of directors is crucial for the governance and decision-making processes of the company. While the minimum number is five, there is no specified maximum limit, allowing flexibility for the company to appoint more directors based on its needs and the provisions of the law. Compliance with regulatory requirements is essential for the smooth functioning of a Producer Company. Visitofficialwebsite

The Role of Directors in a Producer Company:

Directors play a crucial role in the management and governance of a producer company. They are responsible for making key decisions, overseeing the company’s operations, and ensuring that it operates in compliance with relevant laws and regulations. Directors also represent the interests of the members (producers) and work towards the company’s objectives, which primarily focus on the economic well-being of the members and the promotion of their common interests.

some of the key responsibilities and roles of directors in a producer company:

Strategic Decision-Making: Directors are responsible for making strategic decisions related to the business operations, including production, marketing, finance, and expansion.

Compliance: Directors ensure that the company complies with all legal and regulatory requirements, including those specific to producer companies under the Companies Act.

Financial Oversight: They oversee the company’s financial management, including the approval of budgets, financial statements, and the distribution of profits to members.

Representation: Directors represent the interests of the members and act as their voice in the decision-making process.

Appointment of CEO: Directors appoint a Chief Executive Officer (CEO) or Managing Director, who is responsible for the day-to-day management of the company.

Conflict Resolution: Directors may play a role in resolving disputes among members and ensuring harmony within the company.

Legal Requirements for the Number of Directors:

The Companies Act, 2013, prescribes the minimum and maximum number of directors for different types of companies, including producer companies. For producer companies, the Act specifies the following requirements:

Minimum Directors: A producer company must have a minimum of five directors.

Maximum Directors: The maximum number of directors can be determined by the company’s articles of association. It can be up to fifteen directors. To increase this number beyond fifteen, the approval of the company members is required.

These legal requirements are designed to ensure that producer companies have adequate representation and governance without becoming unwieldy due to an excessively large board of directors.

Significance of a Board of Directors in a Producer Company:

Having a board of directors is significant in a producer company for several reasons:

Governance: The board provides a governance structure for the company, ensuring that decisions are made in a transparent and accountable manner.

Diverse Expertise: A diverse board can bring in various expertise and perspectives to address the multifaceted needs of producer members.

Legal Compliance: Directors are responsible for ensuring that the company complies with the legal and regulatory requirements, reducing the risk of non-compliance.

Decision-Making: The board plays a critical role in decision-making, allowing for well-informed and strategic choices for the benefit of the members.

Member Representation: Directors represent the interests of the producer members, ensuring that the company’s activities align with the members’ objectives.

Stability and Continuity: A well-structured board provides stability and continuity to the producer company, even as leadership changes over time.

some key points regarding the minimum number of directors in a producer company:

Five Directors: The law requires a producer company to have at least five directors. This means that there must be a minimum of five individuals who are willing to take on the responsibilities of directorship. These directors collectively form the board of directors of the producer company.

Fulfilling Statutory Requirements: Having a minimum of five directors is not just a procedural formality; it is a statutory requirement. Failing to meet this requirement could lead to non-compliance with the Companies Act.

Eligibility of Directors: The Act also sets out certain eligibility criteria for directors. They should be individuals with no legal disqualifications, and in the case of an agricultural producer company, the majority of the directors should be primary producers themselves.

Additional Directors: While the minimum requirement is five directors, a producer company can have more than five directors if its bylaws (Articles of Association) permit it. The Act allows flexibility in determining the number of directors beyond the minimum.

Roles and Responsibilities: Directors have specific roles and responsibilities, which include overseeing the company’s operations, making strategic decisions, ensuring regulatory compliance, and representing the interests of the members. A diverse board of directors can bring varied expertise and perspectives to these functions.

Which company requires only 1 director

The minimum number of directors is as follows: In the case of public limited companies – 3 directors. In the case of private limited companies – 2 directors. In the case of One-Person Companies – 1 director.

Can a company have 2 managing directors

He/ She will know the company’s policies better and will execute them with the correct strategic plans and in a rightful manner. o Maximum Number of Managing Director that a company can appoint at a time is 2 and not more than that. But in case of a Manager it is only one.

Is managing director the same as CEO

The difference between a managing director and a chief executive officer (CEO) is subtle but crucial. The managing director is usually more closely involved with day-to-day operations, while the CEO’s role is to lead the organization, set the vision, and provide overall direction.

Can a full time employee become a director

This position is clarified by DCA vide letter no. 2/19/63- PR dated 29.06. 1964 which provided that a whole-time employee of a company also appointed as a director of the company is in the position of whole-time director. The view is equally applicable in the case of alternate director.

Who is eligible to be a director

Minimum age (often 18 or 21): Legal requirement to hold the position. Professional experience and expertise: Demonstrated experience in relevant fields can be beneficial. Educational qualifications: Not mandatory everywhere, but relevant degrees or certifications can be advantageous.

What is the maximum sitting fee for directors

With respect to payment of sitting fees Companies Act, 2013 states the that maximum sitting fee that can be paid to non-executive directors is Rs 100,000 per meeting. Meetings here include all types of committee meetings wherein non-executive directors are comprised of.

Is director salary taxable

This means that the director must pay taxes on the payment as a part of their overall salary income. However, if the director is a non-resident, meaning they do not reside in India or fail to meet certain criteria for being a resident, TDS must be deducted under Section 195 instead.

What is the difference between salary and remuneration

The main difference between salary and remuneration is that the former is a subset of the latter. Recompense includes salary, wages, bonuses, commissions, overtime pay, and other social and economic benefits, while salary is a fixed and regular payment that remains excluded from any additional perks.

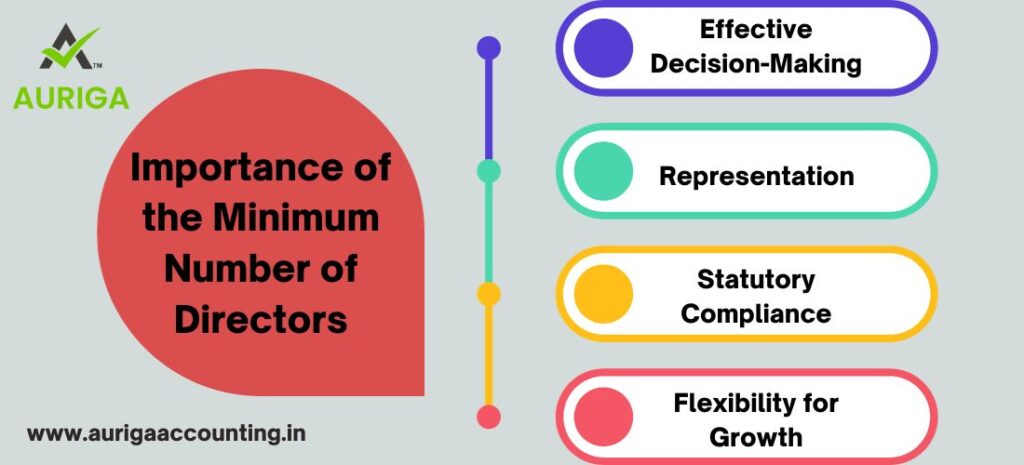

Importance of the Minimum Number of Directors:

The minimum number of directors is crucial for several reasons:

Effective Decision-Making: A producer company with a minimum of five directors has a sufficient number of decision-makers to deliberate on important matters. It ensures that decisions are made collectively and with due consideration.

Representation: A diversified board can better represent the interests and concerns of the members. In the case of agricultural producer companies, having primary producers on the board ensures that the voices of those directly involved in farming are heard.

Statutory Compliance: Complying with the minimum director requirement is essential to meet the legal and regulatory obligations of a producer company. Failure to do so can result in penalties or non-compliance issues.

Flexibility for Growth: While the minimum number is five, producer companies can have more directors, which allows for scalability and accommodating additional expertise as the company grows.

How many directors are there in a private company

Section 149(1) of the Companies Act, 2013 requires that every company shall have a minimum number of 3 directors in the case of a public company, two directors in the case of a private company, and one director in the case of a One Person Company. A company can appoint maximum 15 fifteen directors

Conclusion of director required for producer company

In summary, a producer company in India is required to have a minimum of five directors, as specified by the Companies Act, 2013. This minimum director requirement is a fundamental aspect of forming and operating a producer company. Directors are responsible for guiding the company’s activities, making strategic decisions, and ensuring compliance with the law. It is important to fulfill this requirement and, if necessary, consider appointing additional directors to ensure effective governance and representation within the producer company. However, regulations and requirements may change over time, so it is advisable to consult with legal and corporate governance experts or refer to the latest amendments to the Companies Act for the most up-to-date information on this matter.

how auriga accounting help you to director required for producer company

Auriga Accounting, or any professional accounting or corporate services firm, can play a valuable role in helping you fulfill the requirements for directors in a producer company in India. Here’s how they can assist you in appointing directors for your producer company:

Consultation and Advisory Services: Accounting firms like Auriga can provide expert advice on corporate governance, legal compliance, and the specific requirements for directors in a producer company. They can help you understand the legal framework and the minimum and maximum number of directors allowed.

Eligibility and Qualification Assessment: Auriga Accounting can assess the eligibility and qualification of potential directors, ensuring they meet the criteria specified in the Companies Act, 2013. This includes checking for any disqualifications that might prevent an individual from becoming a director.

Director Search and Recruitment: Auriga Accounting can assist in the recruitment and appointment of directors. This may involve identifying suitable candidates, verifying their credentials, and facilitating the appointment process, which may require the consent of members or shareholders.

Board Diversity and Expertise: Auriga Accounting can advise on the composition of the board of directors to ensure diversity, expertise, and representation of the company’s members. In the case of producer companies, they can help identify and recruit individuals who are actively engaged in primary production activities, as required by law.

Documentation and Compliance: Auriga Accounting can assist in the preparation and filing of the necessary documentation related to director appointments, including filing the consent of directors and intimation to the Registrar of Companies (ROC).

Corporate Governance Framework: Auriga Accounting can help establish and maintain a strong corporate governance framework for the producer company, which includes defining roles and responsibilities for directors, organizing board meetings, and ensuring compliance with all legal and regulatory requirements.

Ongoing Compliance Monitoring: Auriga Accounting help monitor ongoing compliance with directorship requirements. This involves ensuring that the board composition remains in adherence to the statutory requirements and advising on any changes that may be necessary.

Training and Capacity Building: In cases where directors need to build their knowledge and skills to effectively govern the company, Auriga Accounting can arrange training and capacity-building programs.

Conflict Resolution and Dispute Management: If any conflicts or disputes arise within the board or among directors, accounting firms can offer dispute resolution and mediation services to ensure that the board functions smoothly.

Retirement and Succession Planning: Auriga Accounting can assist with director retirement and succession planning, helping the producer company maintain a qualified and experienced board of directors over the long term.