IF MY TAX LIABILITY IS LESS THAN LINE DO I HAVE TO FILE TAX RETURN? NO.1 GUIDE

Introduction

ToggleYOU NEED TO KNOW IF MY TAX LIABILITY IS LESS THAN LINE DO I HAVE TO FILE TAX RETURN?

Understanding Tax Liability:

What is Tax Liability?

Tax liability refers to the amount of taxes a taxpayer owes to the government. It is calculated based on the taxpayer’s total income, deductions, exemptions, and applicable tax rates. Tax liability represents the amount that needs to be paid to meet the legal obligation of paying taxes.Visitofficialwebsite

How is Tax Liability Calculated?

Tax liability is calculated by applying the relevant tax rates to the taxpayer’s taxable income, which is the income left after deducting eligible deductions, exemptions, and credits. The specific calculations vary depending on the tax laws of the country in which you reside.

Step-by-Step Guide to Filing Tax Returns:

Here’s a step-by-step guide to filing your tax return, regardless of your tax liability:

Step 1: Gather Documents: Collect all the necessary financial documents, including Form 16, bank statements, investment proofs, and other income-related records.

Step 2: Choose the Correct ITR Form: Select the appropriate Income Tax Return (ITR) form based on your income sources and financial situation. Even if your income is below the taxable threshold, you should use the correct form.

Step 3: Compute Your Income: Calculate your total income, including salary, interest, rental income, and any other sources. Ensure accurate reporting.

Step 4: Claim Deductions: Check if you are eligible for any deductions or exemptions under various sections of the Income Tax Act. Claim them to reduce your tax liability or increase your refund.

Step 5: File Your Tax Return: File your tax return online through the Income Tax Department’s official portal or manually by submitting a physical return. Online filing is recommended for efficiency and convenience.

Step 6: Verify Your Return: Ensure you verify your return using one of the acceptable methods: Aadhaar-based OTP, digital signature, or physical verification. Failing to verify your return can result in it being considered invalid.

Common Misconceptions:

There are several common misconceptions regarding filing tax returns, such as:

a. “I Don’t Owe Taxes, So I Don’t Need to File”: Filing a return is essential even if you don’t owe taxes. It serves as a record of your income and financial history.

b. “My Income is Below the Taxable Threshold”: You should file a return if your income exceeds the basic exemption limit, which varies based on your age and income sources.

c. “I Don’t Have Any Other Sources of Income”: Even if your primary source of income is salary, you should file a return to report it accurately.

d. “I Will File When I Have a Higher Income”: It’s advisable to file returns each year, regardless of your income. It helps maintain a consistent financial history.

e. “My Employer Deducts TDS, So I Don’t Need to File”: TDS (Tax Deducted at Source) is not the same as filing a return. You should file your return to reconcile your TDS and claim any refunds.

Should I file ITR even if I haven’t earned any income

An income tax return is mandatory to be filed if the person earns income beyond the basic exemption limit. Apart from this, there are certain conditions according to which the person becomes liable to file the income tax return.

However, filing an ITR is always advisable even if the person is not mandatorily required to file the ITR according to the income tax act. This is because the ITR return serves as a proof of income statement for various purposes. This is because the ITR return has the below-mentioned benefits:

- For loan approval :

Applying for any kind of loan, may it be a house loan, car loan, personal loan, education loan for your children, or any other loan application requires the applicant to produce past 2 to 3 years of filed ITR as income proof. The bank or a financial institution considers the income mentioned in the ITR for deciding the eligibility of the loan.

2. To carry forward your losses:

The taxpayer can carry forward losses only when he/ she filed the ITR within the due date. Carry forward of loss will help the taxpayer set off the loss amount with future year gains. For example, a stock market investor incurs a long term capital loss in FY 2020-21; this loss can be carried forward only when he files the ITR for this year within the due date which is extended to 30th September 2021.

3. To claim an Income Tax refund

If you are not liable to pay any tax, but TDS (tax deducted at source) has been deducted from your income, then the refund of TDS can be claimed only by filing the return of income. Hence it becomes mandatory to file ITR if you want to claim a refund. Also, if the return is filed within the due date, then the refund processing is faster than the belated returns.

4. For VISA application:

ITR is considered as a proof of income statement of an individual and makes the VISA approval easy.

5. As a proof of income statement:

In past years ITR works as proof of income for various purposes like credit card applications and loan applications in banks, account opening, and can be produced as proof of income in any government institution.

Benefits of Filing Tax Returns:

Filing your tax return, even with a low or zero tax liability, offers several advantages:

a. Refund Claims: You can claim a refund if you’ve paid more tax than you owe.

b. Proof of Income: Your tax return serves as proof of your income for various purposes, including visa applications, loan approvals, and rental agreements.

c. Record of Financial History: It creates a comprehensive record of your financial transactions and history, which can be valuable for future investments or business dealings.

d. Avoiding Penalties: Timely filing of your tax return helps you avoid late filing penalties and interest on unpaid taxes.

e. Legal Compliance: Filing your tax return is a legal requirement, and non-compliance can result in penalties and legal consequences.

f. Visa and Loan Processing: Many countries and financial institutions require your tax return as proof of income for visa applications and loan processing.

Which ITR should a student with zero income file

A student with no income can file an ITR. However, it is not at all mandatory.

Filing returns is compulsory if an individual comes under the tax slabs( income above 2.5 lacs). Thus a person with income less than 2.5 lacs or no income need not file returns.

Having said this, a habit of filing returns is beneficial in many ways than one.

- for Visa and passport requirements

- for investing buying a property etc

Can a student file an ITR? How

If you are above 18 years of age and earning more than Rs.2.5 lakh you can file your return of income.

The same can be filed from the efiling website of the income tax department.

When should I file ITR 2 to get maximum benefit as a student

The ITR -2 has also been rationalised for individuals and HUFs (Hindu Undivided Families) having income under any head other than business or profession. The new form provides a relief for NRIs as they can now provide details of their foreign bank accounts to claim credit or refunds. However, they will have to use ITR-2 instead of ITR-1.

The following incomes are covered under ITR 2-

a) Income exceeding Rs. 50 lakhs- (which is not covered under ITR-1)

- Income from Salary/Pension; or

- Income from House Property; or

- Income from Other Sources (also includes Winnings from Lottery and Income from Race Horses).

b) The following incomes also includes-

- Income from Capital Gains; or

- Income from Foreign Assets/Foreign income or

- Income from Agricultural exceeding Rs. 5,000

- Dividend received above Rs. 10 lakhs during the year

- Unexplained Income under section 115BBE

The following Income are not covered under ITR-2-

- Income from “Profits and Gains from Business or Profession”

- Income from Partnership Firm as a partner.

Should I file an ITR if I'm earning 6 lakhs per annum

Yes, you should file an Income Tax Return (ITR) if you are earning 6 lakhs per annum or more. In India, individuals with an annual income above a certain threshold are required to file an ITR with the Income Tax Department. The threshold for filing an ITR depends on various factors such as age, income sources, and other deductions.

Filing an ITR is not only a legal requirement but also has several benefits:

- Compliance: Filing your ITR helps you comply with the tax laws and fulfill your legal obligations as a taxpayer.

- Proof of Income: An ITR serves as an official record of your income. It may be required as proof of income for various purposes, such as applying for loans or visas.

- Claiming Refunds: If you are eligible for a tax refund due to excess tax paid, filing an ITR is necessary to claim the refund.

- Carrying Forward Losses: If you have incurred losses in a financial year, filing an ITR is necessary to carry forward those losses for set-off against future income.

- Avoiding Penalties: Failure to file an ITR when required can result in penalties and legal consequences.

- Financial Transactions: Many financial transactions, such as high-value investments and property transactions, require you to provide your ITR as proof of your financial status.

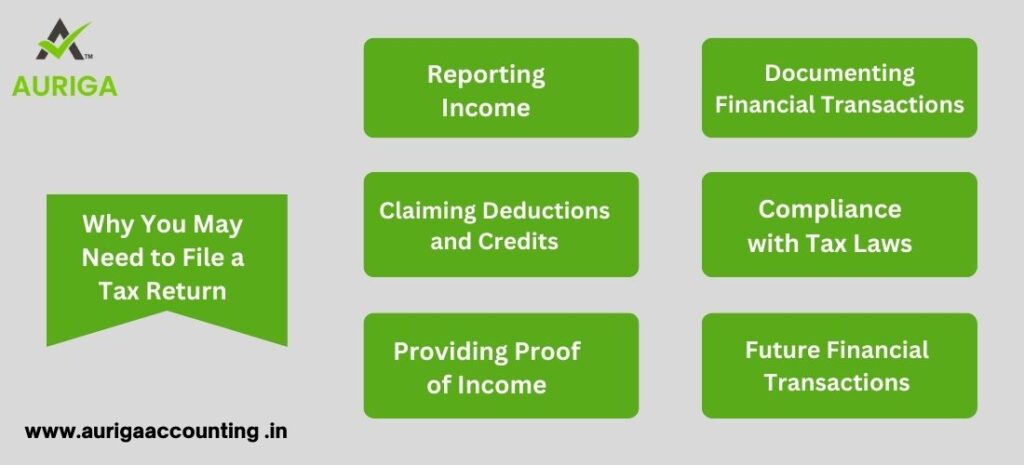

Why You May Need to File a Tax Return:

Even if your tax liability is less than a certain threshold, you may still need to file a tax return for the following reasons:

Reporting Income: Filing a tax return allows you to report your total income, including income from various sources, such as employment, investments, rental properties, and self-employment.

Claiming Deductions and Credits: Tax returns provide the opportunity to claim deductions and tax credits, which can reduce your overall tax liability or lead to a tax refund. Filing a return is necessary to benefit from these deductions and credits.

Providing Proof of Income: A tax return serves as proof of your income, which can be required for various purposes, including loan applications, rental agreements, and visa processing.

Documenting Financial Transactions: Filing a tax return creates a comprehensive record of your financial transactions, ensuring transparency and accountability in your financial dealings.

Compliance with Tax Laws: Filing a tax return helps you stay in compliance with tax laws and avoid penalties or legal consequences that may arise from non-compliance.

Future Financial Transactions: Your tax return history can be valuable for future financial transactions, including investments, business activities, and credit applications.

Conclusion of tax liability in ITR.

Filing a tax return, even when your tax liability is low or zero, is not just a legal obligation; it is a financial responsibility that can benefit you in various ways. It serves as a record of your income, facilitates transparency in tax collection, and allows you to claim deductions, refunds, and other benefits. By understanding the legal requirements, avoiding common misconceptions, and recognizing the advantages of filing a return, you can ensure

how auriga accounting help you to define tax liability in ITR.

Auriga Accounting can play a valuable role in helping you define your tax liability in your Income Tax Return (ITR). While they won’t directly determine your tax liability, they can assist you in several ways to accurately calculate and report it. Here’s how Auriga Accounting can help you define your tax liability in your ITR:

Expert Guidance: Auriga Accounting’s team of experts can provide guidance on the various sources of income you should consider when calculating your tax liability. They can help you ensure that all forms of income, including salary, investments, rental income, capital gains, and more, are accurately reported.

Deductions and Exemptions: They can help you identify and claim deductions and exemptions that you may be eligible for under the tax laws. Properly availing these deductions can significantly reduce your tax liability.

Tax Credits: Auriga Accounting can guide you on claiming tax credits for taxes already paid, such as TDS (Tax Deducted at Source) or foreign tax credits. This can further lower your tax liability.

Income Classification: Their experts can assist in correctly classifying different types of income, such as long-term and short-term capital gains, business income, and salary income. Proper classification is crucial for accurate tax liability calculation.

Capital Gains Calculations: If you have capital gains from investments, such as stocks or real estate, Auriga Accounting can help calculate the tax liability associated with these gains, considering factors like holding periods and tax rates.

Filing the Right ITR Form: Choosing the correct ITR form is essential, as it depends on your income sources and financial situation. Auriga Accounting can ensure you select the appropriate form for accurate tax liability calculation.

Accurate Reporting: They can assist in accurately reporting your income and deductions in the ITR form, reducing the risk of errors or discrepancies that might lead to tax disputes.

Verification: Auriga Accounting can guide you through the process of verifying your ITR to ensure that all the information provided is correct. This helps you avoid inaccuracies that could affect your tax liability.

Compliance with Tax Laws: Auriga Accounting professionals are well-versed in tax regulations and can ensure that your ITR is compliant with the current tax laws, which is crucial for accurate tax liability calculation.

Tax Planning: Beyond ITR filing, they can provide tax planning advice to help you minimize your tax liability in a legal and ethical manner.