WHAT ARE THE MAIN OBJECTIVES OF SECTION 8 COMPANY

Introduction

ToggleWHAT ARE THE MAIN OBJECTIVES OF SECTION 8 COMPANY

The main objectives of a Section 8 Company governed by the Companies Act, 2013 in India, revolve around promoting charitable, educational, scientific, research, social welfare, religious, and similar activities. These nonprofit entities aim to utilize their resources for the advancement of these objectives without the intention of distributing profits among their members. Section 8 companies work towards contributing to societal well-being, fostering education, alleviating poverty, supporting healthcare initiatives, and undertaking activities that benefit the public at large. The primary focus is on social impact and community welfare, making these organizations integral contributors to the betterment of society. Visitofficialwebsite

MAIN OBJECTIVES OF SECTION 8 COMPANY

1. Advancing Education:

One of the primary objectives of many Section 8 Companies is the advancement of education. They often establish and manage schools, colleges, vocational training centers, and educational institutions. These organizations aim to provide quality education to underprivileged or marginalized sections of society, thereby enhancing literacy rates and fostering intellectual development.

Moreover, Section 8 Companies may offer scholarships and financial aid to students who lack the resources to pursue higher education. By promoting education, these organizations contribute to empowering individuals and communities and increasing access to opportunities.

2. Promoting Art and Culture:

Another key objective of Section 8 Companies is the promotion of art and culture. These organizations often play a crucial role in preserving and promoting traditional art forms, music, dance, and crafts. They may organize cultural events, art exhibitions, and workshops to encourage creativity and artistic expression.

By supporting artists and artisans, Section 8 Companies contribute to the preservation of cultural heritage and provide opportunities for individuals to showcase their talents. This objective serves as a means of cultural enrichment and heritage conservation.

3. Relief of Poverty:

Poverty alleviation is a fundamental objective for many Section 8 Companies. They focus on providing relief to impoverished communities and individuals. This may involve offering financial assistance, vocational training, and livelihood support. The goal is to uplift the economically disadvantaged and provide them with the means to improve their quality of life.

Section 8 Companies often work closely with marginalized communities to address the root causes of poverty, empowering individuals to become self-sufficient and escape the cycle of deprivation.

4. Advancement of Healthcare:

The advancement of healthcare is another core objective for Section 8 Companies. Many of these organizations establish and manage hospitals, clinics, and healthcare centers to provide medical services to underserved populations. They may also engage in medical research, health awareness campaigns, and the distribution of medical supplies.

By focusing on healthcare, Section 8 Companies aim to improve the well-being of communities, reduce health disparities, and ensure that individuals have access to essential medical services.

5. Promoting Environmental Sustainability:

Section 8 Companies are often actively involved in promoting environmental sustainability. They initiate conservation projects, engage in reforestation efforts, and raise awareness about environmental issues. By organizing clean-up drives, tree planting events, and wildlife protection initiatives, these organizations contribute to the preservation of the environment.

Environmental sustainability objectives include safeguarding ecosystems, addressing climate change, and protecting natural resources for future generations.

6. Religious and Spiritual Activities:

Some Section 8 Companies are established to promote religious and spiritual activities. They may construct places of worship, organize religious ceremonies, and disseminate spiritual knowledge. The aim is to nurture and support individuals’ spiritual growth and provide a sense of community for religious and spiritual practice.

These organizations may contribute to the construction and maintenance of temples, mosques, churches, and other religious institutions, fostering a sense of devotion and cultural heritage.

7. Advancing Scientific Research:

Advancing scientific research is a crucial objective for certain Section 8 Companies. They provide support for research projects, fund scientists, and promote scientific education and awareness. This objective contributes to the development of scientific knowledge and innovation.

By investing in scientific research, Section 8 Companies help address critical challenges, discover solutions to complex problems, and support scientific progress in various fields.

8. Women’s Empowerment:

Women’s empowerment is a central objective for many Section 8 Companies. They focus on providing women with educational opportunities, vocational training, and economic self-sufficiency. Additionally, they may launch campaigns against gender-based discrimination and violence.

These organizations aim to break down societal barriers that hinder women’s progress and create an environment in which women can achieve their full potential.

9. Support for Persons with Disabilities:

Section 8 Companies often focus on providing support and empowerment for persons with disabilities. This objective may involve offering education, rehabilitation, and livelihood opportunities. These organizations work to remove obstacles that persons with disabilities encounter in daily life.

The aim is to create an inclusive society where individuals with disabilities have equal access to education, employment, and social participation.

10. Disaster Relief:

Many Section 8 Companies are actively involved in providing disaster relief. Their objective is to offer aid and assistance during natural disasters and emergencies. This may include distributing food, clothing, medical supplies, and shelter to affected populations.

By mobilizing resources and volunteers, these organizations contribute to the immediate relief and recovery efforts following natural disasters.

BENEFITS OF SECTION 8 COMPANY

1. Legal Recognition and Credibility:

Section 8 Companies are legally recognized entities under the Companies Act, 2013. This legal recognition lends credibility to the organization and assures stakeholders of its legitimacy. This credibility can be vital for attracting donors, partners, and supporters.

2. Non-Profit Nature:

The core objective of a Section 8 Company is to promote non-profit activities. This makes it an ideal structure for organizations focused on social welfare, education, health, art, culture, and other charitable purposes. The non-profit status ensures that the company’s resources are dedicated to its objectives rather than profit distribution.

3. Limited Liability:

Members of a Section 8 Company have limited liability. Their personal assets are safeguarded in case of the company’s financial troubles. Only the company’s assets can be used to settle its debts. This feature provides a level of security to the individuals involved in the organization.

4. Tax Benefits:

Section 8 Companies are eligible for various tax benefits under the Income Tax Act, 1961. These benefits can include exemptions and deductions, making it financially advantageous for contributors and donors. Donations to Section 8 Companies may be eligible for tax deductions, encouraging individuals and businesses to support their causes.

5. Exemptions and Privileges:

Section 8 Companies enjoy certain exemptions and privileges under the Companies Act. These can include reduced fees for various filings, simplified compliance procedures, and exemptions from some of the requirements applicable to for-profit companies. These exemptions reduce the administrative and financial burden on the organization.

What is the main object clause of Section 8 company

A Section 8 company in India is a type of nonprofit organization that is registered under Section 8 of the Companies Act, 2013. The main object clause of a Section 8 company refers to the specific purposes for which the company is established. These purposes are generally related to promoting commerce, art, science, sports, education, research, social welfare, religion, charity, protection of the environment, or any other charitable objectives.

The key feature of a Section 8 company is that it operates for promoting charitable activities, and any profits generated are used for the furtherance of its objectives rather than being distributed among the members. The company must apply its income, profits, or other earnings solely towards the promotion of its objectives.

Is Section 8 company a trust

A Section 8 company and a trust are two different legal structures used for charitable or nonprofit purposes in India. While both entities serve similar objectives in terms of promoting social welfare, education, healthcare, and other charitable activities, they are subject to different legal frameworks.

Section 8 Company:

- A Section 8 company is a type of nonprofit organization registered under Section 8 of the Companies Act, 2013 (previously Section 25 of the Companies Act, 1956). The primary features of a Section 8 company include its non-profit nature, prohibition on the distribution of profits to members, and the utilization of income for charitable purposes.

- Section 8 companies are incorporated as companies limited by guarantee or without share capital. They have a legal personality separate from their members.

2. Trust:

- A trust is another legal structure commonly used for charitable purposes. It is created through a trust deed, and it involves the transfer of property or assets to a trustee who holds and manages the assets for the benefit of the beneficiaries or for specific charitable purposes.

- Trusts in India are governed by state-specific laws or the Indian Trusts Act, 1882. The trust deed outlines the objectives of the trust and the manner in which its assets are to be utilized for charitable purposes.

While both Section 8 companies and trusts can operate with the goal of advancing charitable activities, they differ in terms of their legal structure, registration process, and regulatory compliance. The choice between a Section 8 company and a trust depends on various factors, including the specific objectives of the organization, the desired legal form, and other practical considerations.

What is Section 8 under Companies Act

Section 8 under the Companies Act in India pertains to the formation and regulation of non-profit organizations, often referred to as Section 8 companies. Section 8 of the Companies Act, 2013, corresponds to Section 25 of the Companies Act, 1956, which governed such companies in the past.

A Section 8 company is a type of nonprofit organization that is formed for promoting commerce, art, science, sports, education, research, social welfare, religion, charity, protection of the environment, or any other charitable purposes. The primary characteristic of a Section 8 company is that it prohibits the distribution of profits or dividends among its members. Instead, any income, profits, or other earnings must be applied solely towards promoting the company’s objectives.

Key features of Section 8 companies include:

Non-profit Nature: The company must be formed with the primary intention of promoting charitable activities, and its income is applied for the benefit of the public.

Restrictions on Dividends: Section 8 companies cannot distribute dividends among their members. Any profits or income earned should be used for the organization’s objectives.

Use of Income: The income and property of a Section 8 company are applied solely towards promoting its objectives. This ensures that the organization operates for charitable or social welfare purposes.

Government Approval: Section 8 companies require approval from the central government for various matters, including their incorporation, alterations to their memorandum and articles of association, and dissolution.

To form a Section 8 company, individuals or associations must apply to the Registrar of Companies (RoC) with the necessary documents, including a memorandum of association and articles of association. The application must demonstrate that the proposed company intends to operate for promoting charitable purposes. Once approved, the company can enjoy the benefits of legal recognition as a nonprofit entity.

What is the minimum capital for a Section 8 company

the Companies Act, 2013, which governs the formation and operation of Section 8 companies in India, does not specify a minimum capital requirement for such companies. The concept of minimum capital is not applicable to Section 8 companies, as they are formed for charitable or non-profit purposes.

Section 8 companies can be formed with a nominal capital or without any share capital. The focus of these companies is on promoting charitable activities rather than generating profits for distribution to members. The financial structure of a Section 8 company should align with its objectives, and any income or surplus generated should be utilized for the furtherance of those objectives.

It’s essential to check for any updates or amendments to the Companies Act or related regulations, as legal provisions may change over time. If you are considering setting up a Section 8 company, it is advisable to consult with a legal professional or company secretary to ensure compliance with the latest requirements and regulations.

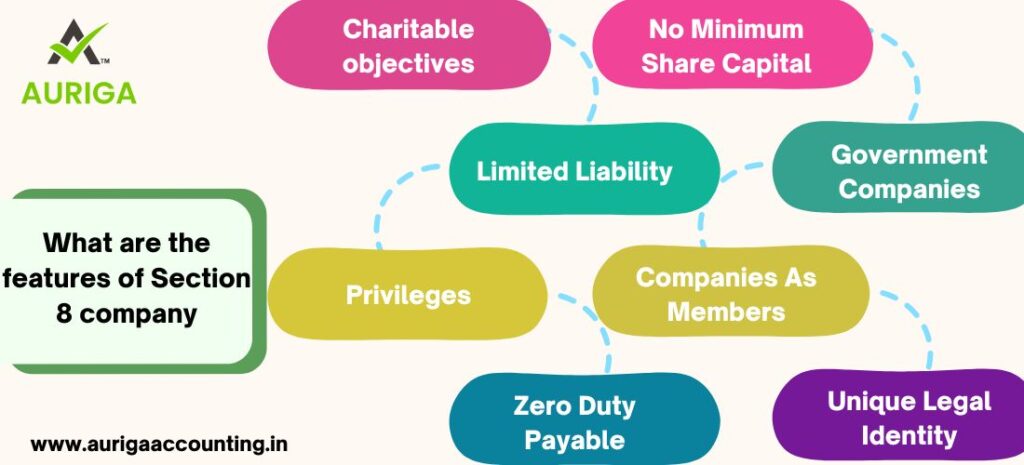

What are the features of Section 8 company

- Charitable objectives:

- No Minimum Share Capital.

- Limited Liability.

- Government Companies.

- Privileges.

- Companies As Members.

- Zero Duty Payable.

- Unique Legal Identity.

Can Section 8 company make profit

While Section 8 companies (formerly Section 25 companies under the Companies Act, 1956) are formed for promoting charitable purposes and are generally not intended to generate profits for distribution among their members, it is not accurate to say that Section 8 companies cannot make a surplus or generate income. Section 8 companies can indeed generate income, but there are strict restrictions on the use of such income.

The primary principle is that any income, profits, or other earnings generated by a Section 8 company must be applied solely for promoting its objectives and cannot be distributed as dividends or profits to the members. The surplus generated by the company is to be utilized for the furtherance of its charitable or social welfare purposes.

It’s important to note that Section 8 companies are granted certain exemptions and privileges to facilitate their charitable activities, such as reduced fees and government approval for certain matters. The emphasis, however, remains on the non-profit nature of these organizations, and any financial gains are expected to be reinvested in pursuing the company’s charitable objectives.

If a Section 8 company is found to be operating with the primary motive of making a profit for distribution to its members, it may risk losing its status and the associated benefits. Therefore, strict adherence to the regulations governing Section 8 companies is crucial to maintaining their nonprofit character and fulfilling their intended charitable purposes.

CONCLUSION OF OBJECTIVES SECTION 8 COMPANY

In conclusion, Section 8 Companies in India are a vital component of the non-profit and charitable sector, established with the primary objective of promoting activities that benefit society and advance the public good. These organizations play a crucial role in addressing a wide array of social, educational, cultural, environmental, and charitable objectives.

The objectives of Section 8 Companies are diverse and reflect their commitment to serving the greater good. They aim to make a positive impact on the lives of individuals and communities by providing essential services, promoting education, culture, healthcare, environmental sustainability, and much more.

HOW AURIGA ACCOUNTING HELP YOU TO DEFINE MAIN OBJECTIVES OF SECTION 8 COMPANY

Defining Clear Objectives: Auriga Accounting can work with you to clearly define and articulate the primary objectives of your Section 8 Company. They can help you craft a mission statement that effectively communicates the organization’s purpose and its commitment to non-profit and charitable activities.

Legal Compliance: They can ensure that the objectives you define align with the legal requirements and restrictions for Section 8 Companies under the Companies Act, 2013. This includes drafting and reviewing the memorandum and articles of association to reflect the non-profit nature and specific objectives accurately.

Tax Benefits: Auriga Accounting can explain the tax benefits associated with different objectives. For example, they can provide guidance on how educational objectives or healthcare initiatives can make the organization eligible for specific tax exemptions and deductions.

Financial Planning: To achieve the defined objectives, Auriga Accounting can offer financial planning services. They can help create budget plans and financial projections to ensure that the organization’s resources are allocated effectively and used to further its charitable goals.

Fundraising Strategies: The company can assist in developing fundraising strategies aligned with the objectives. Whether it’s attracting donors, securing government grants, or partnering with corporate sponsors, Auriga Accounting can help create a plan to raise funds to support the organization’s mission.

Financial Reporting and Compliance: They can ensure that the organization maintains proper financial reporting practices and complies with the transparency and accountability requirements specific to Section 8 Companies. This includes assistance with audit preparations and annual compliance reporting to the Registrar of Companies (ROC).

Governance Best Practices: Auriga Accounting can provide guidance on governance best practices, ensuring that the organization maintains transparency in decision-making, conducts regular meetings, and adheres to compliance regulations.

Legacy Building: They can assist in planning for the long-term sustainability and impact of the Section 8 Company. This includes strategies for asset transfer, succession planning, and creating a legacy for future generations.

Compliance with Section 8 Company Rules: Auriga Accounting can ensure that the Section 8 Company adheres to the specific rules and regulations governing its operations. This includes compliance with restrictions on profit distribution, object clauses, and compliance with the Companies Act.

Internal Controls and Financial Reporting: They can help establish robust internal controls and financial reporting mechanisms to ensure that the organization’s finances are managed efficiently and in accordance with legal and regulatory requirements.