CAN I FILE ANOTHER FORM 3 AND FORM 4 FOR PARTNER IN LLP?

Introduction

ToggleCAN I FILE ANOTHER FORM 3 AND FORM 4 FOR PARTNER IN LLP?

No, you cannot file another Form 3 or Form 4 for adding or removing partners in a Limited Liability Partnership (LLP). Form 3 is the LLP Agreement, submitted at the time of LLP incorporation or when there are amendments to the agreement. Form 4 is used for Notice of Appointment of Partner/Designate Partner or Notice of Cessation/Change in Designated Partner. To add or remove partners, you must file Form 4 with the Registrar of Companies (RoC) along with the required documents. These forms are specific to the respective processes and cannot be used interchangeably for partner changes in an LLP. Visitofficialwebsite

WHAT IS FORM 3

Form 3 – Information with regard to Limited Liability Partnership Agreement and changes, if any, made therein: Form 3 is a crucial document used in the context of Limited Liability Partnerships (LLPs). Officially known as “Form 3 – Information with regard to Limited Liability Partnership Agreement and changes, if any, made therein,” it plays a pivotal role in the registration, compliance, and transparency of LLPs.

This form is used primarily for two purposes:

Initial Registration: When establishing a new LLP, Form 3 is submitted to provide comprehensive details about the LLP agreement and the partners involved. This information includes the LLP’s name, registered office address, partner details (names, addresses, contributions, profit-sharing ratios), and designated partner information.

Updates and Changes: Beyond initial registration, Form 3 is also used to report any subsequent changes made to the LLP agreement. These changes may involve alterations to the LLP’s name, registered office, partner details, capital contributions, or profit-sharing arrangements. It ensures that the Registrar of Companies or the relevant regulatory authority has accurate and current information about the LLP’s structure and partners.

WHAT IS FORM 4

Form 4 – Notice of appointment of partner/ designated partner or changes therein and consent of partner/ designated partner to become a partner/ designated partner: Form 4, officially titled “Notice of appointment of partner/ designated partner or changes therein and consent of partner/ designated partner to become a partner/ designated partner,” is a vital document used in the context of Limited Liability Partnerships (LLPs). This form is instrumental in notifying the regulatory authorities about changes in the partner or designated partner structure within an LLP.

Form 4 serves several key purposes:

Appointment of Partners: It is used to officially notify the Registrar of Companies or the relevant regulatory authority about the appointment of new partners or designated partners in the LLP. This includes providing details such as the partner’s name, address, and consent to become a partner or designated partner.

Changes in Partner Details: If there are any changes in the particulars of existing partners, such as their roles, addresses, or capital contributions, Form 4 is used to update this information. This ensures that the regulatory authority has accurate and current data regarding the LLP’s partner composition.

Consent: Form 4 includes a section for partners or designated partners to provide their consent to take on these roles within the LLP. It demonstrates their willingness to assume the responsibilities associated with these positions.

Compliance: Filing Form 4 is essential for LLP compliance with regulatory requirements. It ensures that the regulatory authority is informed of changes in the LLP’s structure and leadership.

WHY IS IMPORTANT TO FILE FORM 3 & FORM 4 FOR PARTNERS

filing Form 3 and Form 4 in an LLP is essential for legal compliance, transparency, credibility, legal protection, and alignment with governance standards. It ensures that the LLP operates within the boundaries of the law, fosters trust among stakeholders, and facilitates effective governance and record-keeping. Failure to file these forms can result in legal and regulatory consequences and may harm the LLP’s reputation.

Are Form 3 and Form 4 linked forms

Yes, Form 3 and Form 4 are linked forms in the context of securities regulations, and here are the key points:

Purpose: Both Form 3 and Form 4 are filed with the Securities and Exchange Commission (SEC) to report ownership of company stock by insiders of publicly traded companies.

Form 3: This form is filed by individuals upon becoming insiders of a publicly traded company, such as directors, officers, and certain beneficial owners.

Form 4: This form is filed by insiders to report any changes in their ownership of the company’s stock, including purchases, sales, or other transactions. It must be filed within two business days of the transaction date.

Linkage: While Forms 3 and 4 are separate filings, they are linked in the sense that an individual may need to file both forms depending on their circumstances. Form 3 is filed upon becoming an insider, and Form 4 is filed for subsequent transactions.

Filing Requirements: Form 3 must be filed within ten days after an individual becomes subject to reporting requirements, while Form 4 must be filed within two business days of the transaction date.

Completion: An individual may file Form 3 when they initially become an insider and subsequently file Form 4 for any future transactions involving the company’s stock.

In summary, while Forms 3 and 4 are distinct filings, they are linked because they both pertain to the reporting of ownership and changes in ownership by insiders of publicly traded companies, with Form 3 addressing initial ownership and Form 4 addressing subsequent transactions.

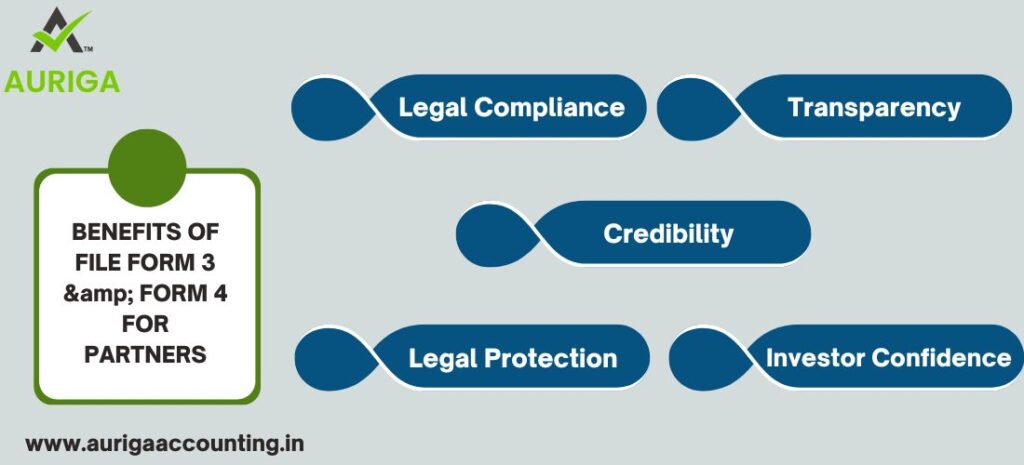

BENEFITS OF FILE FORM 3 & FORM 4 FOR PARTNERS

Legal Compliance: Ensures compliance with legal requirements, helping the LLP avoid penalties, fines, and legal consequences for non-compliance.

Transparency: Provides comprehensive information about the LLP’s agreement, partner details, and designated partners, promoting transparency among stakeholders, including investors and creditors.

Credibility: Demonstrates the LLP’s commitment to adhering to legal and governance standards, enhancing its credibility and reputation.

Legal Protection: Serves as a legal document outlining the rights, responsibilities, and obligations of partners, offering legal protection for the interests of partners and aiding in dispute resolution.

Investor Confidence: Increases confidence among investors, as they can review Form 3 to understand the LLP’s ownership structure and compliance with regulations.

What is the penalty for filing Form 3 LLP

Rs.100/- per day Form 3 is typically associated with insider trading reporting for publicly traded companies in the United States, rather than LLPs. However, if you file Form 3 incorrectly or fail to file it when required for a publicly traded company, the penalty can vary depending on the severity of the violation and the discretion of the regulatory authorities.

Penalties for incorrect or late filings can include fines imposed by the Securities and Exchange Commission (SEC) or other regulatory bodies. These fines may vary based on factors such as the nature of the violation, the size of the company, and any prior regulatory history.

To obtain the most accurate and up-to-date information on penalties associated with Form 3 filings, it’s best to consult the SEC’s regulations, guidance documents, or seek advice from a legal professional specializing in securities law.

What is the due date for filing LLP Form 3

The due dates for filing LLP forms vary depending on the specific form and the LLP’s financial year-end. Generally, LLPs are required to file an annual return (Form 11) within 60 days from the end of the financial year, and financial statements (Form 8) within 30 days from the end of six months of the financial year.

Can we close LLP without filing Form 3

The closure or dissolution of a Limited Liability Partnership (LLP) typically involves several legal and regulatory steps, and the requirements may vary depending on the jurisdiction where the LLP is registered.

In many jurisdictions, the process of dissolving an LLP involves fulfilling all outstanding regulatory obligations, including filing any required forms and documents. Form 3, which is typically associated with insider trading reporting for publicly traded companies in the United States, may not be directly related to the dissolution process of an LLP.

However, it’s important to note that LLP dissolution procedures and requirements are governed by specific laws and regulations in each jurisdiction, and failing to fulfill all necessary obligations, including filing required forms, could lead to legal and regulatory consequences.

Therefore, before closing an LLP, it’s advisable to consult with a legal professional or business advisor who is knowledgeable about the dissolution process for LLPs in your jurisdiction. They can provide guidance on the specific steps and requirements involved in properly closing the LLP, including whether Form 3 or any other forms need to be filed as part of the dissolution process.

How to file Form 3 and Form 4 of LLP in new portal

The filing of Form 3 and Form 4 for a Limited Liability Partnership (LLP) with the Securities and Exchange Commission (SEC) may differ depending on the jurisdiction and the specific requirements set by the regulatory authorities.

For filings related to LLPs in the United States, typically, Form 3 and Form 4 are associated with insider trading reporting for publicly traded companies, and LLPs may not directly file these forms with the SEC unless they are structured as a publicly traded entity.

If you’re referring to LLPs in another jurisdiction or if there have been updates to the regulations since my last update, you should consult the regulatory authority governing LLPs in your jurisdiction for specific guidance on how to file Form 3 and Form 4.

However, if you are referring to LLPs in the context of insider trading and securities regulations, and you need to file Form 3 or Form 4 for individuals associated with the LLP who are subject to reporting requirements as insiders of publicly traded companies, you would typically use the SEC’s Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system. Here’s a general process:

Access the SEC’s EDGAR system: Visit the SEC’s website and navigate to the EDGAR filing system.

Obtain EDGAR Filer Codes: Before filing electronically, you need to obtain filing codes, including a Central Index Key (CIK) number and a CIK Confirmation Code. These codes are obtained by completing the appropriate Form ID filing.

Prepare the Forms: Fill out Form 3 or Form 4 with accurate information regarding the insider’s ownership or changes in ownership of the company’s stock.

Upload the Forms: Log in to the EDGAR system and submit the completed forms electronically. You may need to pay any applicable filing fees.

Receive Confirmation: After submission, you’ll receive a confirmation of the filing. Make sure to keep a record of the confirmation for your records.

Timely Filing: Ensure that Form 3 is filed within ten days after the insider becomes subject to reporting requirements, and Form 4 is filed within two business days of the transaction date.

Please note that the specific steps and requirements may vary, so it’s essential to refer to the SEC’s guidance and instructions provided on their website or consult with a legal or financial professional experienced in securities regulations and filings.

HOW AURIGA ACCOUNTING HELP YOU TO FILE FORM 3 & FORM 4 FOR PARTNERS

Expert Guidance: Auriga Accounting has a team of experts who are well-versed in LLP regulations and compliance requirements. They can provide expert guidance on the specific filing requirements in your jurisdiction and ensure that you are meeting all the necessary legal obligations.

Form Preparation: Auriga Accounting can assist in preparing Form 3 and Form 4 accurately and completely. This includes gathering all the required information, filling out the forms correctly, and ensuring that they are in compliance with regulatory standards.

Document Verification: Auriga Accounting can conduct a thorough review of the completed forms and accompanying documentation to verify their accuracy and completeness. This reduces the risk of errors or omissions in the filings.

Compliance Management: Auriga Accounting can help you stay up-to-date with changing regulatory requirements, ensuring that your filings are always in compliance with the latest rules and regulations.

Timely Submission: Auriga Accounting can ensure that Form 3 and Form 4 are submitted to the relevant authorities within the specified deadlines. Timely submission is essential to avoid penalties and maintain good standing.

Record Keeping: Auriga Accounting can advise on best practices for maintaining records of the filing process, ensuring that you have organized documentation for future reference and compliance audits.

Communication: Auriga Accounting can liaise with regulatory authorities on your behalf, addressing any queries or requests for additional information that may arise during the filing process.

Data Security: Given the sensitive nature of partner information, they can help implement robust data security measures to protect against data breaches and privacy concerns.

Customized Solutions: Auriga Accounting can tailor their services to your specific needs, whether you are a small or large LLP, ensuring that you receive the level of support required for your unique situation.

Comprehensive Support: Auriga Accounting can provide end-to-end support throughout the entire filing process, from data collection and form preparation to submission and compliance management.