HOW CAN I OPEN A PVT LTD COMPANY IN DELHI?

Introduction

ToggleYOU NEED TO KNOW HOW CAN I OPEN A PVT LTD COMPANY IN DELHI?

How Can I open a Private Limited Company in Delhi, follow these steps: 1. Choose a unique company name and check its availability. 2. Obtain a Digital Signature Certificate (DSC) and Director Identification Number (DIN) for the proposed directors. 3. Prepare the Memorandum and Articles of Association. 4. File an application for company registration with the Ministry of Corporate Affairs. 5. Pay the applicable registration fees. 6. Obtain the Certificate of Incorporation. 7. Get a PAN and TAN for the company. 8. Open a company bank account. 9. Comply with tax and regulatory requirements. Seek professional advice for specific details and legal compliance. Visitofficialwebsite

How much does it cost to open a Pvt Ltd company in India

How much does it cost to form a private limited company? The cost of establishing/registering a Pvt Ltd Company generally varies from INR 6,000 to INR 30,000, depending upon the number of Directors, members, the authorized share capital, and professional fees.

Idea and Planning

Idea Generation:

- Identify a viable business idea that aligns with your interests and market demand.

- Conduct market research to understand your target audience, competition, and potential for growth.

2. Business Plan:

- Develop a comprehensive business plan outlining your company’s objectives, strategies, financial projections, and operational details.

- Include market analysis, product or service description, marketing plan, and financial forecasts.

3. Legal Structure Decision:

- Choose a Private Limited Company (Pvt Ltd) structure for limited liability and a separate legal entity.

- Understand the legal and compliance requirements associated with a Pvt Ltd company in Delhi.

4. Name Reservation:

- Select a unique and meaningful company name adhering to the Ministry of Corporate Affairs (MCA) guidelines.

- Check the availability of the chosen name and reserve it through the MCA portal.

5. Director Identification Number (DIN) and Digital Signature Certificate (DSC):

- Obtain DIN for proposed directors by filing an online application with the MCA.

- Acquire a DSC for directors to facilitate secure online transactions during the registration process.

Pre-Incorporation Requirements

Memorandum and Articles of Association (MOA and AOA):

- Draft MOA defining the company’s main objectives and AOA specifying its internal regulations.

- Ensure compliance with the Companies Act and MCA guidelines.

2. Stamping and Notarization:

- Stamp the MOA and AOA as per the Stamp Act regulations.

- Notarize the documents to authenticate their legal validity.

3. Application for Company Registration:

- Submit the incorporation application on the MCA portal with required documents.

- Pay the prescribed fees based on the authorized capital.

4. Certificate of Incorporation:

- Upon approval, receive the Certificate of Incorporation from the Registrar of Companies (RoC).

- This document signifies the company’s existence as a legal entity.

5. PAN and TAN Application:

- Apply for a Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) for the company.

- These are essential for taxation purposes.

Post-Incorporation Compliance

Opening a Bank Account:

- Choose a bank and open a company bank account using the Certificate of Incorporation and PAN.

- Fulfill any additional requirements as per the bank’s policies.

2. Statutory Registers:

- Maintain statutory registers, including the register of members, directors, and charges.

- Keep these registers updated and accessible at the registered office.

3. Compliance under Shops and Establishment Act:

- Register under the Delhi Shops and Establishment Act to comply with labor laws.

- Obtain a shop and establishment certificate for the business premises.

4. Goods and Services Tax (GST) Registration:

- If applicable, register for GST with the Goods and Services Tax Network (GSTN).

- Adhere to GST compliance, filing returns, and timely payment of taxes.

5. Professional Tax Registration:

- Register for professional tax with the Delhi government, if applicable.

- Comply with professional tax regulations and filing requirements.

Ongoing Compliance and Operations

Annual Compliance:

- File annual returns and financial statements with the RoC as per the Companies Act.

- Conduct an annual general meeting and maintain compliance with statutory requirements.

2. Board Meetings and Resolutions:

- Conduct regular board meetings and document resolutions for key decisions.

- Keep minutes of meetings and maintain proper corporate governance.

3. Audit and Financial Statements:

- Appoint auditors and conduct regular audits of financial statements.

- File audited financial statements with the RoC within the stipulated time frame.

4. Changes in Company Structure:

- Notify the RoC about any changes in the company structure, such as directorship or shareholding.

- Comply with disclosure requirements for transparency.

5. Employee Compliance:

- Adhere to labor laws, employee provident fund (EPF), and employee state insurance (ESI) regulations.

- Ensure timely payment of salaries, deductions, and compliance with employment-related laws.

Growth and Expansion

Marketing and Branding:

- Implement effective marketing strategies to promote your products or services.

- Build a strong brand presence in the market through advertising and branding initiatives.

2. Digital Presence:

- Establish a website and utilize digital marketing tools to enhance online visibility.

- Leverage social media platforms for customer engagement and marketing.

3. Networking and Partnerships:

- Attend industry events, conferences, and networking opportunities to build connections.

- Explore strategic partnerships and collaborations for business growth.

4. Diversification and Innovation:

- Explore opportunities for product or service diversification.

- Foster a culture of innovation within the organization to stay competitive.

5. Financial Management:

- Implement effective financial management practices to ensure sustainable growth.

- Monitor cash flow, manage debt, and make informed financial decisions.

Can I register Pvt Ltd by myself

A minimum of two directors and 200 members are required for Private Limited Company Registration in India, as per the Companies Act of 2013. Directors must have a Director Identification Number (DIN) issued by the Ministry of Corporate Affairs (MCA).

Who is eligible for Pvt Ltd

At Least 2 Shareholders

A Private Limited Company must have at least 2 Shareholders, and extend their maximum number to 200. These shareholders can either be individuals or corporate entities, Indian or foreign in origin. There is no requirement of nationality or residence restricted for them.

How much money is needed for a Pvt Ltd company

To start a private limited company, you need to maintain a minimum paid-up capital of Rs. 1 lakh. However, the Companies Amendment Act, 2015 relaxed the minimum requirement for paid-up capital. Therefore, there is now no requirement for any minimum capital to be invested to start a private limited company.

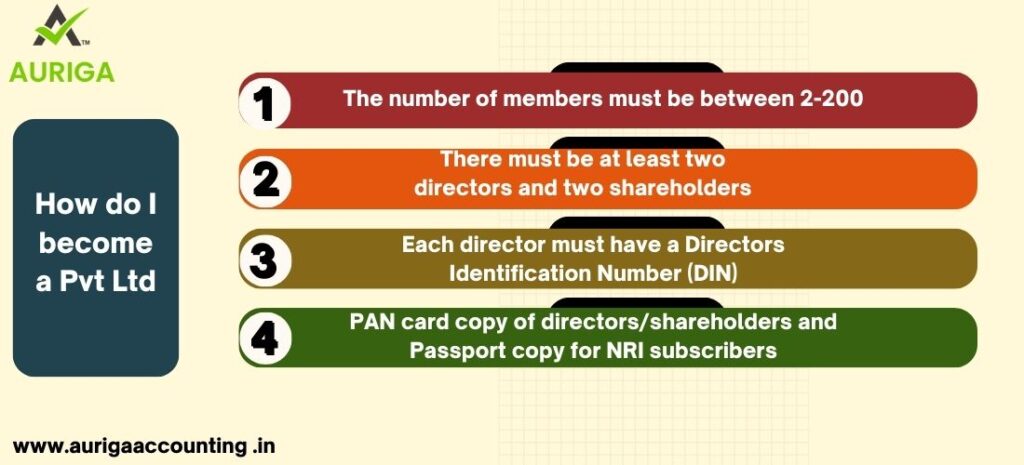

How do I become a Pvt Ltd

- The number of members must be between 2-200.

- There must be at least two directors and two shareholders.

- Each director must have a Directors Identification Number (DIN)

- PAN card copy of directors/shareholders and Passport copy for NRI subscribers.

How do you register a private limited company in Delhi

For registration a Private Limited Company is not a big task in India now. The Ministry of Corporate Affairs has eased the whole process of registration. Now you are eligible to get various certificates or documents along with company free of cost.

For registration Private Limited in Delhi you just need to provide following simple documents-

1. Adhaar Card and PAN card Copy of both directors

2. Email address, phone number, photograph of directors

3. Latest saving account bank statement of directors

4. Electricity Bill of Office along with NOC or Rent Agreement which ever is available

5. Some other information as required.

After registration you will be eligible to get following documents and certificates-

- Certificate of Incorporation

- MOA and AOA of Company

- MCA Registration

- DIN and DSC of 2 directors

- PAN and TAN of company

- PF and ESIC Registration, if government allowed

- Name approval of company

- Bank Account Opening

- GST and MSME Registration

Conclusion:

Establishing a Private Limited Company in Delhi involves a structured process, from ideation to ongoing compliance and expansion. Each step is crucial for legal and operational success, requiring careful attention to detail and adherence to regulatory requirements. Seeking professional guidance and staying informed about legal updates are essential for the smooth functioning and growth of the business.

How auriga accounting help you to open a PVT LTD. company in delhi

However, I can provide you with general information on the steps involved in opening a Private Limited (Pvt Ltd) company in Delhi, or anywhere in India. Keep in mind that the process may involve various legal and procedural steps, and it’s advisable to consult with professionals or services like Auriga Accounting for the most accurate and up-to-date information. Here is a general outline:

Obtain Digital Signature Certificate (DSC):

- Directors of the company need to obtain a Digital Signature Certificate.

Director Identification Number (DIN):

- Directors must apply for DIN, which is a unique identification number.

Name Approval:

- Propose and get approval for the company name from the Ministry of Corporate Affairs (MCA).

Memorandum and Articles of Association:

- Draft and file the Memorandum of Association (MOA) and Articles of Association (AOA) with the Registrar of Companies (RoC).

Incorporation Application:

- File the application for incorporation of the company with the necessary documents.

Certificate of Incorporation:

- Once the Registrar is satisfied, they will issue a Certificate of Incorporation.

PAN and TAN Application:

- Apply for Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) for the company.

Bank Account:

- Open a bank account in the name of the company and deposit the required capital.

Compliance with Statutory Requirements:

- Ensure compliance with various statutory requirements like Goods and Services Tax (GST), Employee Provident Fund (EPF), etc.

Business Registration:

- Register for any specific licenses or permits required for the nature of your business.

Auriga Accounting or Similar Service:

- Engage with professional accounting and compliance services like Auriga Accounting to ensure ongoing statutory compliance, bookkeeping, and financial management.

It’s crucial to note that company registration processes and regulations may change, and it’s advisable to consult with a legal or accounting professional for the most accurate and current information. If Auriga Accounting is a reputable service, they may provide assistance at various stages of the company formation process, including compliance, accounting, and other related services. Always verify the credibility of any service provider before engaging their services.