WHAT ARE THE DOCUMENTS REQUIRED TO BE FILLED BY LLP ANNUALY?

Introduction

ToggleWHAT ARE THE DOCUMENTS REQUIRED TO BE FILLED BY LLP ANNUALY?

Limited Liability Partnerships (LLPs) in India are required to file several documents annually to ensure compliance with regulatory obligations and maintain transparency in their operations. These documents play a crucial role in providing insights into the financial health, structure, and activities of the LLP. The primary documents that LLPs need to file annually include Form 8 and Form 11. Form 8, also known as the Statement of Account and Solvency, provides details about the LLP’s financial position, assets, liabilities, solvency, and particulars of the annual return. Form 11, the Annual Return of LLP, contains information about the LLP’s partners, designated partners, changes in partner details, registered office address, and other basic information. Additionally, LLPs must also fulfill tax-related obligations by filing income tax returns with the Income Tax Department and GST returns if registered under the Goods and Services Tax (GST) regime. Compliance with these annual filing requirements is essential for LLPs to maintain good standing with regulatory authorities and ensure transparency and accountability in their business operations. Visitofficialwebsite

WHY IS IMPORTANT TO FILLED LLP DOCUMENTS ANNUALY

Legal Requirement: In many jurisdictions, annual filings are a legal requirement for Limited Liability Partnerships (LLPs). Failure to comply with these requirements can result in penalties, fines, or even the dissolution of the LLP, jeopardizing its legal status.

Maintaining Legal Standing: Regularly filing annual documents helps the LLP maintain its legal standing and good standing with regulatory authorities. This is essential to continue conducting business and enjoy the benefits of limited liability.

Transparency: Annual filings provide transparency regarding the financial health, ownership structure, and compliance of the LLP with regulatory standards. This transparency is crucial for stakeholders, including investors, creditors, and partners, as it allows them to make informed decisions.

Accountability: By filing annual documents, the LLP demonstrates its commitment to accountability and good governance. It signifies adherence to legal and regulatory standards, which can instill trust among partners, investors, and other stakeholders.

Access to Finance: Financial institutions and lenders often require up-to-date financial statements and compliance records before extending credit or loans to an LLP. Filing annual documents ensures that the LLP can access the necessary financial resources.

Tax Compliance: Annual filings, including income tax returns, are crucial for ensuring the LLP’s compliance with tax regulations. Properly filed returns help calculate and pay taxes accurately, avoiding legal issues with tax authorities.

Record-Keeping: Filing annual documents creates a comprehensive record of the LLP’s financial performance and activities over time. These records can be valuable for internal management, strategic planning, and audits.

Protection of Partners’ Interests: Filing annual documents helps protect the interests of partners by ensuring that the LLP fulfills its legal obligations. Failure to comply could result in partners becoming personally liable for the LLP’s debts and obligations.

Avoidance of Penalties: Timely annual filings help avoid late filing penalties, which can be significant in some jurisdictions. These penalties can place additional financial burden on the LLP.

Credibility and Reputation: Consistent compliance with annual filing requirements enhances the LLP’s credibility and reputation in the business community. It demonstrates professionalism and a commitment to legal and financial transparency.

What is the annual compliance of LLP

The annual compliance requirements for Limited Liability Partnerships (LLPs) in India include the following key obligations:

Filing of Form 8 (Statement of Account & Solvency):

- LLPs must file Form 8 with the Registrar of Companies (RoC) within 30 days from the end of six months of the financial year.

- This form provides details about the LLP’s financial position, including its assets, liabilities, and solvency.

Filing of Form 11 (Annual Return of LLP):

- LLPs must file Form 11 with the RoC within 60 days from the end of the financial year.

- Form 11 contains information about the LLP’s partners, designated partners, changes in partner details, registered office address, and other basic information.

Income Tax Return Filing:

- LLPs are required to file income tax returns annually with the Income Tax Department.

- The due date for filing income tax returns varies based on the LLP’s turnover and other factors.

GST Return Filing (if applicable):

- LLPs registered under the Goods and Services Tax (GST) regime must file GST returns regularly as per the prescribed timelines.

Compliance with Other Regulatory Requirements:

- LLPs must comply with other regulatory requirements applicable to their specific industry or business activities, such as industry-specific regulations, labor laws, environmental regulations, etc.

It’s crucial for LLPs to ensure timely compliance with these annual obligations to maintain good standing with regulatory authorities, avoid penalties, and ensure transparency and accountability in their operations. Non-compliance with annual compliance requirements can lead to penalties, fines, and other legal consequences for the LLP and its designated partners. Therefore, proper attention should be given to fulfilling these obligations within the prescribed timelines.

BENEFITS OF FILLED LLP DOCUMENTS ANNUALY

Limited Liability Protection: LLPs provide partners with limited liability protection, meaning that their personal assets are generally shielded from the LLP’s debts and obligations. Filing annual documents helps maintain this protection, preserving the unique advantage of limited liability for partners.

Flexible Management: LLPs allow partners to manage the business flexibly, with fewer regulatory burdens compared to corporations. Filing annual documents is a relatively straightforward process, allowing partners to focus on business operations.

Pass-Through Taxation: LLPs often enjoy pass-through taxation, where profits and losses pass through to partners’ personal tax returns. Properly filed annual tax returns enable partners to benefit from this tax advantage.

Partner Autonomy: LLPs provide partners with a significant degree of autonomy in decision-making and management. Filing annual documents ensures that partners can maintain control over the business without excessive regulatory interference.

Simplicity in Formation: Forming an LLP is typically simpler and less costly than incorporating a traditional company. Annual filing requirements are also less onerous compared to some other business structures, contributing to cost-effectiveness.

Suitable for Professional Services: LLPs are often favored by professionals such as lawyers, accountants, architects, and consultants due to their ability to provide limited liability protection while maintaining professional autonomy.

Flexible Profit Distribution: LLPs offer flexibility in profit distribution among partners, allowing for different profit-sharing ratios based on individual contributions and agreements. Annual filings help ensure that these distributions are accurately reported.

Partner Diversity: LLPs can have a diverse group of partners, including individuals, corporations, and other legal entities. Filing annual documents accommodates this diversity, allowing for various partner types and structures.

Scalability: LLPs are suitable for both small and large businesses, offering scalability in terms of the number of partners and business operations. Filing annual documents supports the LLP’s growth while preserving its unique characteristics.

Partner Privacy: LLPs may provide a level of partner privacy, as some jurisdictions do not require the public disclosure of partner details to the same extent as with corporations. Annual filings maintain this privacy advantage.

Is it mandatory to file annual return for LLP

Certainly, here are the key points regarding the mandatory filing of annual returns for Limited Liability Partnerships (LLPs):

Legal Obligation: LLPs are legally required to file annual returns as per the provisions of the Limited Liability Partnership Act, 2008, and the LLP Rules, 2009.

Form 11 Filing: The annual return for LLPs is filed using Form 11, which includes details about the LLP’s partners, designated partners, changes in partner details, registered office address, and other basic information.

Timeline: LLPs must file their annual return with the Registrar of Companies (RoC) within 60 days from the end of the financial year. Failure to do so can lead to penalties and legal consequences.

Transparency and Compliance: Filing annual returns ensures transparency and accountability in LLP operations, as it provides regulatory authorities with updated information about the LLP’s structure and activities.

Maintaining Good Standing: Compliance with annual return filing requirements is crucial for LLPs to maintain good standing with regulatory authorities and avoid penalties or legal issues.

In summary, filing annual returns is a mandatory requirement for LLPs in India, and adherence to the prescribed timelines and procedures is essential to ensure regulatory compliance and maintain the LLP’s legal standing.

What forms do LLP need to file every year

Limited Liability Partnerships (LLPs) in India are required to file the following forms every year to comply with regulatory requirements:

Form 8 (Statement of Account & Solvency): LLPs must file Form 8 within 30 days from the end of six months of the financial year. This form provides details about the LLP’s financial position, including its assets, liabilities, and solvency.

Form 11 (Annual Return of LLP): LLPs must file Form 11 within 60 days from the end of the financial year. This form contains information about the LLP’s partners, designated partners, changes in partner details, registered office address, and other basic information.

These forms are essential for maintaining transparency, accountability, and regulatory compliance in LLP operations. Failure to file these forms within the prescribed timelines may result in penalties and legal consequences for the LLP and its designated partners. Therefore, it’s crucial for LLPs to ensure timely filing of these annual forms to maintain good standing with regulatory authorities.

What is the fees for LLP annual return

| S.No | Contribution Amount | Fee Applicable |

|---|---|---|

| 1 | Up to Rs 1,00,000 | 50 |

| 2 | More than Rs 1,00,000 up to Rs 5,00,000 | 100 |

| 3 | More than Rs 5,00,000 up to Rs 10,00,000 | 150 |

| 4 | More than Rs 10,00,000 up to Rs 25,00,000 | 200 |

| 5 | More than Rs 25,00,000 up to Rs 1,00,00,000 | 400 |

| 6 | More than Rs 1,00,00,000 | 600 |

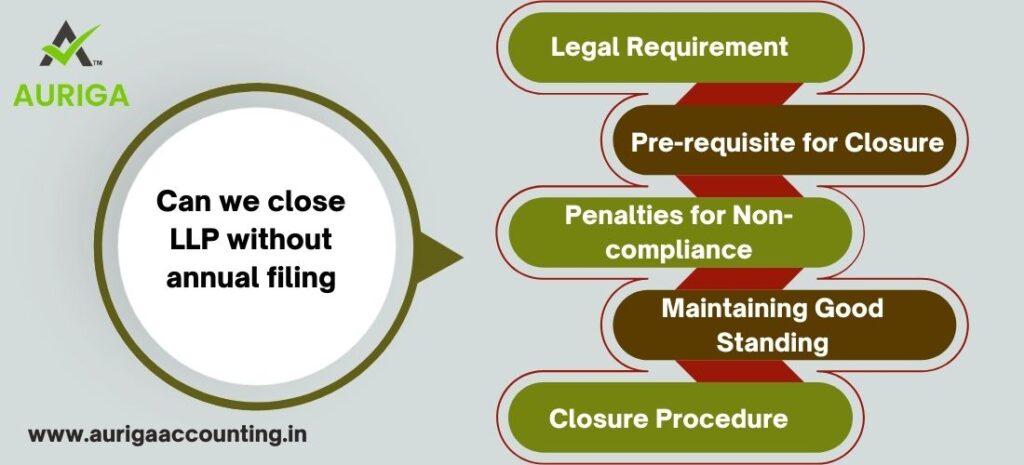

Can we close LLP without annual filing

No, LLPs cannot be closed without completing the mandatory annual filing requirements. Annual filings, including the filing of annual returns and financial statements, are crucial compliance obligations for LLPs in India. Before initiating the closure process, LLPs must ensure that all annual filings are up to date and in compliance with regulatory requirements.

Here are some key points to consider:

Legal Requirement: LLPs are required by law to file annual returns and financial statements with the Registrar of Companies (RoC) every year. These filings provide important information about the LLP’s financial position, structure, and activities.

Pre-requisite for Closure: Fulfilling annual filing requirements is typically a pre-requisite for initiating the closure or winding-up process of an LLP. Regulatory authorities may require evidence of compliance with annual filing obligations before approving the closure application.

Penalties for Non-compliance: Failure to file annual returns and financial statements within the prescribed timelines can result in penalties, fines, and legal consequences for the LLP and its designated partners.

Maintaining Good Standing: Compliance with annual filing requirements is essential for maintaining the LLP’s good standing with regulatory authorities and avoiding penalties or legal issues.

Closure Procedure: Once all annual filings are completed, LLPs can proceed with the closure process as per the provisions of the Limited Liability Partnership Act, 2008, and the LLP Rules, 2009. This may involve steps such as passing a resolution for winding up, appointing a liquidator, settling liabilities, and filing closure documents with the RoC.

In summary, annual filings are a mandatory requirement for LLPs, and compliance with these obligations is necessary before closing the LLP. Failure to fulfill annual filing requirements can hinder the closure process and may lead to penalties or legal complications.

CONCLUSION OF FILLED LLP DOCUMENTS ANNUALY

Filing annual documents for a Limited Liability Partnership (LLP) is not merely a legal obligation but a strategic practice with numerous advantages. These annual filings help maintain the LLP’s legal standing, demonstrate transparency and accountability, protect partners’ interests, and facilitate access to financing. They also ensure compliance with tax regulations and provide valuable records for internal management and growth planning.

HOW AURIGA ACCOUNTING HELP YOU TO FILLED LLP DOCUMENTS ANNUALY

Expert Guidance: Auriga Accounting has a team of experts knowledgeable about LLP regulations and compliance requirements. They can provide expert guidance on the specific annual filing requirements in your jurisdiction.

Document Preparation: Auriga Accounting can assist in preparing and compiling the necessary annual documents, ensuring that they are complete, accurate, and in compliance with regulatory standards.

Document Review: Auriga Accounting can conduct a thorough review of the annual documents to verify their accuracy and completeness, reducing the risk of errors or omissions that could lead to compliance issues.

Compliance Management: Auriga Accounting can help you stay up-to-date with changing regulatory requirements, ensuring that your annual filings align with the latest rules and regulations.

Timely Submission: Timely submission of annual documents is crucial to avoid penalties and maintain good standing with regulatory authorities. Auriga Accounting can help ensure that your filings are submitted within the specified deadlines.

Financial Statements: If required, Auriga Accounting can assist in preparing accurate financial statements, including balance sheets, income statements, and cash flow statements, which are essential for annual filings.

Tax Compliance: Auriga Accounting can help ensure that your LLP is in compliance with tax regulations by assisting in the preparation and submission of annual income tax returns (if applicable).

Record Keeping: Auriga Accounting can provide guidance on best practices for maintaining records related to the annual filing process, ensuring that you have organized documentation for future reference and compliance audits.

Communication with Authorities: Auriga Accounting can liaise with regulatory authorities on your behalf, addressing any queries or requests for additional information that may arise during the annual filing process.

Customized Solutions: Auriga Accounting can tailor their services to your specific needs, whether you are a small or large LLP, ensuring that you receive the level of support required for your unique situation.