CAN A SINGLE PERSON REGISTER PRIVATE LIMITED?

Introduction

ToggleCAN A SINGLE PERSON REGISTER PRIVATE LIMITED?

Many jurisdictions, a single person can register a Private Limited (Pvt Ltd) company. This structure is often referred to as a “One Person Company” (OPC). OPC allows a single individual to be the sole shareholder and director, providing limited liability while maintaining a separate legal identity for the business. The individual must obtain a Director Identification Number (DIN) and a Digital Signature Certificate (DSC). However, specific regulations and requirements may vary by jurisdiction, so it’s crucial to check the local company law and seek professional advice for accurate and up-to-date information.Top of Form Visitofficialwebsite

Can one person company be private limited company?

Certainly, here are the following points explaining how a One Person Company (OPC) can be considered a type of Private Limited Company:

- Legal Structure: An OPC is a distinct legal entity, similar to a Private Limited Company (Pvt Ltd), providing limited liability to its owner.

- Single Ownership: The defining feature of an OPC is that it allows a single individual to own and operate the company, while Pvt Ltd companies traditionally require a minimum of two shareholders.

- Limited Liability: Like Pvt Ltd companies, OPCs offer limited liability to the owner, meaning personal assets are protected from business liabilities.

- Separate Legal Entity: OPCs, just like Pvt Ltd companies, are considered separate legal entities, capable of entering contracts, owning assets, and conducting business independently.

- Perpetual Succession: Both OPCs and Pvt Ltd companies have the benefit of perpetual succession, meaning the company continues to exist despite changes in ownership.

- Formal Structure: OPCs, like Pvt Ltd companies, have a formalized structure with a Memorandum of Association (MOA) and Articles of Association (AOA) outlining their objectives and internal regulations.

- Registration Process: The registration process for OPCs involves filing with the relevant government authority, similar to the process for Pvt Ltd companies.

- Compliance Requirements: Both OPCs and Pvt Ltd companies need to comply with statutory requirements, file annual returns, and adhere to regulatory guidelines.

- Taxation: The taxation structure for OPCs is typically similar to Pvt Ltd companies, subject to corporate income tax rates applicable in the respective jurisdiction.

- Name Designation: The name of an OPC includes the term “One Person Company,” reflecting its unique status within the broader category of Private Limited Companies.

While OPCs share many similarities with Pvt Ltd companies, it’s important to note that the specific regulations and requirements may vary by jurisdiction. Individuals considering the formation of an OPC should familiarize themselves with the local company law and seek professional advice for accurate and up-to-date information.

What are the rules for one person company?

The rules for a One Person Company (OPC) may vary by jurisdiction, but here are the following general points highlighting common features and rules associated with OPCs:

- Single Owner: The primary rule is that an OPC is owned by a single individual. This individual acts as both the shareholder and the director.

- Director and Nominee: While the single individual manages the company, they are required to nominate a person as a nominee who will take over in case of the owner’s death or incapacity.

- Minimum and Maximum Directors: An OPC must have at least one director. However, the maximum limit is fifteen directors, beyond which the OPC must convert into a private limited company.

- No Partnership or Association: An OPC cannot be formed through a partnership or association of individuals. It is a structure for a single individual to operate a company.

- Conversion to Private Limited Company: If the paid-up share capital of an OPC exceeds a certain threshold or its average annual turnover surpasses the specified limit, it must be converted into a private limited company.

- Annual Compliance: OPCs, like other companies, are required to comply with annual filing requirements. This includes filing financial statements, annual returns, and other necessary documents with the regulatory authorities.

- No Minor as Member/Nominee: A minor cannot become a member or nominee of an OPC. The member and nominee must be individuals who have attained the age of majority.

- Change in Membership: The ownership of an OPC can be transferred by altering the membership through the sale of shares. However, an OPC cannot be converted into a Section 8 company.

- Restrictions on Types of Business: Certain types of businesses, such as non-banking financial companies (NBFCs) and companies engaged in investment activities, cannot be registered as OPCs.

- Name Display: The name of an OPC must end with the term “One Person Company” to distinguish it from other company types.

It’s important to note that these rules can vary, and it’s advisable to consult the specific laws and regulations of the jurisdiction where the OPC is registered. Seeking professional advice is recommended to ensure compliance with all applicable rules and regulations.

Which is better OPC or Pvt Ltd?

Choosing between a One Person Company (OPC) and a Private Limited Company (Pvt Ltd) depends on various factors, including the business owner’s preferences, future plans, and the nature of the business. Here are the points to consider when comparing OPC and Pvt Ltd:

- Ownership Structure: OPC is designed for single ownership, while Pvt Ltd requires a minimum of two shareholders. If you prefer sole ownership, OPC may be more suitable.

- Limited Liability: Both OPC and Pvt Ltd offer limited liability, protecting personal assets from business debts. This is a key advantage in terms of risk management.

- Formation Process: The formation process for OPC is generally simpler than Pvt Ltd since there is only one owner. Pvt Ltd requires at least two shareholders.

- Conversion: OPC may need to convert into a Pvt Ltd if it exceeds certain thresholds. Pvt Ltd offers more flexibility in terms of growth and expansion without mandatory conversion.

- Compliance Requirements: OPCs may have slightly less stringent compliance requirements compared to Pvt Ltd companies, making them easier to manage, especially for smaller businesses.

- Nominee Requirement: OPCs are required to have a nominee, which may not be necessary for Pvt Ltd companies. Some business owners may find this requirement burdensome.

- Business Expansion: Pvt Ltd companies have more flexibility for business expansion as they can issue shares to a larger group of shareholders. OPCs are limited to a single owner.

- Investor Preference: Investors may have a preference for Pvt Ltd companies due to their established structure and ability to raise capital through the sale of shares to multiple investors.

- Name Display: The name of an OPC must end with “One Person Company,” which may impact the branding strategy. Pvt Ltd companies don’t have this specific naming requirement.

- Future Plans: Consider the long-term goals of the business. If there are plans for significant growth, attracting investors, or eventual public listing, Pvt Ltd may be a more suitable choice.

Ultimately, the choice between OPC and Pvt Ltd depends on the specific needs and goals of the business owner. Both structures have their advantages, and it’s advisable to seek professional advice to make an informed decision based on the unique circumstances of the business.

What is the minimum turnover for a Pvt Ltd company

Business owners should consult with professionals, such as accountants or legal advisors, to understand specific requirements and implications related to turnover based on the laws applicable in their jurisdiction. Additionally, regulations may change, so it’s advisable to check for any updates or amendments. Here are the following points to consider:

- Formation Criteria: Pvt Ltd companies are formed based on criteria such as having a minimum number of two shareholders, limited liability, and a formal structure with a Memorandum of Association (MOA) and Articles of Association (AOA).

- Limited Liability: One of the key features of Pvt Ltd companies is limited liability, protecting the personal assets of shareholders from the company’s debts.

- Shareholders: Pvt Ltd companies can be formed with a minimum of two shareholders, and there is no specific requirement related to turnover for the registration process.

- Separate Legal Entity: Pvt Ltd companies are recognized as separate legal entities, distinct from their owners. This allows them to enter into contracts, own assets, and incur liabilities independently.

- No Minimum Turnover Requirement: Generally, there is no minimum turnover requirement specified for the registration or existence of a Pvt Ltd company.

- Audit Requirements: Turnover figures might become relevant when considering mandatory audit requirements. Companies exceeding a certain turnover threshold may be required to undergo a statutory audit.

- Taxation: Corporate income tax for Pvt Ltd companies is typically based on taxable profits rather than turnover.

- Goods and Services Tax (GST): Pvt Ltd companies engaged in the sale of goods or services may be required to register for Goods and Services Tax (GST) based on turnover thresholds set by tax authorities.

- Investor Considerations: While there is no minimum turnover for the formation, potential investors or stakeholders may consider turnover as an indicator of financial health and growth potential.

- Sector-Specific Regulations: Certain industries or sectors may have specific regulations or licensing requirements related to turnover. It’s important to check sector-specific regulations applicable to the business.

Which is better Pvt Ltd or Ltd?

The choice between Private Limited (Pvt Ltd) and Limited (Ltd) company structures depends on various factors, including the business’s goals, size, and preferences. Both structures have their advantages, and the decision should align with the specific needs of the business. Here are the points to consider when comparing Pvt Ltd and Ltd structures:

- Limited Liability: Both Pvt Ltd and Ltd structures provide limited liability, protecting the personal assets of shareholders from business debts. This is a crucial aspect for risk management.

- Ownership and Shareholders: Pvt Ltd requires a minimum of two shareholders, while Ltd can have more flexibility in terms of the number of shareholders. The choice depends on the desired ownership structure.

- Ease of Transferability: Pvt Ltd companies may have restrictions on the transfer of shares, providing more control over ownership changes. Ltd companies may offer more flexibility in this regard.

- Public Listing: Ltd companies have the option to go public by issuing shares on the stock exchange, allowing for increased access to capital. Pvt Ltd companies are generally not listed on public exchanges.

- Regulatory Compliance: Pvt Ltd companies often have fewer regulatory compliance requirements compared to listed Ltd companies. This can reduce administrative burdens for smaller businesses.

- Perception and Credibility: Pvt Ltd companies are often perceived as smaller entities, while Ltd companies, especially those listed on stock exchanges, may have a higher level of credibility and visibility.

- Access to Capital: Ltd companies have more options for raising capital through public offerings of shares. Pvt Ltd companies can raise funds through private placements or loans.

- Business Expansion: If there are plans for significant business expansion or if the business is in an industry with high capital requirements, a Ltd structure may be more suitable.

- Cost of Compliance: Pvt Ltd companies may have lower compliance costs compared to Ltd companies, especially when it comes to meeting the stringent requirements of public listings.

- Flexibility in Management: Pvt Ltd companies offer more control and flexibility in management decisions since they are not subject to the same level of scrutiny and regulations as listed Ltd companies.

In summary, the choice between Pvt Ltd and Ltd depends on the specific circumstances of the business. Smaller enterprises or those prioritizing control and simplicity may find Pvt Ltd more suitable, while larger businesses with expansion plans and capital needs may opt for a Ltd structure. It’s advisable to seek professional advice to make an informed decision based on the business’s unique requirements and goals.

Which is the biggest Pvt Ltd?

, it’s challenging to pinpoint the single “biggest” Private Limited (Pvt Ltd) company globally, as the size of a company can be measured in various ways, such as revenue, market capitalization, or total assets. Additionally, the rankings of companies are subject to change due to market dynamics, mergers, acquisitions, and other factors.

However, some of the world’s largest private companies include those in diverse industries such as technology, finance, and retail. Notable examples might include multinational conglomerates like Koch Industries, Cargill, and Dell Technologies.

Koch Industries, based in the United States, is often cited as one of the largest privately-owned companies globally, with diversified interests in various sectors, including energy, manufacturing, and commodities.

Cargill, also based in the United States, is a major player in the agricultural and food industries and is known for being one of the largest privately-owned corporations.

Dell Technologies, although it was public until 2013, became a private company through a significant leveraged buyout. It operates in the technology sector, providing a range of products and services.

It’s important to note that the status and rankings of private companies can change, and new contenders may emerge. For the most up-to-date information on the largest private companies, one should refer to current financial reports, business news, or relevant industry publications.

Who is the real owner of Pvt Ltd company

The ownership structure of a Private Limited (Pvt Ltd) company involves shareholders who collectively own the company. In a Pvt Ltd company, the concept of a single “real owner” is not applicable as the ownership is distributed among multiple shareholders.

Shareholders are individuals or entities that hold shares in the company, representing their ownership interest. The extent of ownership is determined by the number of shares held. Each shareholder, regardless of the number of shares, is considered a part-owner of the company.

The shareholders exercise their ownership rights through voting on key company matters, such as the election of directors and approval of significant decisions. While the shareholders collectively own the company, the day-to-day management and decision-making are typically entrusted to the appointed directors and executives.

Identifying the “real owner” may also involve considering the individuals or entities with significant control or influence over the company. In some cases, it might be a majority shareholder or a group of shareholders acting in concert.

It’s important to note that the ownership structure of a Pvt Ltd company is outlined in the company’s statutory documents, including the Memorandum of Association (MOA) and Articles of Association (AOA). Additionally, company ownership details, including the list of shareholders and their respective shareholdings, are maintained in the company’s statutory records and are often accessible through regulatory authorities.

What is the fee for name approval of company

The fee for name approval of a company can vary based on the jurisdiction and regulatory requirements of the country where the company is being registered. Different countries have their own company registration processes and associated fees.

For example, in India, the Ministry of Corporate Affairs (MCA) charges a fee for name approval during the incorporation process. The fee can depend on factors such as the type of company (Private Limited, Public Limited, etc.) and the method of filing.

It’s essential to check the official website of the relevant regulatory authority or consult with a professional service provider to obtain the most up-to-date and accurate information regarding the fee for name approval in the specific jurisdiction where you intend to register the company.

Please note that fees and regulations are subject to change, and it’s advisable to verify the latest information with the appropriate authorities or seek legal advice to ensure compliance with the current requirements.

What is the fee for name reservation for company?

The fee for name reservation for a company can vary depending on the jurisdiction and the regulatory body overseeing company registrations. , I’ll provide an example based on the process in India, governed by the Ministry of Corporate Affairs (MCA).

In India, to reserve a name for a company, you need to file an application with the MCA through the RUN (Reserve Unique Name) service. The fee for name reservation is typically nominal. However, the exact amount can vary based on factors such as the type of company and whether the application is being filed as a normal filing or a resubmission.

As of my last update, the fee for filing a name reservation application through RUN was in the range of INR 1,000 to INR 2,000, depending on the circumstances. It’s important to note that these figures are indicative, and the MCA may revise the fees or introduce changes.

To obtain the most accurate and up-to-date information regarding the fee for name reservation in a specific jurisdiction, it is recommended to check the official website of the relevant regulatory authority or consult with a professional service provider who can provide the latest details based on the current regulations and fee structures.

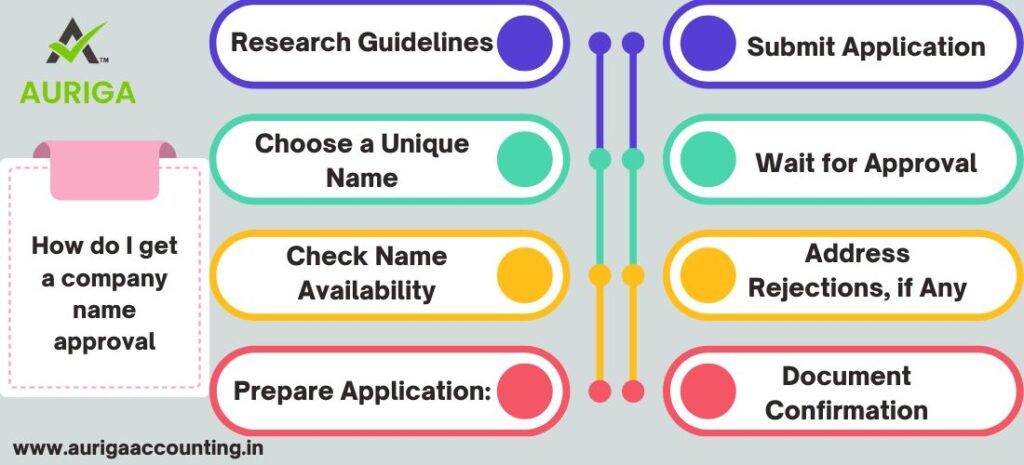

How do I get a company name approval

Getting a company name approval involves following the prescribed procedures set by the regulatory authorities in the jurisdiction where you intend to register the company. Here’s a general guide on how to obtain company name approval:

- Research Guidelines: Begin by researching the guidelines and naming conventions provided by the relevant regulatory authority. Understand any restrictions or requirements for company names.

- Choose a Unique Name: Select a unique and meaningful name for your company. Ensure it is not similar to existing company names to avoid potential conflicts.

- Check Name Availability: Use the online tools or platforms provided by the regulatory authority to check the availability of the chosen name. Ensure it is not already registered or reserved.

- Prepare Application: Prepare the name reservation application according to the format and requirements specified by the regulatory authority. Include details such as the proposed company name, type of business, and other required information.

- Submit Application: Submit the application through the designated online or physical channels. Pay the required fee for name reservation, if applicable, during the submission process.

- Wait for Approval: Await the processing of your application. The time for approval can vary depending on the regulatory authority and whether there are similar names already in the database.

- Address Rejections, if Any: If your chosen name is rejected, the regulatory authority will typically provide reasons for the rejection. Address any issues, modify the name if necessary, and resubmit the application.

- Document Confirmation: Once approved, you will receive a confirmation document or certificate from the regulatory authority confirming the reservation of the company name.

What is the fee for Pvt Ltd company name change? To file the RUN application, the company is required to pay a government

To file the RUN application, the company is required to pay a government fee of Rs. 1000/-. The ROC then evaluates the application to ensure that the proposed name is unique and not already in use by another company, limited liability partnership (LLP), domain, or trademark.

This request must include a copy of the Board Resolution as well as a No Objection Certificate (NOC) from the trademark owner, if applicable.

In many jurisdictions, including India, where Pvt Ltd companies are commonly referred to as Limited (Ltd) companies, the process of changing the company name involves filing the necessary forms and paying the prescribed fee. The fee for name change can vary and is often influenced by factors such as the type of company, the authorized share capital, and the specific circumstances of the change.

For example, in India, if a Pvt Ltd company decides to change its name, it typically involves filing the necessary forms with the Ministry of Corporate Affairs (MCA). The fee structure may include charges for the filing itself, as well as additional fees based on the company’s authorized share capital.

The fee for changing the name of a Private Limited (Pvt Ltd) company can vary based on the jurisdiction and regulatory requirements.

Here are some points to consider regarding the fee for Pvt Ltd company name change:

- Jurisdictional Variations: Different countries and regulatory authorities have their own fee structures for name change processes. The fees can vary significantly.

- Type of Company: The fee may depend on the type and size of the company. Larger companies or those with higher authorized capital may incur higher fees.

- Authorized Capital: Some jurisdictions calculate the fee based on the authorized capital of the company. Higher authorized capital may result in a higher fee.

- Government Regulations: The regulatory authority or government body overseeing company registrations establishes the fee structure for name changes. It’s important to check the specific regulations in the relevant jurisdiction.

- Form Filing Fee: The process of changing the company name usually involves filing specific forms with the regulatory authority. The fee may include charges for these form submissions.

- Professional Service Fees: If a company engages professional services to assist with the name change process, there may be additional fees associated with these services.

- Expedited Processing: Some jurisdictions offer expedited processing options for an additional fee. This can expedite the name change process.

- Late Filing Penalties: In some cases, there may be penalties or additional fees if the company fails to file for a name change within a specified timeframe or if there are delays in the process.

How many days will it take for company name approval

The MCA will process the application in 2-3 working days after submission. You can check the company name status on the MCA portal from MCA services – Track SRN/Transaction status. If MCA finds the name available, the ministry will approve the name and send the name approval letter.

The duration for company name approval varies by jurisdiction and the specific procedures of the regulatory authority. In many cases, the process can take anywhere from a few hours to several days. Some jurisdictions offer online platforms for immediate name availability checks, expediting the approval process. However, factors such as the complexity of the proposed name, manual review requirements, and any resubmission due to rejection can impact the overall timeframe.

The duration for company name approval can vary significantly depending on the jurisdiction and the specific procedures established by the regulatory authority overseeing company registrations. Here’s a general overview of the timeframes involved:

- Online Application Process: Many jurisdictions offer online platforms for submitting name reservation applications, which can expedite the process. Online systems may provide quicker responses compared to traditional paper-based submissions.

- Name Availability Check: The initial step involves checking the availability of the proposed company name. Some jurisdictions provide real-time online tools for this purpose, allowing immediate verification.

- Processing Time: The processing time for name approval can range from a few hours to several days, depending on the efficiency of the regulatory authority. Some jurisdictions have specific service level agreements that outline the expected processing times.

- Expedited Processing: Some regulatory authorities offer expedited processing options for an additional fee. This can significantly reduce the time required for name approval.

- Complex Cases: If the proposed name is straightforward and does not conflict with existing names, the approval process is generally faster. However, more complex cases or names that require manual review may take longer.

- Resubmission Time: If the initial name choice is rejected, the resubmission process may extend the overall time required. Addressing any issues identified during the initial review is crucial to avoiding delays.

- Weekends and Holidays: The calculation of days may exclude weekends and holidays. It’s essential to consider the working days of the regulatory authority.

- Jurisdictional Differences: Different countries have different administrative processes and timelines. Some jurisdictions may have a more streamlined and efficient approval process, while others may take longer.

- Communication Channels: The method of communication with the regulatory authority can also influence the time it takes to receive updates and approvals.

- Additional Approvals: In some cases, additional approvals may be required from regulatory bodies or specific authorities, adding to the overall processing time.

What documents are required for company name approval?

The documents required for company name approval can vary by jurisdiction, but here are some common points that often apply:

- Memorandum of Association (MOA): A document defining the company’s objectives, structure, and powers.

- Articles of Association (AOA): Outlines the company’s internal rules, regulations, and management structure.

- Identity Proof: Identification documents of the proposed directors and shareholders.

- Address Proof: Address verification documents for the proposed registered office of the company.

- No Objection Certificate (NOC): NOC from the owner of the premises where the registered office is situated.

- Name Reservation Application: The application form for reserving the proposed company name.

- Payment Proof: Evidence of payment of the prescribed fee for name reservation.

- Details of Directors and Shareholders: Information about the individuals or entities proposed as directors and shareholders.

- Business Description: Brief description of the business activities the company intends to undertake.

- Board Resolution (if applicable): A resolution passed by the board of directors authorizing the name change.

What is the certificate for change of company name?

When a company undergoes a change of name, it receives a certificate confirming the alteration. Here are ten points regarding the certificate for the change of company name:

- Certificate of Incorporation: The original Certificate of Incorporation is updated to reflect the new company name.

- Issued by Regulatory Authority: The certificate is typically issued by the regulatory authority overseeing company registrations in the respective jurisdiction.

- Legal Recognition: The certificate legally recognizes the change of the company’s name, reflecting the updated details of the business.

- Document of Authority: It serves as a document of authority, demonstrating that the company has undergone an official name change process.

- Key Information: The certificate includes key information such as the company’s registration number, new name, and the date of the name change.

- Validity Period: The certificate is valid indefinitely unless there are subsequent changes requiring further updates.

- Required for Transactions: The updated certificate is often required for various business transactions, contracts, and legal documentation.

- Bank Notification: It is commonly used to notify banks and financial institutions of the change to update the company’s records.

- Public Record: The certificate becomes part of the public record, and interested parties can obtain it for verification purposes.

- Compliance Requirement: Possessing the updated certificate is a compliance requirement, and the company is obligated to provide it when requested by authorities or stakeholders.

Can I use word India in company name?

Using the word “India” in a company name is subject to certain regulations and guidelines set by the regulatory authority overseeing company registrations in the respective jurisdiction. Here are ten points to consider regarding using the word “India” in a company name:

- Regulatory Approval: Approval is typically required from the regulatory authority for using geographical names like “India” in a company name.

- Specific Guidelines: Regulatory authorities may have specific guidelines regarding the use of national or geographical names to prevent misleading representations.

- Scope of Business: The scope of the company’s business activities should align with the use of the word “India” to avoid any misrepresentation.

- Government Consent: In some jurisdictions, obtaining consent from the government or relevant authorities may be necessary.

- Non-Deceptive Intent: The use of “India” should not be intended to deceive or mislead the public about the company’s origin, nature, or ownership.

- Name Availability Check: Perform a name availability check with the regulatory authority to ensure that the proposed name, including “India,” is not already in use.

- Additional Requirements: Some jurisdictions may impose additional requirements or conditions for using national names in a company’s title.

- Public Perception: Consider the potential public perception and how the use of “India” aligns with the company’s identity and mission.

- Cultural Sensitivity: Ensure that the use of “India” is culturally sensitive and does not violate any cultural norms or sensitivities.

- Legal Advice: Seek legal advice to understand the specific rules and regulations applicable to company naming in the jurisdiction where the company is registered.

How auriga accounting help you to register private limited for single person

Auriga Accounting is a service that offers assistance with various financial and accounting tasks, including company registration. While specifics may vary depending on the jurisdiction you’re in, registering a private limited company for a single person typically involves several steps, such as:

Choosing a Business Structure: Auriga Accounting can help you determine if a private limited company is the right structure for your business. For a single person, this might be the most suitable option due to its limited liability and separate legal entity status.

Name Reservation: Auriga Accounting can assist you in selecting a unique name for your company and ensuring it’s available for registration.

Preparation of Documents: Auriga Accounting can help prepare all the necessary documents, including the Memorandum and Articles of Association, which outline the company’s objectives, rules, and regulations.

Filing with the Registrar of Companies: Auriga Accounting can handle the submission of all required documents to the appropriate government authorities for registration.

Tax Registration: Auriga Accounting can assist in registering your company for tax purposes, obtaining necessary tax identification numbers, and ensuring compliance with tax regulations.

Registered Office: Auriga Accounting can provide a registered office address if needed, which is a legal requirement in many jurisdictions.

Compliance Assistance: Auriga Accounting can provide ongoing support to ensure your company remains compliant with all legal and regulatory requirements, including annual filings and tax obligations.

By utilizing Auriga Accounting’s services, you can streamline the process of registering your single-person private limited company, saving time and ensuring compliance with relevant regulations.