YOU NEED TO UNDERSTANDING NIDHI COMPANY FEATURES REGISTRATION PROCESS?

Introduction

ToggleUNDERSTANDING NIDHI COMPANY FEATURES REGISTRATION PROCESS?

introduction of nidhi company

Nidhi Companies, often referred to as “Mutual Benefit Societies,” play a unique role in the Indian financial landscape. These companies are categorized as Non-Banking Financial Companies (NBFCs) and are primarily formed to promote thrift and savings habits among their members while providing them with financial assistance in the form of loans. Nidhi Companies cater primarily to small and medium-income individuals, offering them a reliable source of credit and encouraging disciplined saving.

This guide provides a comprehensive understanding of Nidhi Companies, their key features, and the registration process involved in setting up a Nidhi Company in India.Visitofficialwebsite

Key Features of Nidhi Companies

Nidhi Companies possess several distinct features that set them apart from other financial entities. Understanding these features is essential for those considering establishing or becoming members of Nidhi Companies:

Nidhi Nature: Nidhi Companies are incorporated under the Companies Act, 2013, and function as mutual benefit societies. Their primary objective is to foster the habit of saving and thrift among their members.

Membership: Nidhi Companies are member-centric organizations, meaning they can only accept deposits and provide loans to their registered members. Non-members cannot avail of their services.

Deposit Acceptance: Nidhi Companies primarily collect deposits from their members, which form the source of funds for their lending activities. These deposits can be in the form of recurring deposits, fixed deposits, or monthly savings schemes.

Loan Disbursement: Members of Nidhi Companies can avail loans against the security of gold, jewelry, or immovable property. These loans are provided primarily for personal, business, or educational needs.

Non-Banking Financial Institution: While Nidhi Companies fall under the category of NBFCs, they are subject to specific regulations and requirements. However, they are not required to obtain a license from the Reserve Bank of India (RBI) unless they fall under the criteria of “Core Investment Companies.”

Limited Operations: Nidhi Companies cannot engage in extensive business activities, making them distinct from regular NBFCs. Their primary functions are accepting deposits and providing loans to members.

Minimum Capital Requirement: Nidhi Companies must have a minimum paid-up equity share capital of Rs. 5 lakhs, ensuring their financial stability.

Board of Directors: Nidhi Companies must have a board of directors with a minimum of three members. At least two-thirds of the directors must be individuals. Directors are required to have a Director Identification Number (DIN).

CEO Appointment: A Nidhi Company is mandated to appoint a Chief Executive Officer (CEO) from among its directors, responsible for day-to-day operations and management.

Auditor’s Appointment: Nidhi Companies should appoint an auditor who will audit their financial statements and report on their financial health.

Board Meetings: The Companies Act mandates that Nidhi Companies conduct a minimum of four board meetings in a year, with an interval of no more than 120 days between consecutive meetings.

Reserve Fund: Nidhi Companies are required to transfer at least 20% of their net profits into a reserve fund until it reaches 10% of their outstanding deposits. This reserve fund acts as a safety net for the company and its members.

Loan Regulations: Nidhi Companies are prohibited from offering fixed deposit schemes and can only provide loans to their members. The interest rate charged on loans should not exceed 7.5% above the highest rate offered on deposits.

Asset Quality Management: Nidhi Companies are required to classify their assets into standard assets, sub-standard assets, doubtful assets, and loss assets in line with Reserve Bank of India (RBI) guidelines.

Compliance with Nidhi Rules: Nidhi Companies are required to adhere to various regulations specified in the Nidhi Rules, 2014, which cover aspects such as membership, deposits, lending, and more.

Registration Process for Nidhi Companies

The process of registering a Nidhi Company involves several steps and compliance requirements. Here is a detailed guide to the registration process:

Digital Signature Certificates (DSCs): The first step in the registration process is to obtain Digital Signature Certificates (DSCs) for all proposed directors and the CEO. DSCs are essential for filing online applications with the Registrar of Companies (RoC).

Director Identification Number (DIN): Each director of the company must have a Director Identification Number. Apply for DIN by filing Form DIR-3 through the Ministry of Corporate Affairs (MCA) portal.

Memorandum of Association (MoA) and Articles of Association (AoA): Draft the MoA and AoA for your Nidhi Company. These documents outline the company’s objectives, rules, and regulations and must be in compliance with the Nidhi Rules, 2014, and the Companies Act, 2013.

Proof of Registered Office Address: Provide proof of the registered office address, such as a rent agreement, lease deed, or a utility bill. The registered office should be located within the jurisdiction of the respective Registrar of Companies (RoC).

Board Resolution: Submit a certified copy of the board resolution declaring the intent to establish a Nidhi Company and authorizing directors to file the incorporation documents.

Declaration by Directors: Provide a declaration from all directors confirming their intent to comply with the Nidhi Rules and Regulations, along with other legal requirements.

Permanent Account Number (PAN) and Aadhar Card of Directors: Include copies of PAN and Aadhar cards of all directors.

Passport-sized Photographs: Submit recent passport-sized photographs of all directors and the CEO.

Registered Office Verification: Be prepared for the verification of the registered office address, which may involve an inspection by the RoC.

Subscription Money Proof: Provide proof of the initial capital contribution by the promoters in the company’s bank account. The minimum paid-up share capital should be Rs. 5 lakhs, as mentioned in the MoA.

Auditor’s Consent: Obtain a consent letter from the auditor who will be responsible for auditing the company’s accounts.

Professional Certification: Include a certificate from a practicing company secretary, chartered accountant, or cost accountant confirming that all Nidhi Rules have been duly complied with.

NO OBJECTION Certificate (NOC): Obtain an NOC from the owner of the premises where the registered office is situated.

Certificate of Incorporation: If any of the directors have served as directors in other companies before, you may need to provide a Certificate of Incorporation of those companies.

Declaration of Not Accepting Deposits: Submit a declaration stating that the company will not accept deposits other than from its members.

nidhi company registration process

Nidhi Company registration refers to the process of incorporating and establishing a Nidhi Company, a non-banking financial institution (NBFC) in India. Nidhi Companies are formed to promote the habit of thrift, savings, and financial cooperation among their members.

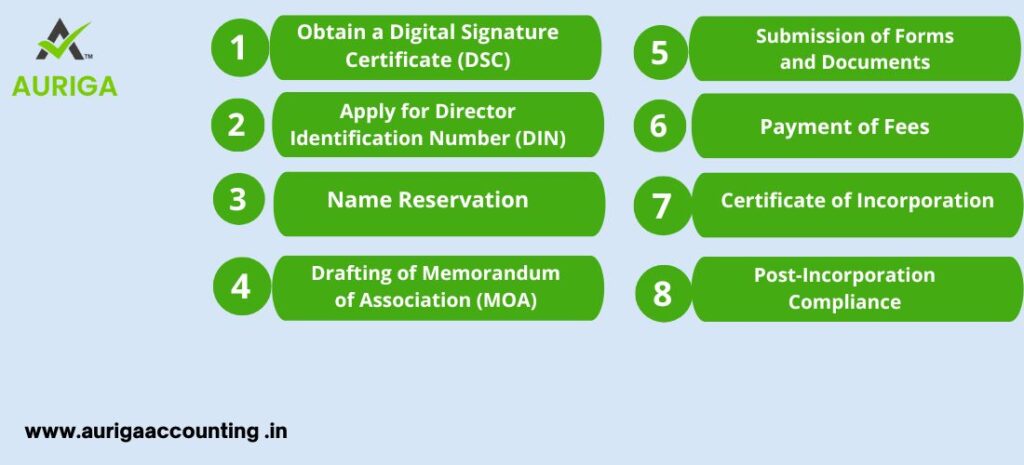

The process of Nidhi Company registration involves the following steps:

- Obtain a Digital Signature Certificate (DSC): The first step is to obtain a DSC for the proposed directors of the company. The DSC is required for the online filing of registration documents.

2. Apply for Director Identification Number (DIN): Each director of the Nidhi Company must apply for a DIN from the Ministry of Corporate Affairs (MCA) by submitting the required documents and forms.

3. Name Reservation: Once the DIN is obtained, the next step is to apply for name reservation through the RUN (Reserve Unique Name) facility on the MCA portal. The proposed name should comply with the naming guidelines and not be similar to any existing company or trademark.

4. Drafting of Memorandum of Association (MOA) and Articles of Association (AOA): The MOA and AOA are the constitutional documents of the Nidhi Company. These documents define the objectives, rules, and regulations, as well as the members’ and directors’ rights and responsibilities. The MOA and AOA need to be prepared per the Companies Act 2013.

5. Submission of Forms and Documents: Once the name is approved, the necessary forms and documents, including the MOA, AOA, and other required declarations, need to be filed with the Registrar of Companies (RoC). These documents should be submitted within 60 days from the date of name approval.

6. Payment of Fees: The prescribed registration fees, based on the company’s authorized share capital, should be paid to the RoC. The fee structure can be obtained from the MCA website.

7. Certificate of Incorporation: After verifying the submitted documents, if everything is in order, the RoC will issue a Certificate of Incorporation, officially recognizing the Nidhi Company as a registered entity.

8. Post-Incorporation Compliance: Once the Nidhi Company is registered, certain post-incorporation compliance requirements need to be fulfilled, such as obtaining a Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN), opening a bank account, and complying with other applicable laws and regulations.

It is important to note that the registration process may involve additional steps and requirements depending on the specific circumstances and regulations at the time of registration. Seeking professional advice or consulting a company secretary can help ensure a smooth and compliant registration process for a Nidhi Company.

What is the scope for nidhi companies in Midia

In order to make regulatory regime for Nidhi Companies more effective and also to accomplish the objectives of transparency & investor friendliness in the corporate environment of the country, the Central Government has recently amended the provisions related to NIDHI under the Companies Act and the Rules

Impact

The amended provisions of the Companies Act (Section 406) and Nidhi rules (as amended w.e.f. 15.08.2019) require that the Nidhi companies have to apply to the Central government for updation of their status/ declaration as Nidhi Company in Form NDH-4.

What are NIDHI Companies?

- Under Nidhi Rules, 2014, Nidhi is a company which has been incorporated as a Nidhi with the object of cultivating the habit of thrift and saving amongst its members, receiving deposits from, and lending to, its members only, for their mutual benefit.

- The companies doing Nidhi business, viz. borrowing from members and lending to members only, are known under different names such as Nidhi, Permanent Fund, Benefit Funds, Mutual Benefit Funds and Mutual Benefit Company.

- Nidhis are more popular in South India and are highly localized single office institutions. They are mutual benefit societies because their dealings are restricted only to the members; and membership is limited to individuals. The principal source of funds is the contribution from the members. The loans are given to the members at relatively reasonable rates for purposes such as house construction or repairs and are generally secured.

- Nidhis are also included in the definition of Non- Banking Financial companies or (NBFCs) which operate mainly in the unorganized money market. However, since 1997, NBFCs have been brought increasingly under the regulatory ambit of the Indian Central Bank, RBI.

RBI and NIDHI

- Since Nidhis come under one class of NBFCs, RBI is empowered to issue directions to them in matters relating to their deposit acceptance activities.

- However, in recognition of the fact that these Nidhis deal with their shareholder-members only, RBI has exempted the notified Nidhis from the core provisions of the RBI Act and other directions applicable to NBFCs.

Benefits of registration nidhi company

Registering a Nidhi Company in India offers several benefits, both to the company and its members. These benefits contribute to the growth and financial stability of the company while promoting thrift, savings, and access to credit for its members. Here are some of the key advantages of registering a Nidhi Company:

Encouraging Savings: Nidhi Companies are primarily formed to promote thrift and savings habits among their members. By offering various savings and deposit schemes, they encourage individuals to set aside a portion of their income, which can be instrumental in building financial security.

Access to Credit: Members of Nidhi Companies can avail of loans against the security of gold, jewelry, or immovable property. This access to credit is often critical for personal, business, or educational needs, especially for those who might not have access to traditional banking services.

Community Building: Nidhi Companies operate within specific communities or localities, fostering a sense of belonging and community building. Members often feel more comfortable dealing with a financial institution that understands their local needs and challenges.

Financial Inclusion: Nidhi Companies contribute to financial inclusion by providing financial services to individuals who are often excluded from the formal banking sector. This can help in reducing the reliance on informal and unregulated financial channels.

Member Ownership: Nidhi Companies are owned and operated by their members, ensuring that the benefits and profits generated by the company are distributed among the members. This ownership structure promotes financial democracy.

Flexible Loan Terms: Nidhi Companies can provide loans with flexible terms, accommodating the specific financial needs and capacities of their members. This flexibility in lending terms can be especially useful for small and medium-income individuals.

Interest Rate Regulation: Nidhi Companies are subject to regulatory restrictions on interest rates. The interest rate charged on loans is capped at 7.5% above the highest rate offered on deposits. This regulation ensures that the interest rates are fair and transparent.

Transparent Lending Practices: Nidhi Companies are required to maintain transparent lending practices, clearly communicating the terms and conditions of loans to borrowers. This transparency fosters trust and ethical financial practices.

Asset Quality Management: Nidhi Companies are required to classify their assets into standard assets, sub-standard assets, doubtful assets, and loss assets, following Reserve Bank of India (RBI) guidelines. This helps in proper risk assessment and management.

Compliance with Nidhi Rules: Nidhi Companies are required to adhere to various regulations specified in the Nidhi Rules, 2014. These rules encompass membership, deposit acceptance, lending, reporting, and other critical areas, ensuring that the company operates within the legal framework.

conclusion of nidhi company

Nidhi Companies serve a vital role in the Indian financial sector by promoting savings and providing financial assistance to their members. Understanding the key features of Nidhi Companies and the registration process is essential for those interested in establishing or becoming members of such companies.

Compliance with the Nidhi Rules, 2014, and the Companies Act, 2013, is crucial to ensure that Nidhi Companies operate within the legal framework, safeguarding the interests of their members and the public. The registration process involves several steps and the submission of specific documents, with a focus on compliance and transparency.

In conclusion, Nidhi Companies offer a unique financial service that encourages thrift and savings while providing access to credit for their members. Adhering to the defined features and registration requirements ensures that Nidhi Companies can continue to fulfill their role in the Indian financial landscape effectively.

how auriga accounting help you to define features and process of nidhi company

Auriga Accounting can be a valuable partner in helping you understand and define the features and registration process of a Nidhi Company. Here’s how they can assist you:

Defining Features of Nidhi Companies:

Expert Guidance: Auriga Accounting has a team of professionals with expertise in financial and regulatory matters. They can provide you with a thorough understanding of the unique features of Nidhi Companies, such as their primary objective, membership criteria, deposit and loan operations, and compliance requirements.

Customized Consultation: Auriga Accounting can offer tailored consultation to match your specific requirements and objectives. Whether you are looking to establish a Nidhi Company or become a member, they can provide guidance that suits your needs.

Legal Compliance: Nidhi Companies operate under specific regulatory guidelines. Auriga Accounting can ensure that you have a clear understanding of these regulations and how they impact the operations and membership of a Nidhi Company.

Documentation Assistance: Nidhi Companies require specific documentation, including Memorandum of Association (MoA) and Articles of Association (AoA), to define their objectives and rules. Auriga Accounting can assist in drafting and customizing these documents to ensure compliance.

Regulatory Updates: Auriga Accounting keeps track of the latest regulatory changes. They can inform you about any new rules or requirements that may affect Nidhi Companies, ensuring you stay up-to-date with the evolving regulatory environment.

Navigating the Registration Process:

Step-by-Step Guidance: The registration process for a Nidhi Company involves several steps and documents. Auriga Accounting can provide a step-by-step guide to help you navigate the process smoothly, ensuring that you don’t miss any essential requirements.

Application Preparation: They can assist you in preparing the necessary documents, such as the MoA, AoA, board resolutions, and director declarations, making sure they align with the legal framework and Nidhi Rules.

Regulatory Compliance: Auriga Accounting will ensure that you are well-informed about the compliance requirements, such as the minimum capital requirement, board meetings, reserve fund creation, and other specific rules that Nidhi Companies must adhere to.

Digital Signature Certificates (DSCs) and Director Identification Numbers (DINs): They can guide you in obtaining DSCs and applying for DINs for directors, crucial for online filing with the Ministry of Corporate Affairs (MCA).

Document Verification: Auriga Accounting can assist you in preparing for the verification of the registered office address, helping you compile the necessary proofs and documentation.