WHAT ARE THE REQUIREMENT FOR NIDHI COMPANY REGISTRATION ONLINE IN GUJARAT?IN JUST 5 STEPS

Introduction

ToggleYOU NEED TO KNOW WHAT ARE THE REQUIREMENT FOR nIDHI COMPANY REGISTRATION ONLINE IN GUJARAT?

Nidhi Company Registration Online in Gujarat, ensure a minimum of seven shareholders and three directors, all Indian citizens. Obtain digital signatures and Director Identification Numbers. Draft Memorandum of Association and Articles of Association. Apply for name reservation, file incorporation documents with the Registrar of Companies, and pay required fees.Visitofficialwebsite

Eligibility Criteria in nidhi company

Before embarking on the registration process, you should ensure that your company meets the eligibility criteria set out in the Companies Act, 2013 for Nidhi Companies:

Minimum Members: A Nidhi Company must have at least 200 members within a year of its incorporation.

Minimum Capital Requirement: It should have a minimum paid-up equity share capital of Rs. 5 lakhs.

No Preference Shares: A Nidhi Company cannot issue preference shares.

Object Clause: The primary objective of a Nidhi Company should be cultivating the habit of thrift and savings among its members, receiving deposits from them, and lending to them for their mutual benefit.

documents requirement to register nidhi company

Registering a Nidhi Company in India requires the submission of several documents and pieces of information to the Registrar of Companies (RoC). These documents are crucial to ensure compliance with the Companies Act, 2013, and the Nidhi Rules, 2014. Here is a list of essential documents and information required for registering a Nidhi Company:

Digital Signature Certificates (DSCs):

- DSCs are required for all proposed directors and the Chief Executive Officer (CEO). DSCs are needed for filing online applications with the Registrar of Companies (RoC).

Director Identification Number (DIN):

- Each director of the company must have a Director Identification Number. Apply for DIN by filing Form DIR-3 through the Ministry of Corporate Affairs (MCA) portal.

Memorandum of Association (MoA) and Articles of Association (AoA):

- Draft the MoA and AoA for your Nidhi Company. These documents detail the company’s objectives, rules, and regulations. Ensure they comply with the Nidhi Rules, 2014, and the Companies Act, 2013.

Proof of Registered Office Address:

- Provide proof of the registered office address, such as a rent agreement, lease deed, or a utility bill. The registered office should be located within the jurisdiction of the respective Registrar of Companies (RoC).

Board Resolution:

- A certified copy of the board resolution declaring the intent to establish a Nidhi Company and authorizing directors to file the incorporation documents.

Declaration by Directors:

- A declaration from all directors confirming their intent to comply with the Nidhi Rules and Regulations, along with other legal requirements.

PAN and Aadhar Card of Directors:

- Copies of PAN and Aadhar cards of all directors.

Passport-sized Photographs:

- Recent passport-sized photographs of all directors and the CEO.

Registered Office Verification:

- Verification of the registered office address is necessary. This may involve an inspection by the RoC.

Subscription Money Proof:

- Proof of the initial capital contribution by the promoters in the company’s bank account. The minimum paid-up share capital should be Rs. 5 lakhs, as mentioned in the MoA.

What is the rule 3 of Nidhi rules

Rule 3A provides that the Nidhi Company, within one year from the date of incorporation or the extended time file NDH – 4. On receipt of the said form the Central Government, if the company meets all the requirements of the provisions relating to Nidhi will declare the company as Nidhi Company through notification.

How many members should Nidhi Company have

As per the provisions of the law, a minimum of seven members are required for the incorporation of a Nidhi Company. It is to be noted that out of those seven members, three of them are supposed to be company directors. Moreover, the company is supposed to have a minimum paid-up equity share of 5 lakhs

What are the benefits of Nidhi Company

- The Nidhi Company strives to help its members save more money.

- Making gifts and obtaining loans from the business for its members is quite simple.

- Members are encouraged to save more since loans are provided at a rate that is lower than the market rate.

Directors and Management:

Directors: A Nidhi Company must have at least three directors, with a minimum of two-thirds of them being individuals. Each director should have a Director Identification Number (DIN).

Board Meetings: The company must hold a minimum of four board meetings in a year, with an interval of not more than 120 days between two consecutive meetings.

Appointment of CEO: A Nidhi Company should appoint a Chief Executive Officer (CEO) who should be a director.

What is a nidhi company’s registration and its process

Nidhi Company registration refers to the process of incorporating and establishing a Nidhi Company, a non-banking financial institution (NBFC) in India. Nidhi Companies are formed to promote the habit of thrift, savings, and financial cooperation among their members.

The process of Nidhi Company registration involves the following steps:

- Obtain a Digital Signature Certificate (DSC): The first step is to obtain a DSC for the proposed directors of the company. The DSC is required for the online filing of registration documents.

2. Apply for Director Identification Number (DIN): Each director of the Nidhi Company must apply for a DIN from the Ministry of Corporate Affairs (MCA) by submitting the required documents and forms.

3. Name Reservation: Once the DIN is obtained, the next step is to apply for name reservation through the RUN (Reserve Unique Name) facility on the MCA portal. The proposed name should comply with the naming guidelines and not be similar to any existing company or trademark.

4. Drafting of Memorandum of Association (MOA) and Articles of Association (AOA): The MOA and AOA are the constitutional documents of the Nidhi Company. These documents define the objectives, rules, and regulations, as well as the members’ and directors’ rights and responsibilities. The MOA and AOA need to be prepared per the Companies Act 2013.

5. Submission of Forms and Documents: Once the name is approved, the necessary forms and documents, including the MOA, AOA, and other required declarations, need to be filed with the Registrar of Companies (RoC). These documents should be submitted within 60 days from the date of name approval.

6. Payment of Fees: The prescribed registration fees, based on the company’s authorized share capital, should be paid to the RoC. The fee structure can be obtained from the MCA website.

7. Certificate of Incorporation: After verifying the submitted documents, if everything is in order, the RoC will issue a Certificate of Incorporation, officially recognizing the Nidhi Company as a registered entity.

8. Post-Incorporation Compliance: Once the Nidhi Company is registered, certain post-incorporation compliance requirements need to be fulfilled, such as obtaining a Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN), opening a bank account, and complying with other applicable laws and regulations.

It is important to note that the registration process may involve additional steps and requirements depending on the specific circumstances and regulations at the time of registration. Seeking professional advice or consulting a company secretary can help ensure a smooth and compliant registration process for a Nidhi Company.

What is the minimum requirement to the registration of a Nidhi company

A Nidhi Company is a type of Non-Banking Financial Company (NBFC) in India that primarily deals with accepting deposits and lending money to its members. To register a Nidhi Company, you must meet the following minimum requirements:

- Incorporation: Register the company as a public limited company under the Companies Act, 2013 with the Ministry of Corporate Affairs (MCA).

- Unique name: Choose a unique name for the company that includes the word “Nidhi Limited” as part of its name.

- Minimum capital: The company must have a minimum paid-up equity share capital of INR 5 lakhs (approximately $6,700).

- Minimum members: A Nidhi Company must have at least seven members (shareholders) and three directors at the time of incorporation.

- Resident directors: All directors must be Indian residents.

- DIN (Director Identification Number): Each director must have a valid DIN.

- DSC (Digital Signature Certificate): Obtain a DSC for each director, which is required for signing electronic documents.

- MOA (Memorandum of Association) and AOA (Articles of Association): Draft the MOA, which outlines the company’s objectives, and the AOA, which contains the rules and regulations governing the company’s operations.

Registration Application:

Submit the application for the registration of your Nidhi Company with the Registrar of Companies (RoC). The application should include the following documents and information:

- MoA and AoA

- Names, addresses, and PAN cards of the directors

- Address of the registered office

- Declaration by the directors stating that the company will comply with all Nidhi Company rules

- Statement of accounts and financial projections

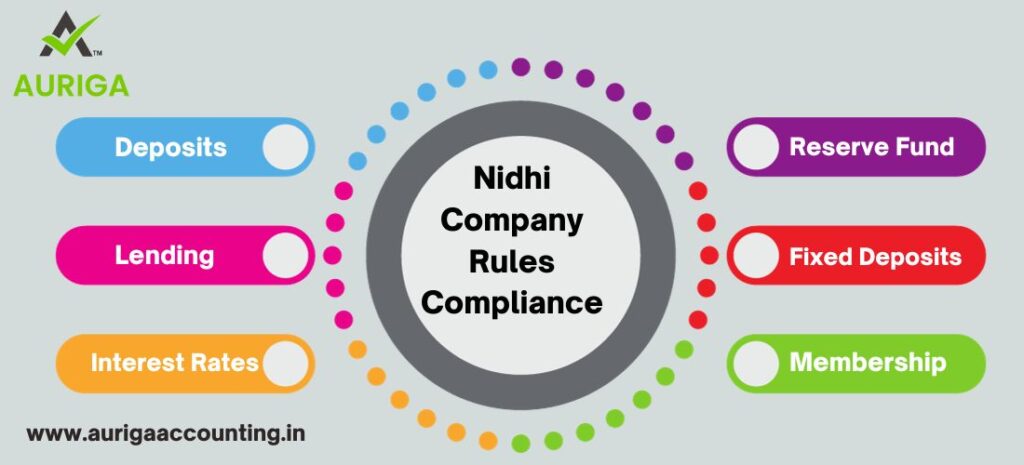

Nidhi Company Rules Compliance:

Nidhi Companies must comply with various regulations under the Nidhi Rules, 2014. These rules include:

- Deposits: Nidhi Companies can accept deposits only from their members.

- Lending: They can lend only to their members.

- Interest Rates: The interest rate charged on loans should not exceed 7.5% above the highest rate offered on deposits.

- Reserve Fund: They are required to transfer at least 20% of their profits to a reserve fund until it reaches 10% of their outstanding deposits.

- Fixed Deposits: Nidhi Companies are not allowed to offer fixed deposit schemes.

- Membership: Membership of Nidhi Companies is limited to individuals and entities specified in the Nidhi Rules.

Conclusion to nidhi company

Setting up a Nidhi Company in Gujarat, as in any part of India, involves a well-structured and legally compliant process. It’s important to adhere to all the requirements of the Companies Act, 2013, and the Nidhi Rules, 2014, and to maintain ongoing compliance with regulatory authorities.

how auriga accounting help you to register nidhi company

Auriga Accounting is a financial services firm that provides a range of services, including assistance with the registration of Nidhi Companies. They can play a crucial role in simplifying the registration process and ensuring that your Nidhi Company is compliant with all legal and regulatory requirements. Here’s how Auriga Accounting can help you with the registration of a Nidhi Company:

Expert Guidance:

- Auriga Accounting has a team of professionals with expertise in company registration, compliance, and financial services. They can provide expert guidance throughout the registration process.

Document Preparation:

- Auriga Accounting assist you in preparing all the necessary documents required for Nidhi Company registration. This includes drafting the Memorandum of Association (MoA), Articles of Association (AoA), and other legal documents to ensure compliance with the Nidhi Rules and the Companies Act, 2013.

Digital Signature Certificates (DSCs) and Director Identification Numbers (DINs):

- Auriga can help you obtain DSCs for the directors and guide you through the process of applying for DINs, which are essential for company registration.

Company Name Reservation:

- Auriga Accounting assist you in selecting a unique and suitable name for your Nidhi Company and check its availability with the Ministry of Corporate Affairs (MCA).

Registration Application:

- Auriga can prepare and file the registration application with the Registrar of Companies (RoC) on your behalf. This includes submitting all the required documents and information in compliance with the Companies Act and Nidhi Rules.

Compliance with Nidhi Rules:

- Auriga Accounting ensure that your company’s operations, objectives, and documents align with the Nidhi Rules and Regulations, as specified by the regulatory authorities.

Address Verification:

- Assistance in verifying the registered office address and providing the required documentation to comply with this requirement.

Financial Compliance:

- Auriga can help you set up the initial capital requirement of at least Rs. 5 lakhs, ensuring it is deposited in the company’s bank account.

Ongoing Compliance and Reporting:

- After registration, they can assist you with ongoing compliance, including annual financial audits, filing of returns, and maintaining statutory records as per regulatory requirements.

Tax Registration:

- Guidance and assistance in obtaining Permanent Account Numbers (PAN) and Tax Deduction and Collection Account Numbers (TAN) for your company.