WHAT ARE THE TYPES OF COMPANY?

Introduction

ToggleYOU NEED TO KNOW WHAT ARE THE TYPES OF COMPANY?

There are various types of companies, including sole proprietorships, partnerships, limited liability companies (LLCs), corporations, and cooperatives. Sole proprietorships are owned by a single individual, while partnerships involve shared ownership. LLCs combine aspects of partnerships and corporations, providing limited liability to members. Corporations are separate legal entities with shareholders, offering limited liability and potential public trading. Cooperatives are owned and operated by their members, who share profits and decision-making. Additionally, companies can be classified based on industry, such as manufacturing, service, or technology, further diversifying the business landscape. Visitofficialwebsite

Sole Proprietorship: A Solo Entrepreneur's Venture

Definition: A sole proprietorship is a business owned and operated by a single individual. This straightforward structure places the owner in direct control of all aspects of the business.

Characteristics: The simplicity of sole proprietorships is their defining feature. The owner assumes full responsibility and liability, making quick decisions without the need for extensive consultations. This type is often found in small-scale enterprises like local shops and freelance services.

Partnership: Collaboration for Shared Success

Definition: Partnerships involve two or more individuals managing and operating a business together. The structure can be general or limited, depending on the level of involvement and liability for each partner.

Characteristics: Partnerships thrive on collaboration and shared responsibilities. Profits and losses are distributed among partners, fostering a sense of teamwork. This model is common in legal firms, medical practices, and small business ventures.

Limited Liability Company (LLC): Flexibility with Limited Risk

Definition: An LLC is a hybrid business structure that combines elements of both partnerships and corporations. It provides limited liability to its owners while avoiding the double taxation associated with corporations.

Characteristics: LLCs offer flexibility in management and operations, with members enjoying protection against personal liability. This structure is prevalent in various industries, catering to entrepreneurs seeking a balance between protection and operational autonomy.

Corporation: A Legal Entity with Corporate Governance

Definition: A corporation is a legal entity separate from its owners, known as shareholders. This structure, often characterized by a board of directors and officers, facilitates the raising of capital through the issuance of stocks.

Characteristics: Corporations provide limited liability to shareholders, enabling large-scale operations and capital investment. They are prevalent in diverse industries and often undergo complex organizational changes.

Nonprofit Organization: Beyond Profits for Social Impact

Definition: Nonprofit organizations are formed for purposes other than making a profit. They focus on social, charitable, or educational goals and are exempt from income taxes.

Characteristics: Nonprofits rely on donations and grants for funding their altruistic missions. Examples include charities, foundations, and educational institutions, contributing significantly to societal well-being.

Cooperative: Empowering Members Through Collective Ownership

Definition: A cooperative is a business owned and operated for the benefit of its members, who are also its customers. This model emphasizes democratic decision-making and profit-sharing.

Characteristics: Cooperatives are characterized by equal voting rights for members and a commitment to shared prosperity. Found in various sectors, including agriculture, retail, and housing, they embody the principles of cooperation and community support.

Franchise: Replicating Success through Partnership

Definition: Franchises involve a business relationship between a franchisor (owner) and a franchisee (operator), where the franchisee operates under the established brand and guidance of the franchisor.

Characteristics: Franchisees benefit from an established brand, operational support, and marketing strategies. Franchisors expand their reach without directly managing every location, creating a symbiotic relationship that has proven successful in sectors like fast food, retail, and hospitality.

Microenterprise: Small in Size, Big in Impact

Definition: A microenterprise is a small-scale business with minimal employees, often operated by a single entrepreneur. These enterprises are characterized by their focus on niche markets and limited initial capital.

Characteristics: Microenterprises play a crucial role in local economies, offering specialized products or services. Common in creative industries and artisanal crafts, they showcase the entrepreneurial spirit on a smaller scale.

Small and Medium-sized Enterprises (SMEs): The Backbone of Economies

Definition: Small and medium-sized enterprises (SMEs) encompass companies with limited employees and relatively moderate annual revenue. They contribute significantly to economic growth and job creation.

Characteristics: SMEs exhibit diversity in terms of industries and services, ranging from technology startups to family-owned businesses. While versatile and adaptive, they may face challenges related to scaling and resource constraints.

Large Corporation: Corporate Giants with Global Reach

Definition: Large corporations are entities with significant resources, extensive operations, and often, multinational reach. These entities play a pivotal role in shaping global economies.

Characteristics: These corporations typically have a complex organizational structure, diverse product lines, and a substantial economic impact. Their influence extends beyond national borders, making them key players in the global business arena.

What are various types of companies

- Companies Limited by Shares.

- Companies Limited by Guarantee.

- Unlimited Companies.

- One Person Companies (OPC)

- Private Companies.

- Public Companies.

- Holding and Subsidiary Companies.

- Associate Companies.

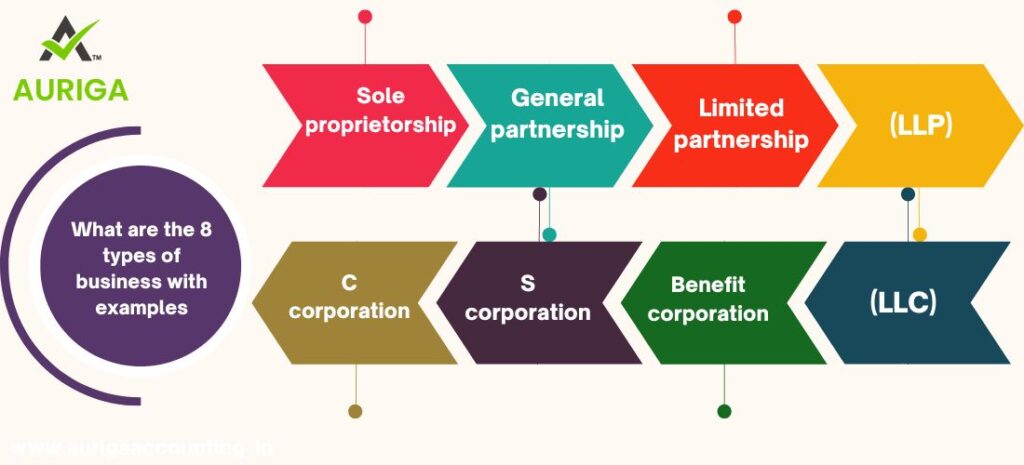

What are the 8 types of business with examples

- Sole proprietorship.

- General partnership.

- Limited partnership.

- Limited liability partnership (LLP)

- C corporation.

- S corporation.

- Benefit corporation.

- Limited liability company (LLC)

How do I start a group of companies

- Step 1: Identify your objectives. The first step in forming a business group is clearly defining your objectives. …

- Step 2: Identify potential members. …

- Step 3: Determine the structure. …

- Step 4: Establish a legal framework. …

- Step 5: Develop a marketing plan. …

- Step 6: Launch your business group.

What is a Pvt Ltd company in India

A private limited company is a privately held business entity held by private stakeholders. The liability arrangement, in this case, is that of a limited partnership, wherein the liability of a shareholder extends only up to the number of shares held by them.

How do I convert my proprietorship to a company

- The proprietor must complete the slump sale formalities.

- The Director Identification Number (DIN) and the Digital signature certificate (DSC) must be obtained for all the directors.

- The proprietor must apply for the availability of name in Form – 1.

Conclusion

In conclusion, the world of business is diverse, and companies come in various types, each with its own structure, purpose, and characteristics. The classification of companies can be based on legal structure, industry, size, ownership, purpose, global presence, and business model. Understanding these different types is crucial for entrepreneurs, investors, and anyone involved in the business world. Here are some key takeaways:

Legal Structure Matters: The legal structure of a company determines factors such as ownership, liability, and taxation. Whether it’s a sole proprietorship, partnership, LLC, corporation, or cooperative, the choice of legal structure has significant implications for how a business operates.

Industry Defines Specialization: Companies operate in various industries, each with its own set of challenges and opportunities. Whether in manufacturing, services, retail, technology, finance, healthcare, or other sectors, the industry context influences a company’s strategies, competition, and regulatory environment.

Size Reflects Scale: The size of a company, often measured by the number of employees, categorizes it as either a small or medium-sized enterprise (SME) or a large enterprise. Size can impact organizational structure, decision-making processes, and resource allocation.

Ownership Determines Control: Companies can be privately owned or publicly traded. Private companies are owned by individuals or a small group, allowing for more control over decision-making. Public companies, on the other hand, issue shares to the public and are subject to more extensive regulatory requirements.

Purpose Drives Mission: Companies operate for-profit or as nonprofits. For-profit companies aim to generate profits for shareholders, while nonprofits focus on fulfilling a mission, whether charitable, educational, or social. The purpose of a company shapes its values, goals, and impact on society.

Global Presence Reflects Expansion: Some companies operate within a single country (domestic), while others expand their operations across borders (multinational). Multinational companies adapt their strategies to diverse markets, considering cultural, legal, and economic differences.

Business Model Shapes Operations: Different business models, such as franchises, startups, and joint ventures, dictate how companies generate revenue and deliver value. Understanding the chosen business model is essential for crafting effective strategies and adapting to market dynamics.

In navigating the complex landscape of companies, entrepreneurs and investors must carefully consider their goals, resources, and the external environment. Flexibility and adaptability are key, as the business world is dynamic, with ongoing changes in technology, consumer preferences, and global events shaping the landscape. As businesses evolve, staying informed about industry trends, regulatory developments, and emerging business models is crucial for success in a rapidly changing marketplace.

how auriga accounting help you to define types of companies

Auriga Accounting” or any tools or systems associated with it. Therefore, I can’t provide details on how this specific accounting system might help in defining types of companies. It’s possible that there have been developments or new features introduced since then.

However, I can provide general insights into how accounting systems, in general, can assist in understanding and categorizing different types of companies:

Legal Structure Identification:

- Accounting systems often track the financial structure of a business. They can provide insights into whether a company is a sole proprietorship, partnership, LLC, or corporation based on how financial transactions are recorded.

Financial Reporting for Different Industries:

- Accounting systems can generate financial reports specific to industries. They help businesses analyze their financial performance in comparison to industry standards, which can be useful in identifying the type of industry a company belongs to.

Size and Revenue Tracking:

- Through financial data, accounting systems can help determine the size of a company based on factors like revenue, assets, and employee count. This information contributes to categorizing a company as small, medium-sized, or large.

Ownership Structure Analysis:

- Accounting systems maintain records of shareholders, partners, or members in the case of various legal structures. This data can help identify whether a company is privately owned or publicly traded.

Profit vs. Nonprofit Distinction:

- Nonprofit organizations have specific accounting requirements, such as tracking donations and grants. Accounting systems designed for nonprofits can help distinguish between for-profit and nonprofit entities.

Global Operations Tracking:

- For companies with global operations, accounting systems may include features to manage and consolidate financial data from multiple locations, helping to identify companies with a multinational presence.

Business Model Analysis:

- The way revenue is generated and expenses are incurred can provide insights into a company’s business model. Accounting systems can be configured to track different revenue streams, such as sales, subscriptions, or licensing fees.

While accounting systems play a crucial role in managing financial data, it’s important to note that they might not explicitly categorize companies into types. Instead, they provide the financial data and reports that can be analyzed to determine various characteristics of a company, which can then be used to categorize it into different types.

For specific information about how Auriga Accounting or any other accounting system facilitates the identification and classification of different types of companies, it’s recommended to refer to the user documentation, features, or consult with the support team of that particular system.