COMPLETE GUIDE OF ITR INCLUDING TYPE FEATURE ROLES AND USE?

Introduction

ToggleCOMPLETE GUIDE OF ITR INCLUDING TYPE FEATURE ROLES AND USE?

Introduction to Income Tax Return (ITR):

Income Tax Return (ITR) is a comprehensive document that taxpayers in India use to report their income, claim tax deductions, and calculate their tax liability. The submission of ITR is a legal obligation for individuals and entities with taxable income, as specified by the Income Tax Act, 1961. Filing an ITR is crucial for both the taxpayer and the government, as it ensures transparency, revenue collection, and compliance with tax laws. This guide explores various aspects of ITR, including its types, features, roles, and uses.Visitofficialwebsite

Types of ITR

There are seven different types of ITR forms available, each catering to different categories of taxpayers. Choosing the correct form is essential for accurate reporting. The main types of ITR forms are:

ITR 1 (SAHAJ): This is for individuals with income from salary, one house property, other sources (like interest), and total income up to Rs. 50 lakhs.

ITR 2: This is for individuals and Hindu Undivided Families (HUFs) with income from various sources, including capital gains, foreign income, and more.

ITR 3: Applicable to individuals and HUFs who have income from business or profession and other sources.

ITR 4 (SUGAM): For individuals, HUFs, and firms (other than LLPs) with presumptive income from business and profession.

ITR 5: Applicable to entities other than individuals, HUFs, and companies, including LLPs, firms, associations of persons (AOP), and body of individuals (BOI).

ITR 6: For companies, except those that claim an exemption under Section 11.

ITR 7: Applicable to entities in which income is required to be furnished under Section 139(4A), 139(4B), 139(4C), or 139(4D) of the Income Tax Act.

Key Features of ITR

a. Reporting Income: ITR is used to declare all sources of income, including salary, business income, capital gains, house property income, and more.

b. Tax Computation: It facilitates the calculation of taxable income, deductions, and tax liability.

c. Claiming Deductions: Taxpayers can claim various deductions under sections like 80C, 80D, and 10(14) of the Income Tax Act.

d. Disclosure of Financial Assets: Certain ITR forms require the disclosure of foreign assets, financial interests, and signing authority in foreign bank accounts.

e. E-Filing: The ITR can be filed online through the Income Tax Department’s official portal.

f. Verification: Taxpayers must verify their ITR using methods like Aadhaar-based OTP, digital signature, or physical verification.

Roles and Importance of ITR

a. Revenue Collection: ITR is the primary source of revenue for the government, enabling it to fund essential services and infrastructure.

b. Documentation of Financial Transactions: ITR serves as evidence of a taxpayer’s financial history and transactions.

c. Legal Compliance: Filing ITR is a legal obligation, and non-compliance can result in penalties.

d. Eligibility for Loans and Visas: Lenders and visa authorities often require ITR as proof of financial stability and income.

e. Record of Financial History: ITR creates a record of a taxpayer’s financial history, which can be useful for future investments or business dealings.

What is the use of filling an ITR

ITR needs to be filled by every responsible Indian citizen and entities. An ITR gives information about your taxable income and tax liability. to Income Tax Department.

There are benefits of filing ITR, such as-

- Easy loan approval – bank sometimes ask for 3 year ITR while processing of loan.

- Best option as income and address proof – Employer issue Form16 to their employee which contain details of income of an employee. this works as a proof for income and address.

- Quick visa processing – for visa approval many country demand ITR with necessary documents. it also give an insight of your income to visa processing officials.

- Claim tax refund – an individual can have tax returns and get his/her money back which was deducted at source if total gross income from all source clubbed is more than Rs.2,50,000.

- Compensate for losses – to claim losses filing of tax return within due date is mandatory.

- Avoid penalty – if you are required to file an ITR according to Income Tax Act, but fails to do so then tax officer can imply a penalty of upto Rs.5,000.

How are you filling ITR & GST

Income Tax Return (ITR) and GST Registration are two different activities. Anyone who is a salaried person should compulsorily file for ITR if he crosses the threshold exemption limit for each assessment year.

Your employer already gives your income-related data to the income tax department. You only have to fill the taxable income as provided by your employer in Form-16, and next, you fill in the deductibles.

Now, you have to add your other income source (if there’s any) in which you need to fill the interest earned from your FDs and accounts if the total interest in the whole is more than Rs. 10000. If the bank deducts TDS, then it will appear on your form automatically. But, for Capital gains, you need help.

I take help from Legal251 for all my ITR-related issues, and their services are always up to the notch. So, if you need help in filing your ITR, or any other ITR or GST-related issues, you can contact them.

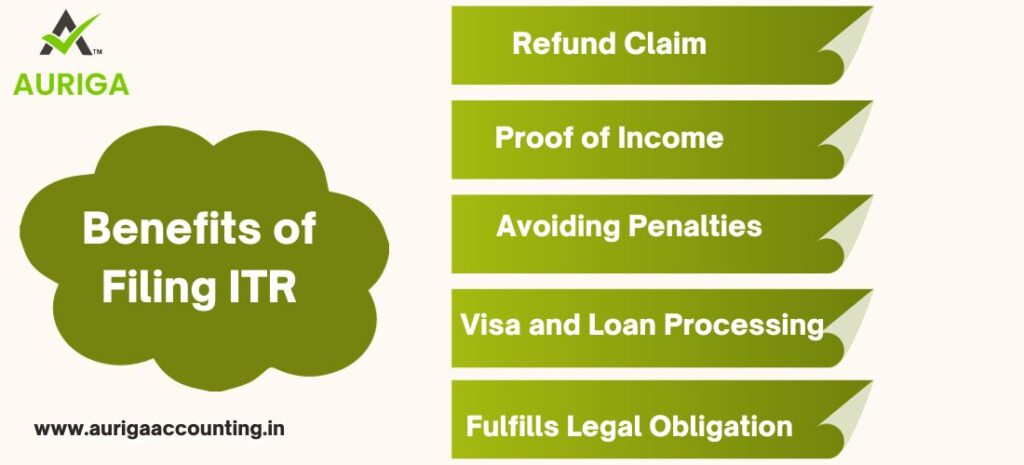

Benefits of Filing ITR:

a. Refund Claim: Filing ITR is essential to claim tax refunds if you’ve paid excess tax during the year.

b. Proof of Income: ITR serves as proof of income for various purposes, including applying for loans or visas.

c. Avoiding Penalties: Timely filing of ITR helps avoid penalties and legal consequences.

d. Visa and Loan Processing: Many countries and financial institutions require ITR as part of their application process.

e. Fulfills Legal Obligation: Filing ITR is a legal obligation, and non-compliance can result in legal consequences.

Steps to File ITR

Registration: Register on the Income Tax Department’s e-filing portal using your PAN.

Collection of Documents: Gather all relevant financial documents, including Form 16, bank statements, investment proofs, and PAN.

Filling in the Form: Choose the correct ITR form, fill in the required details, and compute your income and tax liability.

Verification: Verify your ITR using Aadhaar-based OTP, digital signature, or physical verification.

Submission: Submit your ITR online, and keep a copy of the acknowledgment for your records.

Which ITR form should I fill out

There are different ITR (Income Tax Return) forms that individuals can use to file their income tax returns in India, depending on their sources of income and their tax status.

Here is a list of the most commonly used ITR forms:

- ITR-1 (Sahaj): This form is for individuals who have a salary/pension, one house property, and other income (such as interest income).

- ITR-2: This form is for individuals and Hindu Undivided Families (HUFs) who do not have any income from business or profession.

- ITR-3: This form is for individuals and HUFs who have income from a business or profession.

- ITR-4 (Sugam): This form is for individuals and HUFs who have income from a presumptive business.

- ITR-5: This form is for firms, LLPs, AOPs (Association of Persons), and BOIs (Body of Individuals).

- ITR-6: This form is for companies other than companies claiming exemption under Section 11 (Income from property held for charitable or religious purposes).

- ITR-7: This form is for persons including companies required to furnish return under sections 139(4A), 139(4B), 139(4C), 139(4D) and 139(4E).

To determine which ITR form is suitable for you, you will need to consider your sources of income and tax status. It is recommended that you consult with a tax professional or refer to the income tax department’s website for more information on the different ITR forms and how to determine which one is appropriate for you.

Common Mistakes to Avoid

a. Incorrect Details: Ensure all details are accurate, especially your PAN and bank account information.

b. Missed Deductions: Don’t overlook eligible deductions and exemptions.

c. Ignoring Taxable Income: Report all sources of income, even if tax is not deducted at source.

d. Non-Verification: Failing to verify your ITR can result in it being considered invalid.

e. Missing Deadlines: File your ITR by the due date to avoid penalties and interest.

Penalties for Non-Filing

a. Late Filing Fee: The Income Tax Department may impose a late filing fee if the return is filed after the due date.

b. Interest on Unpaid Tax: Interest is charged on the unpaid tax amount if the return is filed after the due date.

c. Prosecution: In severe cases of non-filing or evasion, prosecution can be initiated under the Income Tax Act.

Conclusion OF ITR

Filing an Income Tax Return (ITR) is not only a legal obligation but also a financial responsibility that can benefit you in various ways. It serves as a comprehensive record of your financial history, facilitates transparency in tax collection, and helps you claim deductions and refunds. Choosing the right ITR form, filing accurately and on time, and avoiding common mistakes are key to a hassle-free tax filing experience. Moreover, seeking professional guidance or using e-filing platforms can simplify the process. Remember, filing your ITR is not just a requirement; it’s a smart financial practice that can benefit you in the long run.

how auriga accounting help you to complete guide step in ITR.

Auriga Accounting is a professional service provider that can offer valuable assistance in completing the various steps involved in filing your Income Tax Return (ITR) in India. Here’s how Auriga Accounting can help you through the process:

Expert Guidance: Auriga Accounting professionals have a deep understanding of the Indian tax laws and regulations. They can provide expert guidance on which ITR form to use, what documents to gather, and how to accurately report your income and deductions.

Selecting the Correct ITR Form: One of the most critical steps in filing your ITR is choosing the right form. Auriga Accounting can assess your financial situation and help you select the appropriate form to ensure accurate reporting.

Document Collection: They can assist you in collecting all the necessary financial documents, including Form 16, bank statements, investment proofs, and other documents required for accurate income reporting.

Filling in the Form: Auriga Accounting can help you fill in the ITR form accurately, ensuring that all income sources, deductions, and exemptions are properly reported. They can also help with the computation of your taxable income and tax liability.

Claiming Deductions: Auriga Accounting experts can guide you on claiming eligible deductions and exemptions under various sections of the Income Tax Act, optimizing your tax savings.

E-Filing Assistance: They can assist you in the e-filing process, ensuring that your ITR is submitted electronically through the Income Tax Department’s official portal. This includes helping you set up your e-filing account and navigating the portal effectively.

Verification: Auriga Accounting can help you verify your ITR using the most appropriate method, whether it’s through an Aadhaar-based OTP, a digital signature, or the physical verification process.

Deadline Compliance: They will ensure that your ITR is filed within the specified due dates to avoid late filing penalties and interest on unpaid tax.

Common Mistake Avoidance: Auriga Accounting can assist in reviewing your ITR to ensure that common mistakes, such as inaccurate details or missed deductions, are avoided.

Penalty Prevention: They will help you meet all the compliance requirements to avoid penalties and legal consequences for non-filing or late filing.