HOW CAN I START A COMPANY IN INDIA?

Introduction

ToggleHOW CAN I START A COMPANY IN INDIA?

Starting a company in India involves a series of steps and compliance with various legal

requirements. The process may vary depending on the type of company (e.g., private

limited, public limited, LLP) and the business activities. Here is a general outline of the

procedure to start a company in India: Visitofficialwebsite

procedure of start a company in india

1. Identify the Type of Company:

Determine the type of company structure based on factors such as ownership,

liability, and business objectives. Common types include private limited company,

public limited company, and limited liability partnership (LLP).

2. Name Approval:

Choose a unique name for the company and check its availability on the Ministry

of Corporate Affairs (MCA) website. The selected name should comply with

naming guidelines.

3. Digital Signature Certificate (DSC):

Obtain Digital Signature Certificates for the proposed directors and shareholders.

DSC is required for signing electronic documents during the registration process.

4. Director Identification Number (DIN):

Obtain Director Identification Number for the proposed directors. DIN is a unique

identification number required for individuals intending to be directors in a

company.

5. Preparation of Documents:

Prepare the Memorandum of Association (MOA) and Articles of Association

(AOA). These documents outline the company's objectives, rules, and

regulations.

6. Stamping and Notarization:

Stamp the MOA and AOA, and get them notarized. Stamp duty varies based on

the authorized capital of the company.

7. Filing for Incorporation:

File an application for incorporation with the Ministry of Corporate Affairs (MCA)

through the SPICe (Simplified Proforma for Incorporating Company

Electronically) form. The form includes details such as the company's name,

registered office address, director details, and share capital.

8. Payment of Fees:

Pay the required fees for incorporation. The fee depends on the authorized

capital of the company.

9. Verification and Approval:

The Registrar of Companies (RoC) reviews the application, and if everything is in

order, the Certificate of Incorporation is issued. This certificate serves as proof of

the company's existence.

10. Obtain PAN and TAN:

Apply for and obtain the Permanent Account Number (PAN) and Tax Deduction

and Collection Account Number (TAN) for the company.

11. Opening Bank Account:

Open a bank account in the name of the company using the Certificate of

Incorporation, PAN, and other relevant documents.

12. Post-Incorporation Compliance:

Fulfill post-incorporation compliance requirements, such as appointment of

statutory auditors, holding the first board meeting, issuing share certificates, and

maintaining statutory registers.

13. Goods and Services Tax (GST) Registration:

If applicable, register for Goods and Services Tax (GST) through the GST portal.

HOW MUCH MONEY IS REQUIRED TO START A COMPANY IN INDIA?

The amount of money required to start a company in India can vary widely depending

on various factors such as the type of business, scale, location, industry, and your

business model. Here are some general considerations:

1. Legal Structure: The cost may vary based on whether you choose to set up a sole

proprietorship, partnership, limited liability partnership (LLP), private limited company, or

other legal structures.

2. Registration Fees: The government charges fees for registering a business entity. The

fees depend on the type of business structure you choose.

3. Capital Requirements: Some types of companies may have minimum capital

requirements, especially in the case of private limited companies.

4. Professional Fees: You might need to hire professionals such as chartered

accountants, lawyers, or company secretaries for assistance in the registration process,

which will add to the initial costs.

5. Premises: The cost of setting up an office or manufacturing facility, if required, will

contribute significantly to the initial investment.

6. Technology and Equipment: Depending on the nature of your business, you might

need to invest in technology, machinery, or equipment.

7. Working Capital: You should also consider having enough working capital to cover

your initial operational expenses until your business starts generating revenue.

WHO IS ELIGIBLE TO START A COMPANY IN INDIA?

In India, individuals, foreign nationals, and entities are generally eligible to start a

company, subject to certain conditions and regulations. The eligibility criteria may vary

depending on the type of business structure chosen. Here are some key points to

consider:

1. Resident and Non-Resident Individuals:

Resident Indians: Any person who is a resident of India as per the Income Tax

Act is eligible to start a company.

Non-Resident Indians (NRIs): NRIs are also eligible to start a company in India.

They may need to comply with certain regulations and approvals, and the type of

company structure they choose can vary based on their residential status.

2. Foreign Nationals: Foreign nationals are generally allowed to start a company in India, subject to

certain conditions and approvals. The specific requirements may depend on

factors such as the type of business, industry, and the individual's visa status.

3. Entities and Organizations:

Indian companies and other legal entities, such as trusts, societies, or Section 8

companies, are eligible to start a new company or set up subsidiaries.

4. Minors:

In general, minors (individuals below the age of 18) are not eligible to register a

company. A company must be registered by individuals who have attained the

age of majority.

5. Compliance with Regulations:

All individuals and entities must comply with the regulations set forth by the

Ministry of Corporate Affairs (MCA) and other relevant authorities. This includes

adhering to the Companies Act, 2013, and other applicable laws.

6. Types of Business Structures:

Different business structures have different eligibility criteria. For example, sole

proprietorship and partnership have fewer formalities compared to private limited

companies or LLPs. The eligibility and requirements also depend on whether the

business is for-profit or not-for-profit.

WHAT ARE THE NECESSARY DOCUMENT TO START A COMPANY IN INDIA?

The specific documents required to start a company in India can vary based on the type

of business structure you choose and the nature of your business. However, here is a

general list of documents that are commonly needed when registering a company in

India:

1. For all Types of Companies:

Identity Proof: Passport, Aadhar card, Voter ID, or driver's license of the

proposed directors/partners/shareholders.

Address Proof: Recent utility bills (electricity, water, gas) or bank statements in

the name of the proposed directors/partners/shareholders.

Passport-sized Photographs: Recent passport-sized photographs of the

proposed directors/partners.

PAN Card: Permanent Account Number (PAN) card of the proposed

directors/partners/shareholders.

2. For Sole Proprietorship:

No specific documents for registration, but the individual's PAN card and address

proof are essential.

3. For Partnership:

Partnership Deed: A written agreement specifying the terms and conditions of

the partnership.

Partnership Registration: While not mandatory, registering the partnership

deed with the Registrar of Firms is recommended.

4. For Limited Liability Partnership (LLP):

LLP Agreement: Drafting an LLP agreement specifying the roles,

responsibilities, and contributions of partners.

LLP Registration: Filing the incorporation documents and LLP agreement with

the Ministry of Corporate Affairs (MCA).

5. For Private Limited Company/Public Limited Company:

Memorandum of Association (MOA) and Articles of Association (AOA):

These are legal documents that outline the company's objectives and rules

governing its internal affairs.

Director Identification Number (DIN): Directors must obtain a DIN by filing

Form DIR-3.

Digital Signature Certificate (DSC): Directors must obtain a DSC for digitally

signing documents filed with the MCA.

Company Name Approval: Filing an application for the approval of the

company's name with the MCA.

Incorporation Documents: Filing various forms such as SPICe (INC-32) for the

incorporation of the company.

Registered Office Address Proof: Documents verifying the registered office

address, such as rental agreement or property ownership documents.

6. For Section 8 Company:

In addition to the above, a Section 8 company needs to submit a declaration in

Form INC-14 and the license issued by the Central Government in Form INC-16.

7. For Other Specific Types:

Depending on the nature of the business, additional documents may be required.

For example, a Producer Company may need documents related to agricultural

activities.

WHAT IS THE ROLE OF CA FIRM TO START A COMPANY IN INDIA?

Chartered Accountancy (CA) firms play a crucial role in the process of starting and

managing a company in India. Their expertise is valuable in ensuring that the financial

and legal aspects of the business are handled appropriately. Here are some of the key

roles that a CA firm can play when starting a company in India:

1. Business Structure Selection:

CA firms can provide advice on selecting the most suitable business structure

based on the nature of the business, ownership preferences, and other factors.

They can help decide whether a sole proprietorship, partnership, LLP, private

limited company, or another structure is most appropriate.

2. Company Registration:

CA firms assist in the preparation and filing of necessary documents for the

registration of the company with the Ministry of Corporate Affairs (MCA). This

includes drafting the Memorandum of Association (MOA) and Articles of

Association (AOA) for companies, LLP agreements for LLPs, and other

incorporation documents.

3. Tax Planning and Compliance:

CA firms play a crucial role in tax planning, helping businesses structure their

finances in a way that minimizes tax liabilities. They also ensure that the

company complies with various tax regulations, including Goods and Services

Tax (GST), income tax, and other applicable taxes.

4. Auditing and Accounting:

CA firms handle the auditing and accounting functions of the company. They help

maintain proper financial records, prepare financial statements, and ensure

compliance with accounting standards and regulations.

5. GST Registration and Compliance:

For businesses involved in the sale of goods and services, CA firms assist in the

registration under the Goods and Services Tax (GST) regime. They also ensure

that the company complies with GST regulations, including filing timely returns.

6. Statutory Compliance:

CA firms help businesses navigate the complex landscape of statutory

compliance. This includes compliance with the Companies Act, labor laws,

environmental regulations, and other applicable laws and regulations.

7. Corporate Governance:

CA firms contribute to maintaining good corporate governance practices within

the company. They ensure that the company adheres to ethical standards and

complies with regulations related to corporate governance.

8. Financial Planning and Advisory:

CA firms provide financial planning and advisory services, helping businesses

make informed decisions about investments, expansion, and financial

management.

9. Due Diligence:

CA firms can conduct due diligence for businesses, especially during mergers,

acquisitions, or investment processes. This involves a comprehensive

examination of the company's financial health and compliance status.

10. Annual Filings:

CA firms assist in the preparation and filing of annual returns and financial

statements with the MCA, ensuring that the company remains compliant with

regulatory requirements.

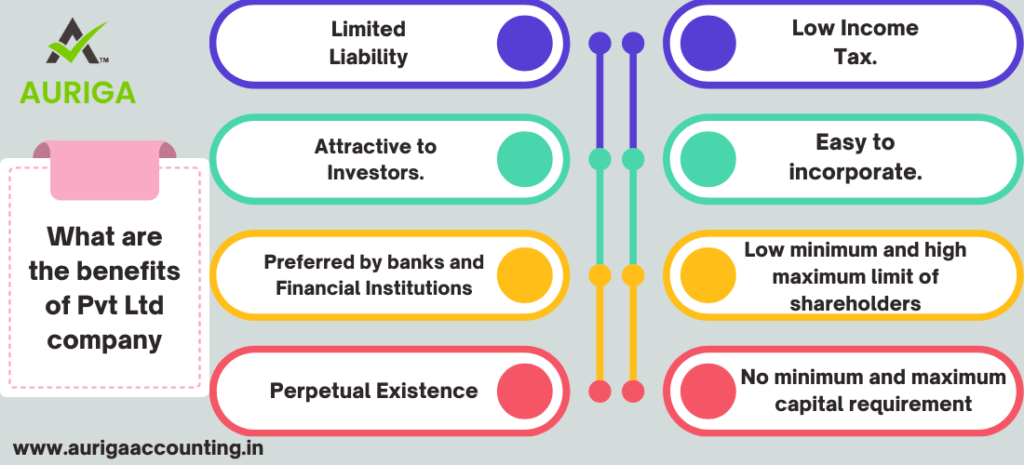

What are the benefits of Pvt Ltd company

- Limited Liability. …

- Attractive to Investors. …

- Preferred by banks and Financial Institutions. …

- Perpetual Existence. …

- Low Income Tax. …

- Easy to incorporate. …

- Low minimum and high maximum limit of shareholders. …

- No minimum and maximum capital requirement.

HOW MANY PERSONS ARE REQUIRED TO START A COMPANY IN INDIA?

The number of persons required to start a company in India depends on the type of

company structure you choose. Here are the requirements for different types of

companies:

1. Sole Proprietorship:

A sole proprietorship can be started and operated by a single individual. No

additional persons are required.

2. Partnership:

A partnership in India requires a minimum of two individuals to act as partners.

The maximum number of partners in a general partnership is limited to 20, while

there is no such restriction in a limited liability partnership (LLP).

3. Limited Liability Partnership (LLP):

An LLP can be started with a minimum of two designated partners. Unlike a

general partnership, there is no upper limit on the number of partners in an LLP.

4. Private Limited Company:

A private limited company in India must have a minimum of two shareholders and

two directors. The directors and shareholders can be the same individuals. The

maximum number of shareholders in a private limited company is restricted to

200.

5. Public Limited Company:

A public limited company requires a minimum of seven shareholders and three

directors. There is no maximum limit on the number of shareholders in a public

limited company.

6. One Person Company (OPC):

As the name suggests, an OPC is designed for a single individual. It allows a

single person to start a company as both the shareholder and the director.

conclusion of start company in india

In conclusion, initiating a company in India involves a strategic and structured process. Starting with a well-defined business idea and comprehensive planning, entrepreneurs must navigate through legal procedures and compliance requirements. The choice of a suitable business structure, such as a private limited company or LLP, is pivotal. The registration process, including name reservation and submission of necessary documents to the Registrar of Companies, demands attention to detail. Post-incorporation, adherence to compliance and licensing obligations, tax planning, and seamless business operations are essential for sustained success. Given the evolving regulatory landscape, staying abreast of updates and seeking professional guidance ensures a smooth and compliant journey for businesses venturing into the dynamic Indian market.

How auriga accounting help you to start company in india

Auriga Accounting or the details of how they assist in starting a company in India. However, professional accounting and consulting firms, in general, provide a range of services to support businesses in their establishment and operations. Here are some ways in which accounting firms like Auriga Accounting might help in starting a company:

Business Structure Consultation:

- Advising on the most suitable business structure based on the nature of the business, such as a private limited company, LLP, or others.

Name Reservation:

- Assisting in the selection and reservation of a business name, ensuring it complies with regulatory guidelines.

Document Preparation:

- Drafting essential legal documents, including the Memorandum of Association (MOA) and Articles of Association (AOA).

Incorporation Process:

- Guiding through the entire process of company incorporation, including the submission of documents to the Registrar of Companies (RoC).

Tax Planning:

- Providing advice on tax planning strategies to optimize the tax structure for the business.

Compliance Management:

- Ensuring adherence to all legal and regulatory requirements post-incorporation, including GST registration and other compliance obligations.

Financial Advisory:

- Offering financial guidance and structuring to align with the business’s financial goals.

Government Liaison:

- Interacting with government authorities, such as the RoC, to facilitate approvals and ensure smooth compliance.

Post-Incorporation Support:

- Providing ongoing support for compliance management, accounting, and financial reporting.

Customized Solutions:

- Tailoring services to the specific needs and industry requirements of the business.

For precise details on how Auriga Accounting can assist in starting a company in India, it is recommended to contact them directly or visit their official website. Additionally, legal and regulatory information may change, so consulting with them directly will provide the most accurate and up-to-date informations.